Originally published on Forbes.com.

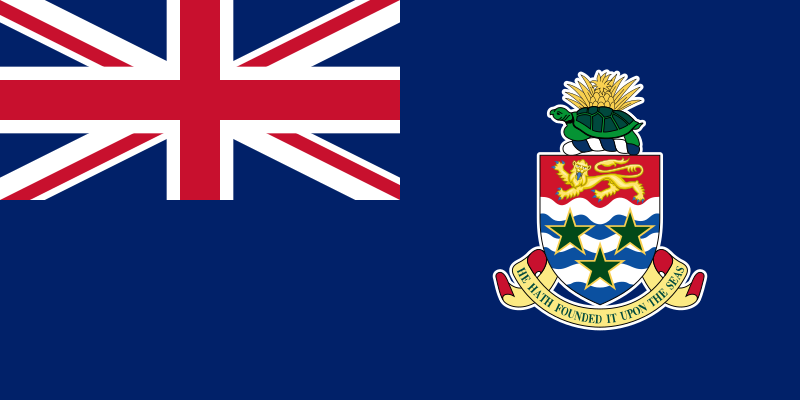

When I wrote about the recent Acera decision here and here, something occurred to me. Whenever I hear about the Cayman Islands, I immediately think something sketchy must be up. Somebody recently said to me “The Cayman Islands is just a mailbox.” I started wondering if that was fair. The Cayman Islands are a real places where people live. And they are not all attorneys and accountants, although they do have more than their fair share. There are about 60,000 people in the Cayman Islands and around 100,000 registered companies. What I am chronicling here is my tentative effort to get a sense of what it is like to be an accountant working in Georgetown on Grand Cayman, which seems to be pretty much where all the accounting action is.

It is not that satisfying an investigation and I am hoping that a foundation or something will fund a more thorough inquiry. My accounting partner is also my life partner and between us within a couple of months I think we could get a really clear picture. We’re wrapping up our final tax season, so availability will not be an issue. All I have for you now is the results of internet research and two interviews. One with a Big 4 grunt who prefers to be anonymous (I’ll call him Joe) and the other with Ben Leung, Managing Partner of EisnerAmper Cayman. According to this article EisnerAmper ranks 18th among US accounting firms in terms of revenue. Globally EisnerAmper has 195 partners and 1,650 employees. There are 18 in the Cayman office.

Is A Thousand A Lot?

Trying to get a handle on the concentration of accountants in the islands is a little tricky, but I am giving it a shot.

The Cayman Islands Society of Professional Accountants has over 1,000 members. The Massachusetts Society of Certified Public Accountants has over 11,000 members. Massachusetts has a population of 6.86 million. It is probably not a true apples to apples comparison, but I think it is pretty dramatic indicating that there are quite a few more accountants per capita in the Caymans. Like if your kid gets invited to a birthday you are more likely to have a couple of the parents there that you can chat about GAAP with. How many times do you get together with a bunch of people and there is nobody else there who knows about blocker corporations and they end up talking about sports or Game of Thrones or something and you are just out of it? Maybe in the Caymans not so much.

A place in Massachusetts with a similar population to the Caymans is the city of Waltham, which is actually a very important component of the accounting industry in New England. It is home to Bentley University which turns out a lot of accountants. Waltham does not however have offices of KPMG, Deloitte, EY, PwC, Grant Thornton, Baker Tilly and EisnerAmper. Well Rodman CPAs looks pretty substantial and they are part of the BDO Alliance, which is as good as having BDO or at least that is what we used to say at CCR when we were BDO allies. So you can get accounting services in Waltham just not such a concentration as is available in Georgetown.

Of course, if you are in Waltham, you can get in your car and drive say 200 miles or so. I think that would be enough to catch all those firms that are in Georgetown. There is a small island at the mouth of the Hudson River that is pretty dense in terms of accountants. Manhattan is half the area of Grand Cayman, but it has more people. 1.6 million as opposed to 60,000, and that’s just the ones who live on the island who are supplemented by millions who can get there by bridge, tunnel and ferry on a daily basis.

Feeling Claustrophobic

The big thing in my mind about Grand Cayman, which of the three islands is the one with the most accounting action, is this sense of claustrophobia that I think I would feel if I were there. I spent a long weekend on Bermuda a couple of years ago. Bermuda has a very similar history to the Caymans and is different in a very important way. Bermuda is not in the Caribbean, which can come as a shock to the geographically unsophisticated who go there in January. I once worked for a travel agency that offered specially discounted Bermuda packages in January. The point of the offer was to have the agents give a geography lesson and then up-sell to a Caribbean package. I was a bookkeeper/controller/CFO of sorts for the not very large operation. I told the manager that I thought he was indulging in “bait and switch”, but he insisted he was educating the public.

History though has some similarity. As far as anybody seems to know neither the Caymans nor Bermuda had any indigenous populations. The story of the first permanent settlement of Bermuda has its roots in the shipwreck of the Sea Venture in 1609, giving just a bit of a Gilligan’s Island feel to the whole thing. The Caymans were discovered by Columbus in 1503 but not settled till much later. As Wikipedia puts it there were ” pirates, refugees from the Spanish Inquisition, shipwrecked sailors, and slaves. The majority of Caymanians are of African and English descent, with considerable interracial mixing.”

The claustrophobic feeling sneaked up on me in just a couple of days on Bermuda as we rode the bus from one end of the country to the other in about an hour or so and then took a boat ride, from one end of the country to the other. It slowly dawned on me that even if I had a car I would not be able to get in it and drive 500 miles, something I rarely do. It was irrational but there it was.

Mr. Leung who had been living in Britain and he did indicate that he felt that way a bit for the first couple of years on Grand Cayman but that now the idea of driving more than 45 minutes to go anywhere seems daunting. (Of course by my reckoning even Great Britain is a bit cramped. You cannot drive three thousand miles west, a thousand or so south and three thousand east and then back north like I did back in 2010. God bless the USA.)

There is one thing that he noted that is a big upside to the Caymans. A tragic remnant of racism probably has its roots in white supremacist ideology, which used to be quite popular and often seems like it will make a comeback. It blights much of the English speaking world. Mr. Leung, who is of Asian descent, noticed a whiff of it in Scotland, but finds the Caymans utterly devoid of racism. Pirates, refugees, shipwrecked sailors and enslaved people might not seem to be the best material to start a country to some, but clearly there is an upside.

The Caymanians And The Expats

The Cayman Islands is an autonomous British Overseas Territory. Defense is handled by the UK. There is no income tax, but they make up for it in other ways. You can’t just move to the Cayman Islands. You have to have a work permit and it is the employer who pays for it. The job has to first be offered to Caymanians, but the local supply of tax geeks has probably been long since exhausted. Mr. Leung told me that a permit will cost his firm around $17,000. There are exceptions and other requirements, one of which is fluency in English. And of course all those companies have to pay registration fees which add up. By some accounts consumption taxes are pretty stiff, but I did not look into that.

According to this article the top countries of origin for Caymanian work permits were Jamaica (10,924), Philippines (3,626), United Kingdom (1,798), India (1,168), USA (1,165), Canada (1,143) and Honduras (1,070). That leaves roughly 6,000 others. Expats work not only in financial services, but also hospitality, construction and other areas. Even the police force has used expats. Americans are at a bit of a disadvantage if they are making much over $100,000 as they have to pay US income taxes. Many other countries don’t tax citizens on their world-wide income.

Mr. Leung indicated that the EisnerAmper office is quite diverse in terms of national origin and that he likes it that way. That strikes me as pretty cool, but also possibly on the distracting side.

Interesting thing that he told me about office size is that the EisnerAmper office is larger than most. Some firms just have a couple of people, but some of the very large firms have a hundred or more. The Caymans have very strict regulations on some types of companies and much of the audit work needs to be done in the Caymans. The very large firms also do some of the tax work there, but EisnerAmper’s US tax compliance for Cayman clients is handled in New York.

And that brings us to the work that Joe was doing.

Inside The Hedge Fund Sausage Factory

Joe who is no longer in the Caymans has a fairly cynical view of the whole enterprise.

A beautiful island, but absurd. Despite having the population of a suburb, the island has its own currency, its own securities regulatory agency, and, my personal favorite – a British style cabinet of officials – Minister of Health, Minister of Commerce – etc. that address each other as “the Honorable.”

The zero tax policy brings in steady revenue for the government from issuing certificates of incorporation. In addition, it has created an enormous system of local spoils… a network of local auditors, regulators, “independent” directors for hire and the like. Relatively minor shakedowns for a fund with billions under management looking to avoid an income tax. The economy is largely driven by an industry that adds no value to the world.

The percentage of Cayman that is poor is way higher than you’d expect – you would think that with the amount of money coming through that place they could just buy everybody an annuity.

The expats are almost half the population and they seem to be the ones who are living it up, so as you can imagine there is quite a rift between the locals and the expats (they call us expats, which always struck me as a more polite term for “foreigner” which is what we use in the U.S.) and that is the big political issue there.

Joe was involved in designing sophisticated partnership deals in the US. He had reasons for wanting to be in the Caymans, but found that the only work to be had was preparing returns for one of the larger firms. Being able to make that transition indicates that he has a lot on the ball.

Joe also discovered something I have known for a long time. It is reflected in Reilly’s Ninth Law of Tax Planning – Tell the preparer what the plan is. The sophisticated planning that goes into partnerships is sometimes lost when it actually gets to return preparation. Oddly, it seems that often nobody cares.

At any rate, a downside for professional growth is that you might not be working with the best and the brightest and be doing work that is complicated but repetitive. Still hedge funds tend to invest in just about everything, which is why individual preparers hate them. So you might learn a lot from looking down at the lower tier.

Some Agreement

It is pretty clear that if you want to engage in the type of shenanigans that were portrayed by Tom Cruise in The Firm back in 1993, the Cayman Islands are not a great place to do that anymore.

The intense regulation that Joe thinks is entirely a white-collar jobs program is also oriented around making the Caymans a respectable financial center. One of the problems with sketchy jurisdictions is that your money can end up being protected against everybody including you.

What both the managing partner and the lower level employee agree on is that there is not a tremendous amount of beach sitting time for accountants in the Caymans. There is a lot of work to get done and intense deadlines. But the beaches are beautiful. So much so that when people living in the Caymans go on vacation, they generally go more for bright lights and big cities.

Good Career Move?

I could see a couple of years in the Caymans being a reasonable step in an accounting career, as long as you won’t miss scraping ice off your windshield for a while. It strikes me as not that likely that too many people can make a full career there, but as noted more research is required.

End Of An Era

It might be appropriate that I have been working on something about the accounting industry for the last week or so. My close readers will recall that I often cite the wit and wisdom of my first managing partner Herb Cohan of Joseph B Cohan and Associates, a pillar of the Central Massachusetts accounting world for most of the twentieth century. You will be sad to hear that Herb passed away last week. A biographical detail that he rarely mentioned is that he was World War II veteran – United States Navy. A rather large proportion of Worcester County accountants from the fifties through the nineties worked for Herb at one time or another, but I have the honor of being the last one to become one of his partners. One of his mottoes was “If you want something done, ask a busy person to do it”. He always kept busy and he kept us busy too.

Correction

In previous versions of this piece, I misspelled Mr. Leung’s name in some places. I apologize for any confusion that may have created.