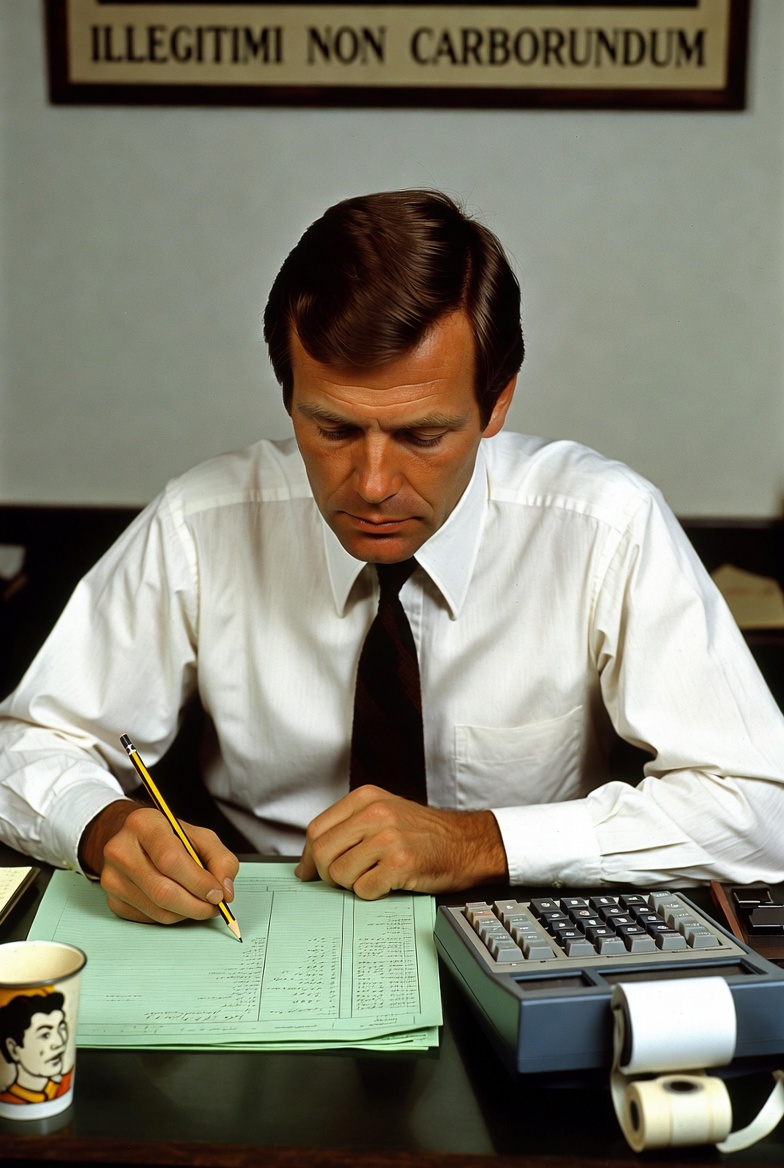

Image by Grok

The memories of old people about the days of their youth are notoriously unreliable, but I think I am enough of a historian to adjust for that. And I am going to say that how accountants went about their jobs changed radically in the Eighties. Here is how I remember it.

Joseph B. Cohan and Associates (JBC) was a large local accounting firm, about fifty people, founded in 1917. There I started my first and arguably only job in public accounting in November 1979. I went from junior accountant to partner in that large local to equity partner in a regional to managing director in a not quite big 4 (more nimble, you know). 90% of success is just showing up.

The Junior Accountant

In 1979, the first job assigned to entry-level junior accountants at JBC was line-ups. I remember reading somewhere that the origin of the term was that apprentice chartered accountants literally had to draw lines on the paper that their seniors would be writing numbers on. We were more advanced and had paper with lines (lots of them both up and down) already drawn on it to make for neat rows and columns. The paper was a light shade of green that I think was supposed to be easy on your eyes. There were also convenient holes pre-punched so that it could be put in a folder and secured by a metal clip. Had to be careful with those things to not get cut. Some of the most important papers had thirteen columns, making them so wide that they had to be folded over to fit in the folder.

The idea of the lineup was to get a start on a set of workpapers for the seniors who would go out into “the field.” We would take the previous year’s workpapers and copy over the account numbers and names onto a thirteen-column worksheet where the trial balance would go. A prior-year column on the far right would be filled in with the final balances from the previous year.

Our workpapers used a mnemonic: CRISP FO AWL NEXT. As I recall, the lineup would include one of the P workpapers and the F. P was prepaid, and we would line up the prepaid insurance schedule, which generally did not have a lot to it. F was fixed assets, and that could be a project. We had to compute the current year’s depreciation on all the assets on hand at the end of the previous year.

Absent some specific assignment, juniors kept busy by pulling things out of the prepare drawer. That would be a completed set of workpapers. The workpaper set would be as much of CRISP FO AWL NEXT as was applicable. A C workpaper would have, say, a bank reconciliation. On the trial balance next to the extended balance of a cash account, there would be C-1 or C-2, etc. On C-1 there might be many numbers, but there would be one number that represented the adjusted balance in that account. Next to that number would be T/B.

We didn’t really need to worry about that as preparers. We just had to prepare the federal and state tax returns for the entity and draft the financial statements. It would be clear if the job was an audit, but otherwise we might have to ask whether it was a compilation or a review. Sometimes the partner or senior would have to think about that, which seems ridiculous, but it was 1979 and compilation and review were new things. People who came into the firm with a Big Eight background might go a little crazy about the number of audit steps that we performed on jobs that weren’t audits.

We did the returns in pencil. After they passed first check, they would be photocopied and assembled by the secretaries or whatever it was we were calling them then and go for final check. The admin staff would also “tape” the returns. Anywhere there were numbers added on the return, they would add them and subtract the indicated total, kicking it back if it was not zero. Some reviewers swore by the tapes, but when I became a reviewer, I still added things up on my own. If a number on the return was the result of a combination of more than one number on the trial balance, the combination could be written on the return with a light blue pencil that would not show up on a photocopy.

Individual returns were actually harder than corporate returns, because there was no balance sheet that proved you had caught everything. We used the blue “invisible” pencil on individual returns also.

The review process had a certain level of brutality to it. Sometimes reviewers would have us change something on first check, and somebody else would have us change it back on final check. And changing something on a return was a project. It was important that a change be followed through. You misread a 1099 and entered 67 instead of 87 on Schedule B. So you change the 67 to 87. Now you add the Schedule B numbers again, which changes a line on Page 1 of the 1040, and so on.

The Senior

A guy I called Mikey started a couple of months before I did, which gave him priority in the lunchtime kitty whist game that one of the partners hosted in the small library. If enough seniors were out in the field, we sometimes both got to play and would be partners. We were both also bridge players, so we used signals indicating major/minor rather than red or black, which mystified our opponents.

The firm kept hiring people who had more experience than Mikey and I did, but they generally didn’t last. Two very long-term guys left to start their own firm, so before long we were considered seniors. We were going out into the field and preparing workpapers. For some clients, we would go out quarterly and prepare payroll returns and quarterly statements.

Mikey and I each developed specialties of a sort, although we worked on other things. He had the automobile dealerships, and I had the “shelters,” low-income housing partnerships. My cross to bear—preparing partnership returns by hand that had as many as seventy-five partners—was probably not as bad as Mikey’s LIFO inventory workpapers.

The picture that sticks in my mind is of a tax season around 1985. Monday through Thursday we worked till 10 PM or so, with usually eight hours on Friday and Saturday and maybe six on Sunday. The joke was that when somebody was leaving at 3:00 PM on Sunday, we would tell him to have a nice weekend..

The firm had a full-service accounting package that was used mainly by dentists. There was a computer that was dedicated to that, along with the firm’s time and billing system. There was also a terminal for an online service that did individual returns, but that was not used that much. An accountant would manually fill out sheets, which were entered by a woman named June, who I believe ended up working in that practice for over 50 years. There was also a payroll service for the dentists. Internally, we called the group “medical,” and it also included a number of bookkeepers who did bank reconciliations and the like. Several of them would become enrolled agents. Anyway, they were almost all women.

The other side of the practice was called “audit,” although most engagements were compilation, review, or tax-only. That was almost all male when I started. We were on our way to becoming CPAs. The gender transformation of the firm and the profession in general is another fascinating story but it is beyond the scope of this piece.

Back to that image. The hard-core guys working till 10:00 PM were all seniors or managers. There was not much of a distinction between the two.

We had gathered things while we were out in the field that would be used to create workpapers put in the folder using CRISP FO AWL NEXT, finished the depreciation schedule and the prepaid insurance schedule. And we had come up with adjustments, often very many of them. There were routine things like accrued expenses, misclassifications, and things that needed to be charged to a related entity.

We would draft adjusting journal entries. And then came the project, which could sometimes be interminable. We put the elements of the entries on the row of the account in the trial balance that they affected. The first two columns of the workpaper had the unadjusted trial balance we had “taken off” from the client’s general ledger—debits on the left, credits on the right, one or more sheets for balance sheet accounts and one or more sheets for profit and loss accounts.

While in the field, we would have added up the unadjusted trial balance to make sure it was balanced. Then, once the adjusting entries were posted to the workpaper, we had to add across, extend, to get the adjusted trial balance. And then we had to go down. The balance sheet debits would not equal the balance sheet credits. The P&L credits would not equal the P&L debits. However, the difference in both cases would be the same—net income.

Well, the difference would ultimately be the same, and that was the project. If the numbers were not the same, it might be because you added up and down wrong. Or you could have added across wrong. Or maybe one of your entries was unbalanced. There was the good old “rule of nine” to help you. If digits in a number are transposed, the difference between the wrong and the right number will be divisible by 9. That was a useful but not conclusive clue, since not all differences divisible by nine are transpositions.

I had the advantage of my experience as a hotel night auditor. Part of that job required adding up the balances due on all the guest folios to prove a number computed from the day’s activity. That is where I learned the rule of nine, and the other thing I learned was the three-finger method with the calculator. There is a reason there is a little nub on the 5 on desk calculators.

I think one of the things that made the long hours tolerable was that a lot of it was spent almost meditatively engaging in fourth-grade math that did not require a lot of judgment. There was also a feeling of fellowship and a sense that we were experiencing real hardship, which from a world-historical view is ridiculous. Years later, I would work a reduced schedule for several years due to family considerations. I still worked Saturdays in tax season, and it dawned on me that many of the accountants working on Saturday actually enjoyed it, although they would never admit it.

The Breakthrough

Around 1984, there was a breakthrough. We acquired a couple of Kaypros. an early portable computer. It included a spreadsheet program called Perfect Calc. Finally, there was a computer we could directly interact with. I remember one thing we used it for was the income averaging calculation. I was working on a big audit of several returns that had interrelated computations. An issue could look important but might turn out to have no bottom-line effect. I managed to model the returns on Perfect Calc so we knew what an issue was worth.

One time we were talking about what the Kaypro potentially could or could not do. One of the staff accountants speculated that the statement of changes in financial position was certainly beyond it. A lot of staff had trouble with that one. I used to try to explain it to them with an analogy that started with “It’s like a river.” Unfortunately, I don’t recall where it went from there. Anyway, I predicted that in a few years there would be one of “those,” pointing to the Kaypro, on everybody’s desk. I think the others all scoffed. There were computers on everybody’s desk before the decade was out, although they were not Kaypros.

The fits and starts and trials and tribulations that were involved in eliminating green sheets and pencils are not something I can tackle in detail. It was particularly painful when it came to 1040 software. Blogger Robert Flach even today refuses to use 1040 software. There is one event though that sticks in my mind when it comes to the transition.

The Not Quite Partner

It was late June 1989. The first of the Warner Brothers Batman films, called Batman, had just been released. It was early afternoon, and there were no partners around. The power went out. We were in an open room with plenty of light, temporary quarters as a new office was being built out. Back in the day, that would have just slowed us down a bit. We could do fourth-grade math without calculators, but now we were paralyzed.

So everybody except me left to go see Batman. I felt a little responsible, as I was the senior person present, soon to be a partner. I think I may have tried to talk the guys out of it. The combination of a partner showing up and the power coming on shortly afterward made the whole thing a bit of an incident. Nonetheless, the guys were right that they really couldn’t do much of anything without their computers.

For inquiring minds here is what the workpaper acronym stood for – Cash, Receivables, Inventory, Securities, Prepaids – Fixed Assets, Other Assets – Accounts Payable Withholdings, Liabilities – Notes Payable, Equity, Expenses, Taxes

—————————————————————————————————————————————————————–

You can find my most practical advice along with a lot of other great stuff at Think Outside The Tax Box.

For great value in continuing professional education check out the Boston Tax Institute.

Pete,

I heard today that Larry Schwartz passed away on Thursday