Originally published on Forbes.com.

It seems like the left and the right have entered into a competition as to which side can make the stupidest tax observation . The New York Times came out strong for the left as its team of reporters was handed fragments of Trump’s 1995 tax filings. They proceeded to “explain” flow-through entities and net operating losses, fairly mundane tax concepts, as if they were tools of Satan. It did not take long for the right to strike back at least as stupidly.

I was occupied Tuesday, so it was my son who alerted me to this development telling me that it was all over the internet that Hillary Clinton had done the same tax maneuver as Donald Trump had. That had me scratching my head a bit, but here is a sample of what William was referring to. It is by Jim Hoft of the Gateway Pundit and has the subdued title of “WOW! Hypocrite Hillary Clinton Used SAME TAX AVOIDANCE LAW as Trump to Save Money on Taxes”

And Hillary following up, adding Trump “apparently got to avoid paying taxes for nearly two decades—while tens of millions of working families paid theirs.”

However, a look back at Hillary Clinton’s tax returns from 2015 (here), proudly displayed by the campaign proving she has nothing to hide – shows something awkward on page 17…

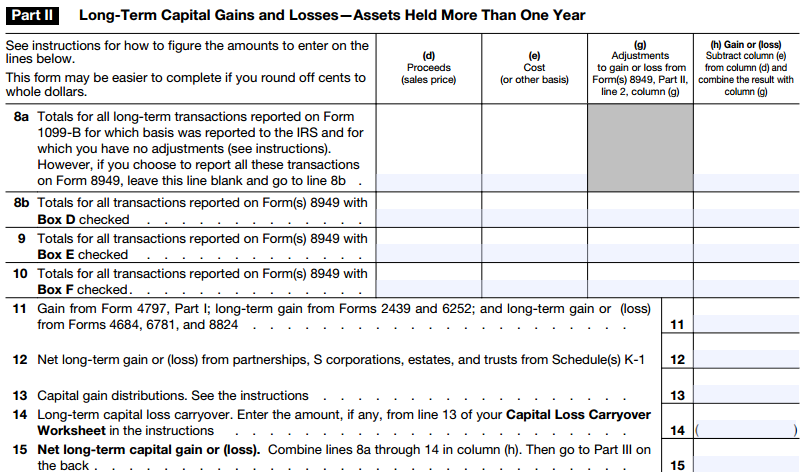

While not on the scale of Trump’s business “operating loss”, Hillary Clinton – like many ‘wealthy’ individuals is taking advantage of a legal scheme to use historical losses to avoid paying current taxes.

What is displayed is an excerpt from the Clinton 2015 return that shows that the Clintons have a long term capital loss carryover into 2015 of $699,540.

The Clintons Are Not Getting Away With Anything At All

———————————————————————————————————————————————————————————————————————–

This article will be available soon on Think Outside The Tax Box