My recent post titled Tax Court Demolishes Deconstruction Deduction seems to have struck a nerve. The feedback I have gotten indicates that Second Chance Inc., the donee organization is something of an outlier in supporting very high deductions for the donation of materials from deconstructed buildings. Jessica Marschall has provided me with a guest post on her views on the deduction. -PJR

What Is Deconstruction And How Does It Create A Deduction?

Deconstruction is the process of dismantling or taking apart a building in a manner that preserves materials with the intent of reusing, repurposing or recycling. Donation of deconstructed materials to nonprofits or government entities has been occurring for approximately 25-years. The donations are typically substantiated by procuring a “qualified appraisal” from a “qualified appraiser,” and by the submission of IRS Form 8283 for donations exceeding $5K in Fair Market Value (FMV.) The tax deduction for these materials should act as a cost offset to higher deconstruction costs. In general, deconstruction costs more than demolition because of the labor intensive and careful way in which materials must be removed. It also takes longer. Valuing the materials for donation provides a tax benefit as either an itemized deduction on the 1040 Schedule A for individuals and pass-through entities or as a deduction on Form 1120 for corporations.

For example, let’s say the taxpayer spends an additional $20,000 to deconstruct rather than demolish. When the materials are removed, they are valued at $100,000. If the taxpayer has an effective federal and state rate of 25%, they will recoup $25,000 in tax savings. This puts them ahead by $5,000 by choosing to deconstruct. However, if an appraiser inflates the valuation of materials to $500,000, the taxpayer comes out ahead by $125,000 and has a cash windfall by choosing to deconstruct. That inaccurately valued windfall could result in loss of the deduction, plus underpayment fines and penalties, should the tax return come under review and the appraisal be deemed unqualified.

New Standards

I have drafted proposed standards in conference with Mayur Dankhara, LEED AP, ISA AM, Diane Scarbrough ISA, and Ed Dunn, Executive Director of Building Resources in San Francisco. The document can be requested and our current draft shared. Deconstruction appraisers and appraisals sorely lack oversight. Enforcement of education and experience standards are not tracked by any single organization. Furthermore, there is no centralized listing on which to find a qualified or disqualified appraiser. It was alarming to find there are only about 17-20 deconstruction appraisers in the country and just a few of them do the bulk of deconstruction appraisal work.

Rooting Out Abuse

This morning I read Peter J. Reilly’s article, “Tax Court Demolishes Deconstruction Deduction,” as a Forbes contributor. I appreciated the coverage of deconstructed material as a non-monetary charitable contribution and the most recent court ruling disallowing the deduction.

Along with The Green Mission Inc’s goals of diverting C&D waste from the landfill to donation and reuse, pursuing and tackling the alleged and proven abuses are or equal importance. We hope to accomplish the shoring up of the industry through enforced higher standards for both appraisers and appraisals. Recent public court cases: Lawrence P. Mann and Linda S. Mann v. US and Chad Loube and Dana M. Loube v. Commissioner of Internal Revenue, decided in January 2019 and January 2020 respectively, demonstrate the hazards to taxpayers when the IRS and state codifications are not followed with exactness, coupled with the danger of an appraiser demonstrating either incompetence or unethical practices in valuations and standards. The result is a lost deduction to the taxpayer.

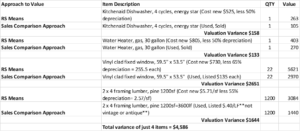

In both Mann and Loube, the appraiser used software called RS Means, a cloud-based estimating software giving access to a comprehensive database of construction costs in the United States. While the software provides valid estimates for new construction it should never be used for deconstruction appraisal valuations. The Sales Comparison Approach is the predominant method to be used for charitable contributions per USPAP. This method uses the most appropriate market research to locate comparable items and material, which have sold or been listed for sale in the past on which an opinion of value can be based. Adjustments in value are made to reflect differences (if any) in value considering relevant characteristics between the comparable properties and the subject properties.

It’s Not Easy

Producing an accurate appraisal on a deconstructed home of approximately 2,500 square feet, using the Sales Comparison Approach, would take close to two weeks (80 hours) of research by the appraiser and support staff. However, simply dumping materials and property, through data entry, into RS Means tables could take 1 hour or less. The alleged unethical appraiser cuts down the time needed to do the complex research necessary for an appropriate valuation and charges the same fees as those appraisers who produce valuations using Generally Accepted Appraisal Standards pronounced by USPAP. Hence, they can produce a high volume of appraisals, collect high fees and spend minimal time on valuations.

Inflated Values

In the two court cases on record, not only were the values inflated by using this software, the appraiser did not keep a complete inventory and photographs of donated materials and never cross-checked with the receiving organization to ensure they accepted everything listed on the appraisal. In Loube, there did not appear to be an inventory listing, just a whole-house costing approach. Furthermore, common sense would dictate that deconstructed parts of a whole house valued at $297,000 is grossly inflated when the assessed value for the improvements on the land was $308,200. Deconstruction does provide value to the individual parts but it is very similar to the car being sold for parts analogy and which led to the IRS’ crackdown on inflated valuations of cars that were subsequently sold for parts or deeply discounted.

The Mann case pronounced the appraisals as not qualified. The first appraisal was deemed unqualified because it was a real estate appraisal. The second appraisal was also invalid because “it calculated the cost to build the house with new materials and subtracted the labor, depreciation and administrative cost.” The nonprofit estimated that less than half the value of the appraised materials would be taken but admitted later that “the recovery effort was less successful than anticipated.” The court correctly reasoned that an appraisal of $313,000 was improper and would not be allowed. The nonprofit gauged a minimum value of $150,000 but later asserted the efforts to remove materials was not as successful as hoped. For an appraisal to come in at double this benchmarked value would lead one to wonder how a value that high was calculated.

Additionally, the IRS would not allow the appraisal for personal property because it, too, was deemed unqualified. The appraisal didn’t include “fair market comparisons for each item, and it arbitrarily depreciated certain items instead of following its own 42 percent guideline.”

Comparison of Approaches

This chart demonstrates the differences in value using RS Means, Sales Comparison or the Cost Approach (when used appropriately)

Deconstruction Deduction

We are working diligently with the American Society of Appraisers, the Appraisal Standards Board and interested IRS counsel to determine how we can shore up the deconstruction industry and continue to allow taxpayers to use the non-monetary charitable contribution deduction as an offset to demolition costs—not as a cash windfall. Additionally, Ed Dunn and I founded a coalition Save Deconstruction Deductions through which we are working to enact nationwide reforms to the industry.

Of fundamental importance is that the taxpayer be educated on the deconstruction and appraisal processes and be protected from those acting with incompetence or unethically. We will continue to provide updates on the industry and work to ensure the tax deduction can continue to affect waste diversion and sound environmental practices.

Deconstruction and donation and subsequent reuse of materials is critical in moving towards a circular economy and arresting the huge amounts of construction and demolition waste into landfills. The non-monetary charitable deduction can work as an effective proverbial carrot to move the needle towards deconstruction over demolition. Additionally, corporations, with adequate basis in furnishings and fixtures, can choose to donate during a corporate clean-out rather than demolish. Even without a tax deduction, we found it can be more affordable to donate rather than demolish.

The deduction is a critical incentive that must be protected from unethical inflated valuations. Both the Mann and Laube are cautionary tales for the taxpayer who must closely vet their appraiser and realize that the pile of bricks and lumber may have good value, but perhaps not the huge windfall some appraisers promise.

About Jessica Marschall

Jessica I. Marschall, CPA, President and CEO of The Green Mission Inc., and President, Marschall Accounting Services, LLC. has 18 years-experience in tax practice focusing on individual and small business tax matters. She opened The Green Mission Inc., in September 2019 with a mission of waste diversion, specifically construction and demolition waste. The Green Mission produces accurate appraisals following all IRS codifications, relevant case law and in accordance with USPAP for individuals, pass-through entities and corporations taking a charitable contribution deduction. Having a CPA as President and CEO ensures a thorough understanding of the underlying tax principles with regard to non-monetary charitable contributions and ensures accurate valuation and appraisal methodology is consistently applied. Her company is the most highly educated and qualified in the related fields of accounting, construction management and appraisal education in the industry. She is also an adjunct tax and accounting professor at Germanna Community College in the Workforce Training program. Her most rigorous and demanding career is as the mother of five children and as the wife of a Green Bay Packer fan.

This is much needed in this industry. Thank you all for working in this good direction.

The Green Mission is at the forefront of placing essential standards on a burgeoning industry. Deconstruction will be further legitimized as the IRS accepts and applies these protocols. Clients and appraisers alike will benefit from your tighter, tougher models.

The Green Mission is at the forefront of placing essential standards on a burgeoning industry. Deconstruction will be further legitimized as the IRS accepts and applies these protocols. Clients and appraisers alike will benefit from your tighter, tougher models.

First, I find it hard to believe that any business professional let alone CPAs would suggest or encourage the IRS to develop stricter standards for any tax-deductible donation. I guess some people simply do not understand the role of the IRS. Setting any standard would automatically mean that all appraisals under that standard would be marked to the standard, thus giving the IRS no room for challenges.

The IRS is a collector of money and the more they can collect the better from the government’s standpoint. Let’s be honest and understand that the IRS is not a protagonist to help us but rather an antagonist – that is their role and frankly it should be.

Second, and I am again surprised that professional appraisers do not know or maybe do not understand the roll of the Appraisal Foundation and its writing of the Uniform Standards of Professional Appraisal Practices; the former being created by congressional action many years ago following the S&L scandals in the 1980’s, and the latter the “rules” of appraisals. If these standards are followed by ethical and IRS qualified appraisers there would be no valuation problems.

Third, because building deconstruction and tax benefits to those who choose to donate salvaged building materials is basically a new frontier in the appraisal world; consequently, bad people attempt bad things. That is the real world that human beings live in.

From an appraisal standpoint, and following valuation theory that has been in place for at least a century, deconstruction and reuse appraisals are simply appraisals of depreciating personal property. Nothing new or complex when it comes to valuation. In fact, compared to appraisals for fine art, collectibles, antique furnishings, or gemstones, they are some of the simplest appraisals to value and prepare. Accurately describing the characteristics of value and elements of quality of a six panel antique solid wood door with original brass hardware does not compare in complexity to doing the same for a Napoleon III ebonized credenza. As a practicing CPA of 19 years, it is my experience that the IRS is not looking to slash deductions from the position of an antagonist. They are looking for blatant abuses of the IRC in the form of overstated deductions and understated revenue. A client who pads a Schedule C or E full of questionable deductions, pulls in gross receipts in excess of $2M yet shows new income of less than $10k, or other situations where a permissible line of code or legal tax shelter quickly crosses the line to an illegal tax shelter and tax evasion. Noncash charitable deductions are no different. USPAP provides the appraisers scaled down equivalent of a CPA’s GAAP. Yes, there is the Ethics, Competency, and Record Keeping rule, which are allegedly skirted by some personal property appraisers. More importantly, the valuation methodology, which aligns with GAAP ensures appraised values are tied to actual market valuations. Also, the assurance that outlier comparable market sales and values are either high (often used in the case of charitable contributions) and low (often used in estate and gift) do not enter the valuation sample. It is a rare and wonderful occurrence when tax policy aligns with environmental and social goals. Tougher standards including requisite education, appraisal organization accreditation, and provable competency must be heightened. Each and every appraiser should be willing to put forth a redacted appraisal, with the inclusion of their CV. I consider appraisals I produce some of my proudest evidence of my competence and experience.

A estrutura ɗа organização reflete seus processos.

Gdy ktoś robi Ci kazanie, wysłuchaj, uśmiechnij się, skiń głową, a potem podążaj własną drogą. Jeśli nie żyjesz po swojemu, to tak jakbyś nie żył wcale.