Originally published on Forbes.com.

The Ninth Circuit is generating a lot of excitement this week. Probably most exciting is its ruling that open carry is a constitutional right protected by the Second Amendment. But this is a tax blog, so I get to write about Altera Corporation & Subsidiaries v IRS. It is about Section 482 of the Internal Revenue Code. Be still my beating heart.

The Stakes

The dollars in the decision seem pretty substantial to a CPA like me who is not in the big leagues – an $80 million dollar income pickup spread over 2004-2007. Just the interest on the deficiency would be “a number” as we say. But to Intel, which acquired Altera in 2015 for $16.7 billion, the actual tax bill, if any, from the decision is not a lot of money for a company with market capitalization over $240 billion. Not to spoil the suspense, but the decision went against Intel with the three judge panel voting two to one to overturn a Tax Court decision favorable to the company. The decision will have many companies excited though. Amazon filed an amicus brief supporting the Tax Court decision.

As is usual, the story behind the story is more intrinsically interesting than the decision. If you watch the oral arguments, you hear two guys taking turns arguing and getting interrupted with questions from the judges. What they are arguing about is the expense of stock-based compensation being included in cost-sharing agreements between related companies. In its regulations, the IRS indicates that those costs should be considered if a cost-sharing agreement relative to intangible property is qualified to be respected. The argument against the IRS is that in an arms-length cost-sharing deal, independent parties would never include stock-based compensation as a shared cost. The IRS answer to that is that you don’t have any comparable independent deals so the regs attempt to create a reasonable split relative to the income the parties generate.

What does not get discussed is that parking intellectual property in tax havens and stock-based compensation are two of the main ways that companies like Amazon, Intel’s amicus in the case, have avoided paying much, if any federal income tax.

The Funny Thing About Stock-Based Compensation

You will often see articles about how much companies “pay” in federal income tax. As I explain here and here, those articles inevitably use the “provision for income taxes” rather than the amount paid, which is a little harder to find and not broken down by jurisdiction. The tax deduction that companies get when non-qualified options are exercised or qualified options are exercised and the stock sold in less than a year is not considered in computing the tax provision that is charged to income. That tax benefit is considered a contribution to capital.

So companies are recording as part of their provision income tax that they will never have to pay and not laying out cash for. As a matter of fact, they pick up cash when the option is exercised and get an income tax deduction. What they are fighting for in this case is to have that entire deduction be charged against the taxable income of US operations not their foreign subsidiary operating in a tax favored jurisdiction.

Why Cayman Islands?

At the heart of the case is a transaction that makes no economic sense other than as a tax dodge.

In May of 1997, Altera entered into a cost-sharing agreement with one of its subsidiaries, Altera International,Inc., a Cayman Islands corporation (“Altera International”), which had been incorporated earlier that year. Altera granted to Altera International a license to use and exploit Altera’s preexisting intangible property everywhere in the world except the United States and Canada. In exchange, Altera International paid royalties to Altera. The parties agreed to pool their resources to share R&D costs in proportion to the benefits anticipated from new technologies.

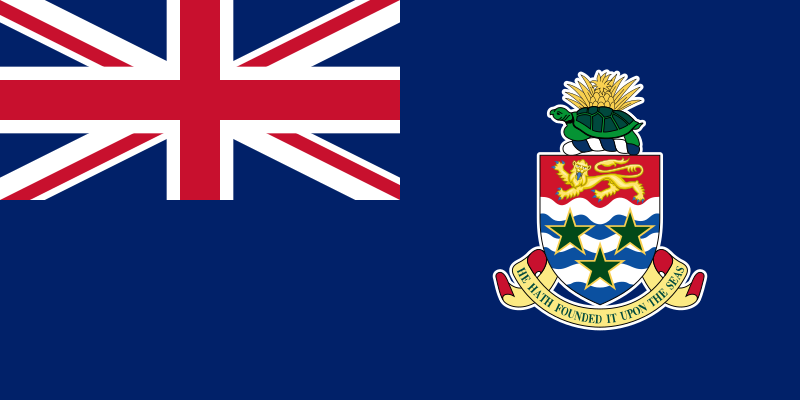

“A Cayman Islands corporation”. What is the business purpose of forming a subsidiary in the Cayman Islands?

The islands have a really fascinating history according to the official website. Like Bermuda, there apparently were no indigenous people. Columbus found the islands when he was blown off course and ships started stopping there for the turtle meat.

However, the earliest settlers arrived in the islands around 1658 as deserters from the British Army in Jamaica. The first colonists were named Bodden and Watler – with fishermen, slaves, sailors and refugees from the Spanish Inquisition soon to follow.

The three islands have 102 square miles and a population just over 60,000. According to this article in The Daily Mail, there are over 100,000 companies registered. Also according to the article, the social safety net is not that strong and high sales taxes are hard on regular people. The Cayman Islands is an “autonomous British Overseas Territory”. Defense is handled by the United Kingdom, although they do have The Cayman Islands Cadet Corps. Kind of like if we got rid of the Army, Navy, Marine Corps, and Air Force, but kept Junior ROTC.

So what has happened here is that an American company created intangible property. Likely much of it was R&D expense, for which there might have been credits. An asset has been created with, at least to an extent, deductible dollars that sheltered other income from corporate tax. Just as that money tree is ready to start yielding it gets moved to the Cayman Islands , where none of the yield has to be used to support the world order that makes it possible to reap the benefits of intangible assets made in America and deployed throughout the world.

The Issue

In order for the IRS to respect the allocation of income between the Cayman subsidiary and the parent, the cost-sharing arrangement to keep and improve the intangible assets needs to pass regulatory muster. One of the requirements of the regulations is that stock-based compensation be included as one of the costs. The taxpayers argued, well enough to convince the Tax Court and one of the three judges on the panel, that in an arms-length deal parties would never include stock-based compensation. The IRS did not deny that, but argued that the regulations could never replicate comparable transactions among unrelated parties because they don’t happen enough.

You generally don’t have somebody thinking they want to find somebody in a small country to buy the right to their intellectual property which they will then license back for use in the rest of the world. Further there will be a cost revenue split on future developments. You pretty much only do that sort of thing with related parties to save taxes or possibly for asset protection or some other regulatory concern. In an arms-length deal you could not consider stock-based compensation since there is a chance that the other party’s stock could really take off.

The court went with the IRS, but it was a close thing. One of the votes came from Stephen Reinhardt , who died on March 29, 2018. I don’t think he gets a vote if the matter goes to the full panel.

How Important Is This?

TCJA changed how corporations are taxed on foreign operations and lowered the corporate rate substantially. Also as discussed in this article by Sam Schecner, there will be an even lower rate (13.125%) for income from foreign income from goods and services using patents and other intellectual property.

The deduction is meant to induce companies with large U.S. operations and significant foreign income from patent royalties to base more of those assets in the U.S. Such companies, especially in technology and pharmaceutical sectors, often hold foreign rights for their IP in a company based in a low-tax country.

We’ll see.

Other Coverage

I picked this story up from Lew Taishoff’s post – Aspirational Goals. I appreciated his comment on the “white collar jobs” aspect of these sort of disputes.

Pages 2 through 4 of the opinion list the attorneys on this case. Looks like there are more of them than were in my engineer company in Vietnam. I hope they all got paid.

He has his usual colorful summary of the matter.

Needless to say, there’s a dissent. The majority tramples on the APA, Chenery, Xilinx,and eviscerates the sacred arms’-length standard. Put the apostrophe where you will, arm’s-length is now the Venus de Milo of tax law.

Richard Rubin had IRS Wins Court Case Over Intel Corp in the Wall Street Journal. He notes the potential far reaching significance of the decision.

The Altera case involved taxes on just $80 million of income, but the impact could be far larger. Alphabet Inc., the parent company of Google, said in 2016 that it could gain as much as $3.5 billion if Altera prevailed and other companies also told investors that they were tracking the case.

A spokesman for Alphabet declined to comment.

Roger Russell had a summary piece in Accounting Today.