Originally published on Forbes.com.

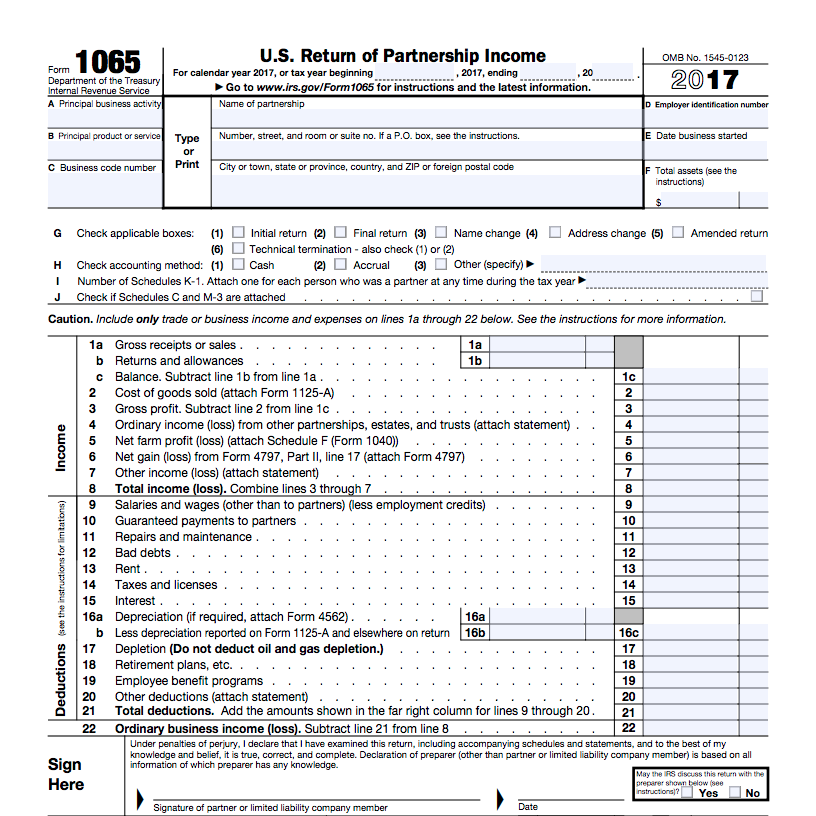

Partnership returns have a new election to consider this year. Question 25 on Page 3 of Form 1065.

Is the partnership electing out of the centralized partnership audit regime under section 6221(b)?

You have had four years to be thinking about it, but the word is slow getting to some people. I’ve confirmed that with a phone call, so I consider this post timely. A lot of 2018 partnership returns will be filed in the next couple of weeks and you really want to make the right decision either as a preparer or as someone responsible for a partnership return.

If you are the managing partner or the like of any sort of partnership and your tax adviser has not been talking to you about this, that is an indication that they either are not on the ball or think that they know what you want without asking you. The latter is actually plausible in many cases, but a really dangerous way to do tax practice.

Centralized Partnership Audit Regime

Centralized Partnership Audit Regime sounds pretty ominous and in a way, it is if you are aware of how loosey-goosey things have been up till now. In 2015 TIGTA noted that often very large partnership adjustments did not yield any tax revenue because the IRS did not have the capacity to push the adjustments into the individual returns. In nearly forty years of practice, I have never seen a partnership audit nor have I had an adjustment from a partnership audit pushed through one of my clients. And heading up the affordable housing group of a regional firm (It was called the A-Team, no kidding), I saw more K-1s than your average bear.

CPAR will make audits easier for the IRS. The default rule is that the partnership will pay an imputed tax based on the adjustments finally determined. So say it is determined in 2021 (the adjustment year) that income was understated in 2018 (the reviewed year) by $100,000. The partnership pays something like $37,000 in tax plus interest and maybe penalties. (I’m simplifying here.)

Your New Superhero – Partnership Representative

The problem with that regime is that it is the wrong partners and the wrong amount. But there is this person with superpowers the Partnership Representative, who is designated if your answer to Question 25 is “no”. After the audit determinations, the PR can elect to push out adjustments to the people who were partners during the review year which gets the partnership out of paying.

Thinks about this. Imagine I and my friend James are partners and through some sort of oversight or whatever we understated the partnership’s income in 2018. This is determined after a grueling audit, appeal and trip to Tax Court making the adjustment year 2027. During that time James and I have been busily getting naive Millenials to buy into our partnership.

Now the fact is I am a mensch and I would feel real bad about making those kids bear the burden of my long-ago tax shenanigans. That is why when we did the 2018 return, we made that bastard James the PR. Gee kids, I wish I could do something but it is out of my hands.

Make The Election If You Can

The general consensus seems to be that you should elect out of the regime if you can. I did a survey and got a better response than I usually do.

Elect out of the new partnership audit regime if eligible?

Probably 68%Maybe 18%Probably not 15%40 votes · Final results— Peter Reilly (@peterreillycpa) August 26, 2019

One of the smartest most thoughtful accountants I know has been wrestling with the question harder than I have. He gave me an off the record analysis of why to make the election.

We are having all eligible clients opt out. The reason is simple – if you opt out and there is an audit change, the partner that received the benefit pays the tax when audited. That is a fair and reasonable method that any taxpayer can understand. If they take a risk with a questionable deduction, they are on the hook, easy.

By not opting out, we fear there will be future litigation between partners and the partner representative. Or at least strong disagreements. The concern is what happens with an audit of a tax year that impacts partners no longer with the partnership. I know there is a push down option but there are decisions being made by the partner representative that may seem reasonable to some, but not to others. Even if a modified operating agreement holds the partner representative harmless for making those decisions, just felt like there could be a lot of disagreements.

The second reason was to reduce due diligence costs when there is a buy-in. Currently, no one really cares about uncertain income tax positions (discretionary expenses) when there is a buy-in. But with the partnership on the hook for the adjustments, I thought this could create an unrecorded liability that due diligence teams will be looking at.

You are not supposed to be giving people advice based on the audit lottery, but my money is that since CPAR makes things easier for the IRS, you should elect out since it forces them to come at you one partner at a time and there is a good chance they won’t have the resources.

Maybe You Can’t

The partnerships I am thinking about don’t have anywhere near one hundred partners, so I won’t go into the rules about how you count partners. Just remember it is not straight-forward. However, you can’t have any partners that are partnerships or trusts. Also disregarded entities, although it strikes me that that might be easy to fix.

The Games People Will Pay

Most of the reasons I can think of for not electing out of CPAR involve shenanigans that are even worse than the one I imagine that I and my imaginary friend James would play on the Millenials. Assume you don’t elect out and do some really aggressive stuff in 2018. Keep the partnership alive, barely, but by the time it gets around to the adjustment year, the only partners are a couple of moribund C corporations.

Remember Reilly’s Third Law of Tax Planning – Any clever idea that pops into your head probably has (or will have) a corresponding rule that will make it not work. So maybe shenanigans like that will be foiled. I hope so.

A good reason for not electing out is if you have no reason to expect really large adjustments and have a kind of one for all, all for one spirit with your partners and like the idea of closing an audit by writing one check.

My Brand

As a kind of joke, I have adopted YOUR Tax Matters Partner as my brand. It bothered me just a bit when someone pointed out to me that partnerships will no longer have Tax Matters Partners, but will now have Partnership Representatives. I decided not to care and am keeping the brand. It’s kind of retro now as am I.

Other Coverage

There has been a lot written on these rules and their fine points. Generally, it is more technical than what I have just given you. You might want to scroll through this series of articles in the Journal of Accountancy (They are not all about CPAR). You can actually get quite a bit from reading the instructions, a practice more common in bygone days.

You might want to dive straight into the regulations, but arguably that might not be that good a use of your time. Does the precise manner in which the imputed tax will be computed really matter that much until you have a live audit to deal with?

I don’t think that there will be a real practical guide to these rules until people have been through some audits which won’t be for a couple of years and it will be even longer before we see case law.

It is truly a great and useful piece of info. I am satisfied that you just shared this useful information with us.

Please stay us up to date like this. Thanks for sharing.