Originally published on Forbes.com.

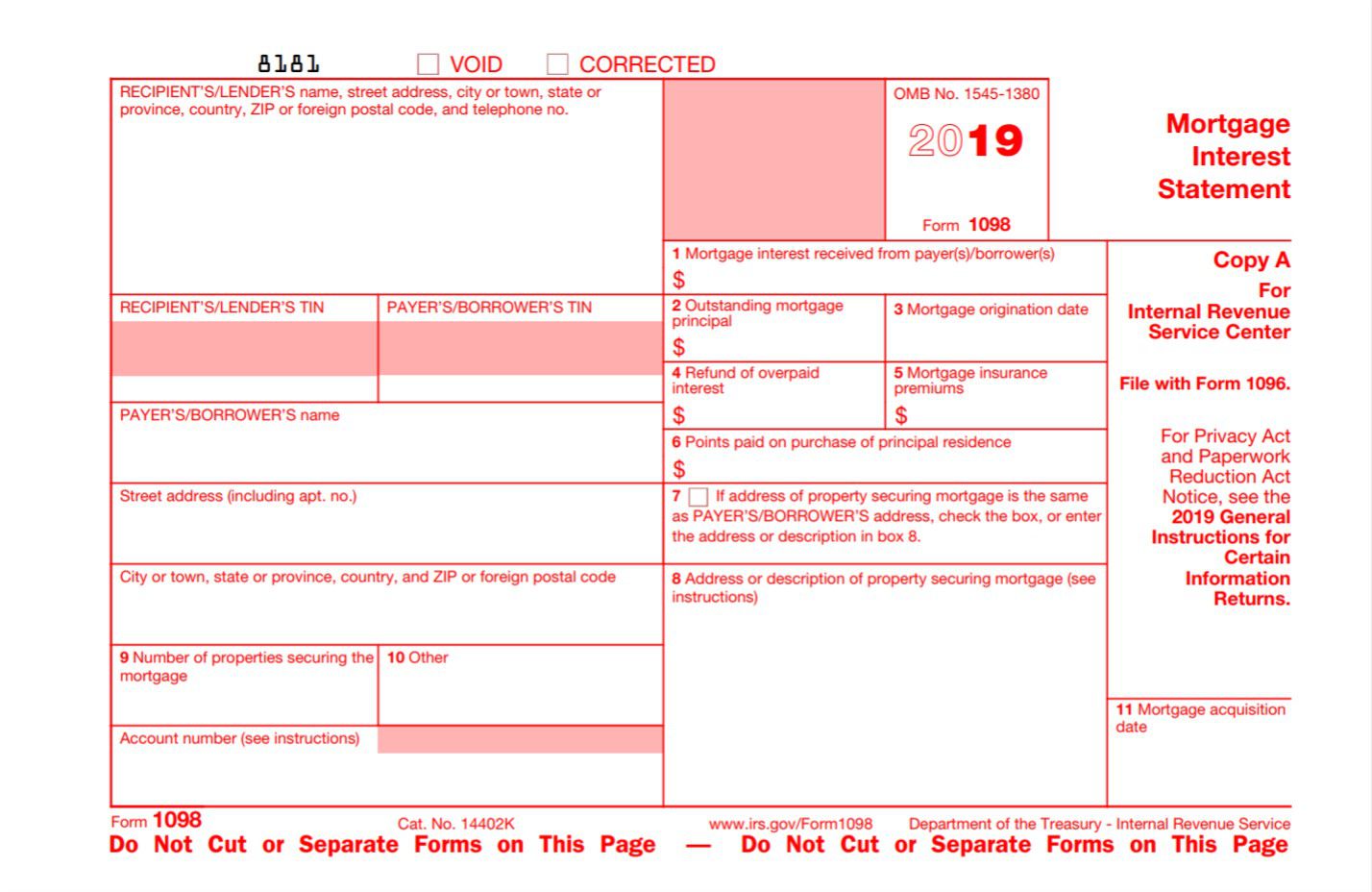

There are many people who have unwittingly understated their mortgage interest deductions who should be seeking refunds. Also, preparers of tax returns should not be taking Form 1098, which reports mortgage interest at face value. There are three situations in which there is a good chance that the amount on Form 1098 is not the deductible mortgage interest. Those three situations are negative amortization loans, loan modifications, and short sales.

I picked up on this from a recent decision by Judge Cynthia Bashant. Her ruling was on a motion to dismiss in the case of Adriana Rovai v Select Portfolio Servicing Inc. The litigation itself is an interesting story and we will get to it, but the take away for people who prepare tax returns is what I think is really important.

I think that most of us tend to think that when they send our clients Form 1098, the banks are telling them what their deductible mortgage interest is (Assuming the mortgage balance is not over the threshold). The litigation reveals that that is not necessarily what the banks think they are doing.

The Complaint

Adriana Rovai’s numbers as outlined in the complaint illustrate the problem

In or about February 2012, Plaintiff received a Form 1098 from SPSI supposedly reflecting the amount of mortgage interest that it had received from Plaintiff during tax-year 2011. Although Plaintiff had paid $2,698.20 to SPSI on her note during 2011, the Form 1098 she received reflected only $1,443.58 in mortgage interest paid. This is the amount of interest accrued and paid on the 2011 balance owed. The Form 1098 for tax-year 2011 also reflected that Plaintiff had paid $1,254.62 in supposed “principal.”

SPSI’s method for calculating mortgage interest is wrong because it assumes that the entire loan balance that it took over in December 2011 was comprised of principal, and fails to recognize that the interest that was previously deferred does not lose its character as interest simply because it is paid back at a later time, or to a different mortgage servicer

Ms. Rovai’s mortgage was one that allowed negative amortization. For some period she had paid less than the interest that accrued each year. The shortfall was added to principal. In 2011 she started paying more than the interest that accrued during the year.

What Are You Supposed To Do?

There is authority on what you are supposed to do for income tax reporting purposes in that situation. Revenue Ruling 77-135, was about a particular HUD program, but the ruling is based on general principles. Referring to the payments in excess of current interest in later years, the ruling states:

This excess will be treated as discharging first that part of the unpaid balance of the loan that represents accumulated interest carried over from prior years

I reached out to my Facebook buds, who include some pretty sharp practical accountants to ask how they would handle this situation. Jeff Kristoff of Rosen and Associates responded first.

Obtain from the client enough documentation to respond to a notice (that is, don’t take client word) and put the difference on “amount not reported on 1098.

Jeff is referring to a line on Form 1040 Schedule A in the mortgage interest section.

The complaint filed in the case, which is a class-action suit, makes it seem like it might not be that easy, but there is reason to think that the approach will work.

Knowing that you need to question the Form 1098 and figuring out the right number is a little trickier. If you are sure that your client is way underwater (a mortgage balance much higher than the amount originally borrowed), you can be pretty sure that everything they paid is interest for income tax purposes, but if there is not that much accumulated interest then some of the payment may be actual principal in the sense of starting to pay back the money borrowed rather than in the legal sense.

So Why Don’t The Banks Give Us The Right Number?

I should note that I am using the term bank kind of generically. Sometimes the 1098 is produced by a “servicer” which is not actually a principal in the transaction. As a matter of fact, your mortgage obligation may have changed hands several times with or without the servicer changing. This may well be the source of the problem.

The interest that is accrued but not paid under a negative amortization loan will be added to principal. So in order to properly compute the deductible interest, you need to have its principal in two separate buckets. One bucket has the original amount loaned and the other has the accumulated interest. When a payment in excess of current interest needs to be reported, you need to dip into the second bucket until it is empty. Then you start dipping into the first one, which holds nondeductible payments.

The problem is that both buckets have principal in them (from a legal perspective) and that principal is all you need to know to compute interest or figure a payoff. So a new servicer might not even have the information available to separate out the balance between the two buckets.

The Question The Bank Thinks It Is Answering

The requirement to send out Form 1098 is not in Section 163 with the interest deduction. It is Section 6050H surrounded by other reporting requirements. It instructs the payee to report “interest”. There is no reference to Code Section 163 and no further guidance.

In dismissing with prejudice Rovai’s false representation claim, Judge Bashant wrote:

Fatal to Rovai’s statutory construction-based assertion of falsity is Section 6050H’s ambiguity and the lack of regulatory guidance at the time SPS issued its Forms 1098. While Rovai “would characterize the question as a simple undertaking of statutory construction, that is quite frankly not the case.

This observation is extremely annoying to David Vendler despite his overall praise for the decision. David Vendler is the plaintiff’s attorney and this issue is something of a crusade on his part. He has several others class action lawsuits on 6050H , including one -Pemberton v Nationstar Mortgage-, which also just survived a motion to dismiss. In both cases, much of the complaint was dismissed, but there is still something left, which will allow the cases to keep moving.

Relief Sought

Mr. Vendler is not asking for much. Send out revised 1098s along with some money to pay for preparing amended returns. Reimburse people for taxes that they overpaid that are lost to the statute of limitations. Oh yeah and pay the plaintiffs attorney. He told me that in a case that was settled with Bank of America, three law firms split over $10 million.

The SPSI response is essentially that Ms. Ravai’s troubles are entirely of her own making. She could have added the capitalized interest paid to what was on the Form 1098. The IRS gives you a line for it, which they point out. Or she can file an amended return

What troubles me about that response is that it seems a little inconsistent with SPSI core values which include:

We work hard to exceed expectations.

Where Is The IRS?

It seems that this problem should really be solved by the IRS. Tell the banks exactly what they are supposed to put on Form 1098 and provide some sort of expedited refund process. It crosses my mind that maybe some sort of catch-up deduction considered as an accounting method change might do the trick including giving relief for closed years.

There has been outreach to the IRS, but nobody has gotten anywhere with it according to Mr. Vendler.

The Nefarious Part

There was one part of the complaint that really intrigued me and also struck me as improbable.

Plaintiff alleges on information and belief that the reason SPSI is wrongfully reporting plaintiff’s interest payments and those of other class members is for its own financial benefit. It is alleged that SPSI knowingly started to purchase the servicing rights to Option Arm Mortgages that had a separately reportable income component to the seller (i.e. the unpaid deferred interest) which would be reportable by the seller as income, with the intent to convert it into an asset note only such that there was no separately reportable income component. 23. Through its purchase SPSI effectively transformed interest to principal without notice to borrowers and in direct violation of IRS regulations, and for its own pecuniary benefit – and/or the benefit of the other party to the servicing contract – and to the direct harm and detriment of the borrowers

The argument is that somehow by undereporting the interest expense on Form 1098, SPSI is reporting less taxable income or helping somebody else do that. I asked Mr. Vendler what the basis for that part of the complaint was. His answer was essentially that banks always have a reason for what they do. So that information and belief is predominately belief. He expects that the information will be uncovered in discovery.

I asked Blake Crow of EideBailly if he found anything plausible about that theory. Mr. Crow is a CPA who does audit and tax work for banks. He told me that in doing the tax provision and return they always start with book income and that banks generally don’t want their book income lowered. He has never seen a bank’s interest income reconclied with the Forms 1098 it sends out. The left hand really doesn’t know what the right hand is doing. He went on at some length about the compliance difficulties of small banks.

So we can look forward to discovery in this area. My money is on my fellow CPA, but there is a cynical part of me that would not be shocked if Mr. Vendler turns out to be right.

The Bottom Line

This litigation is going to be fun to watch, but the important thing is for tax preparers and people who do their own returns is to see if they have missed something. Turn a skeptical eye on Form 1098 particularly on negative amortization loans. The issue also comes up on short sales and with loan modifications.

SPSI is right that your first move should be to try to get the money from the IRS, which will probably work for a lot of people. If you want to get somebody to reimburse you for your costs, drop a line to Mr. Vendler.

Other Coverage

Procedurally Taxing had significant coverage of this issue in 2016. The impression I have from looking at that coverage and my discussion with Mr. Vendler is that lawyers are focused on the procedural issues of 6050H and don’t have the same perspective as return preparers, who I hope I am reaching with this piece.

Bloomberg also spoke with Mr. Vendler late in 2016.

Hi yourtaxmatterspartner.com Owner! my name’s Eric and I just ran across your website at yourtaxmatterspartner.com…

I found it after a quick search, so your SEO’s working out…

Content looks pretty good…

One thing’s missing though…

A QUICK, EASY way to connect with you NOW.

Because studies show that a web lead like me will only hang out a few seconds – 7 out of 10 disappear almost instantly, Surf Surf Surf… then gone forever.

I have the solution:

Web Visitors Into Leads is a software widget that’s works on your site, ready to capture any visitor’s Name, Email address and Phone Number. You’ll know immediately they’re interested and you can call them directly to TALK with them – literally while they’re still on the web looking at your site.

CLICK HERE https://rushleadgeneration.com to try out a Live Demo with Web Visitors Into Leads now to see exactly how it works and even give it a try… it could be huge for your business.

Plus, now that you’ve got that phone number, with our new SMS Text With Lead feature, you can automatically start a text (SMS) conversation pronto… which is so powerful, because connecting with someone within the first 5 minutes is 100 times more effective than waiting 30 minutes or more later.

The new text messaging feature lets you follow up regularly with new offers, content links, even just follow up notes to build a relationship.

Everything I’ve just described is extremely simple to implement, cost-effective, and profitable.

CLICK HERE https://rushleadgeneration.com to discover what Web Visitors Into Leads can do for your business, potentially converting up to 100X more eyeballs into leads today!

Eric

PS: Web Visitors Into Leads offers a FREE 14 days trial – and it even includes International Long Distance Calling.

You have customers waiting to talk with you right now… don’t keep them waiting.

CLICK HERE https://rushleadgeneration.com to try Web Visitors Into Leads now.

If you’d like to unsubscribe click here https://rushleadgeneration.com/unsubscribe.aspx?d=yourtaxmatterspartner.com