My favorite tax blog, by a long shot, is Taishoff Law. I first learned of it because of the way I have done my own blogging. I read original source material and come up with my own take on it. As part of my wrap-up I then see what other have had to say. I then frequently add an “other coverage” section to my post. That way I make the fact that my coverage is usually not up to the minute a feature rather than a bug, Another feature is that my coverage is not thorough. Generally if I don’t have something to add I will just pass an opinion or a notice unless it is part of one of the long story arcs that I am covering.

Something I found was that whenever it was the Tax Court, Lew Taishoff was always ahead of me, I started almost feeling competitive about it, because there have been a couple of times where I have come close to breaking the story, but Mr. Taishoff was inevitably ahead, Then I learned his secret. Mr. Taishoff blogs exclusively on the Tax Court and it is practically in real time. He goes through the opinions and the orders as they come onto the Tax Court website. He is reading them as the ink is drying or more aptly while the electrons are still excited. Then he gives us his take. Since it is backed up by over half a century of experience, it will generally be pretty worthwhile.

Well here is a special treat. Mr. Taishoff has given me permission to reproduce one of his columns. I had had call to read a BTA opinion (Board of Tax Appeals is the predecessor to the Tax Court). The BTA opinion is famous because an important holding in it was overturned by Learned Hand writing for the Second Circuit. I realized that if Mr. Taishoff and I had been blogging in 1928 we both would have covered the opinion just for the issues, but the fact that it had a major celebrity angle would have made it inevitable. So I asked him to write it up as if it had just come off DAWSON, the Tax Court case management (FWIW Howard A. Dawson, for whom the case management system is named turned 6 in the year that the decision came out. Without further ado, here is Mr. Taishoff.

PJR

As there is neither opinion nor order from United States Tax Court worthy of comment today, I withdraw my pass from a request from my colleague Peter Reilly, CPA. Mr. Reilly, as always manifests “the cool clear eyes of a seeker of wisdom and truth,” as Mr. Frank Loesser put it. During this Thanksgiving weekend, Mr. Reilly suggested that it would “(B)e great if you give the Taishoff treatment to that opinion. It has a lot of interesting elements to it.”

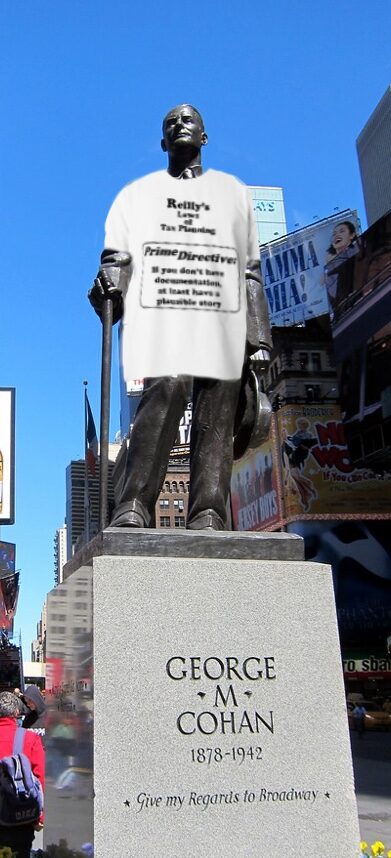

“That opinion” is, of course, the hallowed Cohan v. Com’r, 11 B.T.A. 743 (1928), re’d in part 39 F. 2d 540 (2 Cir, 1930).. George M., theatrical legend whose graven image overlooks the cut-rate ticket outlet at 48th & Broadway on this Minor Outlying Island off the Coast of North America, starred in this epic. Judge Learned Hand’s famous suggestion, which later grew into a mandate less variable than the laws of the Medes and the Persians, in Cohan v. Com’r, 39 F. 2d 540 (2 Cir, 1930), at pp. 543-544 is, my sources tell me, one of the ten most-cited decisions.

“Absolute certainty in such matters is usually impossible and is not necessary; the Board should make as close an approximation as it can, bearing heavily if it chooses upon the taxpayer whose inexactitude is of his own making.”

OK, Mr. Reilly, my unhallowed hands shall now disturb the sacred Sinaiatical pronouncement; the country’s probably done for anyway.

Judge Arundell at the Board (of Tax Appeals, Tax Court’s forebear) found some seven (count ’em, seven) issues upon which to rule. T&E, advertising, and excise taxes, which George M.’s inexactitude gave rise to the famous formula hereinabove set forth, is only one.

There was the famous family partnership between George and Mom, which both Judges Arundell and Hand blew off as an assignment of income. George’s attempt to characterize a gift of the cash generated from certain royalties as an assignment of the right to receive the royalties failed at least as to a one-third share.

George dropped some annuities, and the losses he took survived. George’s short year maneuver worked. A loan to George M’s former business partner was just that, and not deductible.

But what about the remand? What did the Board allow George M. on the T&E, advertising and excise taxes? Mr. Reilly would like to know. But Google is silent.

The answer lies, I suspect, in the archives of the old B.T.A. But how to access them? Can the Tax Court Copycats work their three-buck magic?

Suggestions welcome.

This all started with a piece that will be coming out soon on Think Outside The Tax Box about the current state of the Cohan rule. There is more which I will address here on YTMP

———————————————————————————————————————————————————————–

For great value continuing professional education. I recommend the Boston Tax Institute

You can register on-line or reach them by phone (561) 268-2269 or email vc@bostontaxinstitute.com. Mention Your Tax Matters Partner if you contact them.

For articles oriented toward tax professionals check out Think Outside The Tax Box.