Originally Published on forbes.com on October 28th,2011

______________________________________

This guest post is by Paul Combe, president and CEO of American Student Assistance.

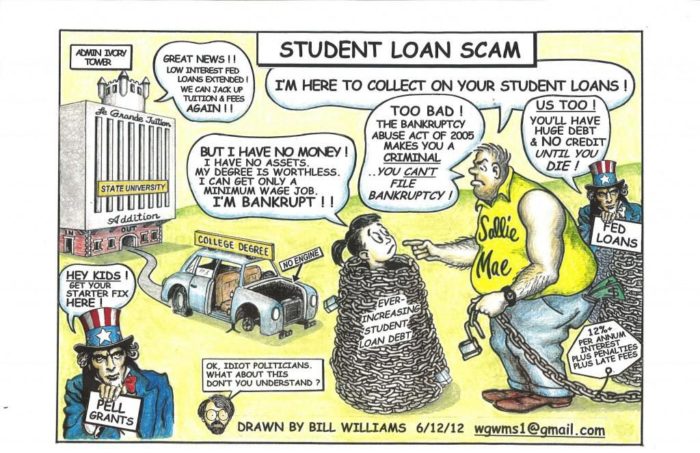

The “Occupy” movement is drawing attention to some very real problems that plague our nation’s higher education financing system: skyrocketing college costs, an increased reliance on student loans over grants, the role of private loans, people repaying their student loans until their own kids head off to college, “draconian” collection methods, and so on.

The solution receiving the most buzz is an idea to forgive all student loan debt. More than 600,000 Americans have signed a petition asking the federal government to forgive student loan debt as a “trickle-up” approach to stimulating the economy.

Critics of the notion say it’s an impractical solution, as well as unfair to past and future generations who either already repaid their student debt or won’t be able to avoid student loans in the years ahead. But dismissing this remedy out of hand ignores the very real pain, fear and anger felt by recent college students as they stare down the barrel of huge student loan payments in the worst job market since the Great Depression. Studentdebtors in droves are turning to Facebook and Twitter to tell their own personal stories and their message shines through loud and clear: We need an immediate fix to the student loan crisis.

In the spirit of commonsense solutions, then, I propose we move the national conversation around student loans to a more practical first step that can provide immediate relief to millions of Americans who can’t keep up with their monthly student loan payments. Give student loan borrowers the help they need to understand their repayment rights.

Let me explain: The plain truth is that no federal student loan borrower who acts in good faith to repay should ever have to default, given their current rights to make the debt more manageable.

If you borrowed federal student loans, you have the right to postpone payment for up to three years (and sometimes longer) if you’re unemployed or facing economic hardship. You have the right to extend your payment term so you have lower monthly payments. You have the right to start out with low payments and gradually increase the amount as your salary increases. If you have high student loan debt but entered a low-paying career, you may have the right to make monthly payments that don’t exceed 10% of your income and any outstanding balance may be forgiven after 25 years of payment. You have the right to have your loan forgiven after 10 years of payment if you enter a public service field.

Still, student debtors continue to struggle. The U.S. Education Department just announced that the national student loan default rate rose for the fourth year in a row and an Institute for Higher Education Policy studyshowed that only 37% of federal student loan borrowers actually made their payments without interruption over the past five years.

That’s because most borrowers simply don’t have the information they need to avoid payment problems before they start. For example, the fairly new Income Based Repayment program languishes in obscurity. Only about 350,000 are enrolled when early estimates showed one million borrowers could be eligible.

Complexity of program rules is another barrier. While taking advantage of some of these repayment rights requires just a simple phone call or email, others, like IBR, take a considerable amount of time and energy. But the student loan system as currently designed offers little to no support for borrowers trying to navigate the repayment process. Colleges give students a laundry list of rights and responsibilities when they enter and exit, but too few offer any real debt management counseling to alumni. The private firms that collect federal student loan payments (“servicers”) typically only respond reactively after the borrower has fallen behind, and they rarely offer the in-depth counseling needed to find a payment solution in the borrower’s best short- and long-term interests (time on the phone is money, after all).

Research by my nonprofit, American Student Assistance, has shown that giving student debtors access to more information and an advocate who’s on their side works. We’ve learned that proactively communicating with student loan borrowers and walking them through the necessary process to select an appropriate payment plan can cut delinquency by 50 percent – saving them the heartbreak of ruined credit, wage garnishment and other nasty consequences. If we could expand proactive communication to every student loan borrower and cut delinquency by 50% across the board, what would the nation’s student loan crisis look like then?

Research by my nonprofit, American Student Assistance, has shown that giving student debtors access to more information and an advocate who’s on their side works. We’ve learned that proactively communicating with student loan borrowers and walking them through the necessary process to select an appropriate payment plan can cut delinquency by 50 percent – saving them the heartbreak of ruined credit, wage garnishment and other nasty consequences. If we could expand proactive communication to every student loan borrower and cut delinquency by 50% across the board, what would the nation’s student loan crisis look like then?

So maybe the real right that Occupy student protestors should fight for, at least to start, is the right to receive proactive, unbiased, personalized and timely information and advice about how to repay their loans. We might not all agree that student loan debt should be forgiven but I think most folks are of like minds that, if the federal government continues to promote loans over grants as the way to finance college, then Americans deserve a student loan system that, at the bare minimum, empowers borrowers to take control of the debt management experience.

The federal government should invest in proactive education debt management services for all student loan borrowers. In an encouraging first step, the U.S. Department of Education is taking steps behind the scenes to do just that, by assigning certain private service providers in the federal student loan program (“guarantors”) a greater role in delinquency and default prevention, financial literacy and debt management. Unfortunately, though, only borrowers in the now-defunct Federal Family Education Loan Program will have access to these services; Direct Loan borrowers will have to continue to rely solely on their servicers for information.

I acknowledge that proactive education debt management isn’t a panacea. Many student loan reformers are calling for expanded borrowers’ rights, like bankruptcy protection, truth in lending disclosures, and no capitalization of interest. Tackling these big policy issues, though, shouldn’t preclude us from helping borrowers to maximize their existing rights. Because let’s be honest – solutions to these problems will takeyears. Years that student debtors suffering today just don’t have. Proactive communication that informs and empowers can make a difference right now in the lives of struggling borrowers who everyday must choose between paying off their student loans and providing a better life for their families.

Supporters of the forgive student debt movement say their real goal is just to start a national conversation about student loan reform. A noble goal, but such a sharp focus on this unlikely remedy runs the risk of stopping the conversation before it starts. Going for all the marbles could cause a public sentiment backlash against student loan debtors, pitting Baby Boomers and Generation X against Millennials, or those who pursue a college degree against those who follow a different life path. In the battle to win the public’s hearts and minds in the student loan debate, start the rally around the borrowers’ rights that everyone can agree on.

Trackbacks/Pingbacks