This was originally published on PAOO.

The case of Holdner v Com TCM 2010-175 is giving me pause. When I read what William Holdner and his son Randal achieved over the years in business I am very impressed. Mr. Holnder seems a much sharper businessman than I am. It makes me hesitate to criticize him as an accountant, which he also is. It’s just that I think he picked an unnecessary fight.

The issue in the case was whether he and his son had a partnership. The facts make up one of those family sagas that make some tax court cases a good substitute for novels. The years in question were 2004-2006, but the story begins in 1968 when Mr. Holdner bought his son and daughter two cows, a bull and a horse, which were kept on a 3.36-acre property. As the years went by the children’s livestock increased and multiplied. In 1972 Mr. Holdner purchased a 17-acre property in the same town.

Apparently Future Farmers of America had found a prime recruit in son Randall. When he graduated from high school in 1977, he showed little interest in college. So in lieu of higher education, his father offered to back him in farming. The enterprise was called Holdner Farms and duties were divided as follows:

Randal Holdner was responsible for managing the farm, and his duties included feeding the cattle, maintaining farm equipment, and tending to sick animals. William Holdner was primarily responsible for Holdner Farms’ financial affairs, and his duties included arranging cattle sales, making payments to suppliers, and obtaining financing to purchase new farm properties. William Holdner also agreed, at least initially, to contribute money to the farm, though it is unclear how much money he actually contributed or whether he expected to be repaid.

If I was going to go into farming with my son, that’s exactly the deal that I would make reserving for youth the activities involving moving heavy objects from one place to another and dealing with animals significantly larger than myself. Mr. Holdner besides being an astute businessman was also apparently an effective parent. I would never be able to persuade my son to go for such a deal.

During the period 1977 – 2004 Holdner farms expanded by joint purchases of land which were paid for from the operations. By 2004 they owned or leased over 1,000 acres and had as many as 2,000 head of cattle at a time. Although joint ownership did not include right of survivorship, there was an understanding that Randall would inherit full ownership of the farm. There were not written agreements documenting their arrangement. (Here we must genuflect to Goldwyn’s law of contracts – “A verbal contract isn’t worth the paper it is written on.”).

While all this was going William Holdner maintained a successful accounting practice with several partners. So what was the problem?

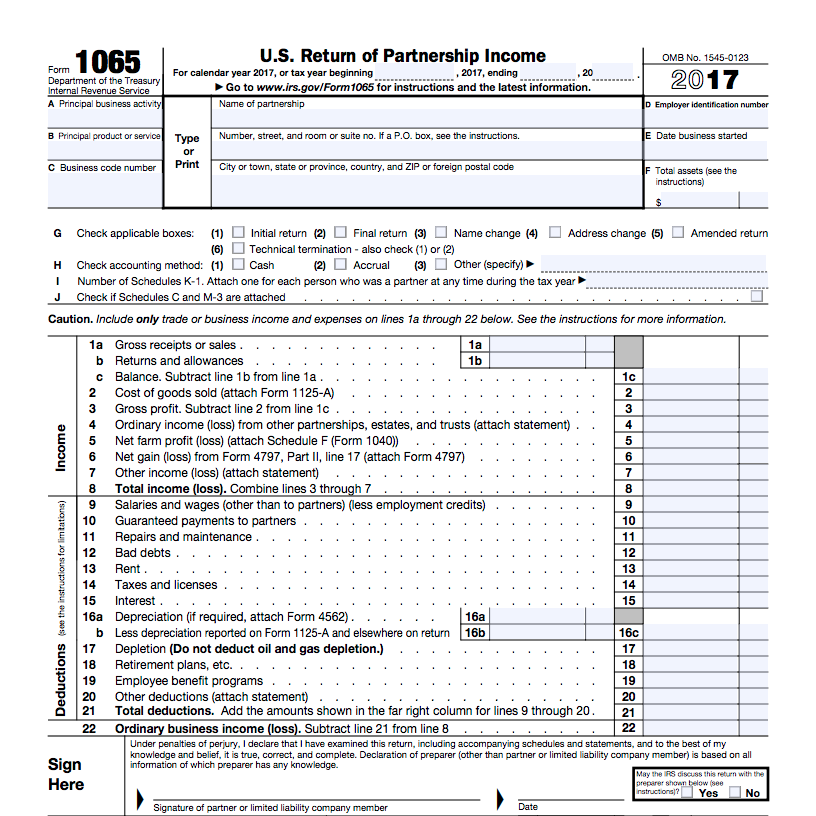

Mr. Holdner did not treat Holdner farms as a partnership. Instead he and his son separately reported income and expenses from the operations. Apparently the IRS did not dispute the total income and total expenses. Here is where one of my partners would be wont to remark “So no harm. No foul.” Well not exactly. The gross income was reported 50/50, but the expenses were divided – well :

In a few instances petitioners shared expenses in the same way they shared gains; i.e., 50-50. In most instances, however, William Holdner allocated Holdner Farms’ expenses between himself and his son as he saw fit. Indeed, the allocation of Holdner Farms’ expenses between petitioners did not bear any apparent relationship to petitioners’ respective ownership interests in, or their respective levels of involvement with, Holdner Farms. In fact, the allocation of expenses made by William Holdner had no apparent rational basis and appeared completely arbitrary…

Actually the rational basis is pretty apparent. William had over $250,000 per year in taxable income from his accounting practice while Randal, devoting all his time to being the farmer in the dell, had no other source of income.

I have to wonder how this case was handled at the agent and appellate level, because when it came time for the deficiency notices, the IRS, in order to avoid being whipsawed, asserted deficiencies based on taxing both William and Randall on 100% of the income and allowing them each 0% of the deductions. For the three years, the business had net income of roughly $80,000 which had admittedly been reported and the deficiency notices totaled over $1,000,000 in tax.

The court’s finding was, not surprisingly, that Holdner farms was, in fact, a partnership and that absent any agreement or other evidence, the expenses should be split 50/50 just as the income was. What is ironic is that if they had been filing as a partnership, it would have been perfectly reasonable to allow Randall a guaranteed payment based on the extent of his services to the partnership. It is also possible that special allocation of deductions to William would have been reasonable in years in which he had to provide funds to the partnership.

There are times when it is very important that an entity not be considered a partnership. For example, a partnership interest cannot be the subject of a like-kind exchange. If you are actually jointly running a business with somebody, though, it is difficult to argue that you don’t have a partnership and, frankly, you might just as well go ahead and admit it. There is a great deal of flexibility in how you allocate income and expense provided that your allocations reflect the economic reality of the arrangement between the partners. Although there is one more return to file, this is somewhat offset by simplifying the returns of the partners.

It could be that when they started out the Holdners were running separate enterprises with father owning the land and son chasing the cattle. Once they started buying land jointly and having a joint account where income was deposited and from which expenses were paid, there was an entity and there was not really a strong argument for the entity being anything other than a partnership.