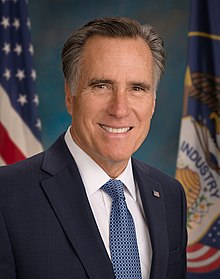

We know that Mitt Romney was on the audit committee of Marriott in 1994, when it did a Son of Boss deal, that sheltered $70,000,000 in income. The Court of Claims ruled against Marriott in 2008. Since we don’t have Romney’s individual returns prior to 2010, we don’t know if he did one for himself. (They are opaque enough so that we might not be able to tell even if we did have his return.) The subject is interesting enough to inspire a campaign ad approved by the President

What if Romney did do a Son of Boss deal himself ? Does it tell us anything about him that we don’t already know ? Given the type of business that he was in, I don’t think so. And if he did do a Son of Boss deal, I really do not think it his fault. The blame lies squarely with the tax professionals who were recommending them. If the deals worked, I could see him thinking that it would be irresponsible not to do one.

It is worth discussing what a Son of Boss deal was, before going further:

If you google Son of Boss one of the top links you will get is a site created by attorney Robert Sommers titled Son of Boss – Abusive Tax Shelter transaction. He outlines the plan as follows:

1. Tax shelter promoter sets up two companies, Company A and Company B and funds each company with $50. Company A buys a briefcase for the $50.

2. Client comes to promoter and says, “I have a $1.0 million capital gain.” Promoter says, “No problem, I can eliminate that gain for you by generating a $1.0 million loss to offset your gain.”

3. Promoter devises the following plan:

a. Client purchases the $50 briefcase from Company A by paying Company A $1,000,050!

b. Client pays $50 in cash. In addition (here’s the tax shelter part), Client “pays” another $1.0 million by signing a promissory note (a promise to pay) payable to Company A for $1.0 million in 30 years7. For tax purposes, Client purchased the briefcase for the cash payment and the promissory note, so the tax cost for Client’s briefcase is $1,000,050.

c. Client then sells the briefcase to Company B for $50. Thus, economically, Client is made whole; Client paid $50 for the briefcase and sold the briefcase for $50. However, Client’s tax basis in the briefcase was $1,000,050 and by selling the briefcase for $50, Client incurred a $1.0 million loss! That loss will then be used to offset Client’s $1.0 million capital gain, effectively zeroing out his tax liability.

d. Assume that Company B then sold the briefcase back to Company A for $50. Promoter is ready for his next client now that Company A has the briefcase and Company B has $50, and the pattern can be repeated.

If you know anything about taxes, you know that that plan does not even make good nonsense. What about the $1,000,000 promissory note ? That was either additional proceeds, income from the discharge of indebtedness or maybe a purchase price adjustment. Regardless, you cannot get free basis from a promissory note. Furthermore, Son of Boss deals did not include overvalued assets. The thing that was purchased, typically some sort of financial instrument, would in fact be something worth $1,000,000.

What made Son of Boss work was either writing an option or a short sale. This produced cash that you could use to buy a similar asset or option. The deals were often structured so that you would most likely have a net loss particularly after transaction costs, but if the stars all aligned perfectly there was a sweet spot where you would hit an economic homerun. Regardless, you would contribute both the asset and the obligation to a partnership, but not consider the obligation to be a liability for partnership taxation purposes. (If you contributed an asset subject to a promissory note, it would not work. Not that it actually worked anyway, but you couldn’t even pretend that it worked.) There actually was support for the notion that the obligation to cover a short sale was not a liability for partnership tax purposes.

I never ran into the deals when they were being promoted. Better to be lucky than good, I guess. I would have had a really hard time with them because they seem to require an unbalanced entry in order to work, but if I had a letter from a prestigious law firm or a national accounting firm saying that it worked and the statutory analysis, I would have had a hard time telling somebody that it absolutely did not work. Intentionally defective grantor trusts and deep discounts for family limited partnership interests don’t seem like they should work, but they do.

If a Son of Boss deal was approved by PWC, who currently does Romney’s return, or another national firm, what would he be guilty of other than being aggressive ?

You can follow me on twitter @peterreillycpa.

Originally published on Forbes.com on August 10th, 2012