Originally published on Forbes.com Apr 15th, 2013

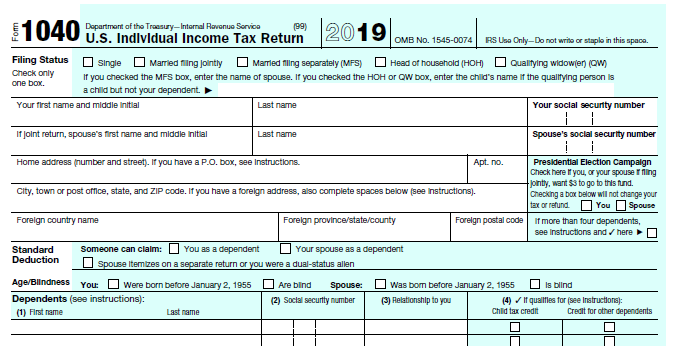

April 15 and here and there throughout the country, spouses, usually women, are being presented with 1040s that have to be signed right away. Any questions that they might have are dismissed in the interest of urgency. It is like the scene on the battleship Missouri If any of the Japanes had questions about the documents, General MacArthur’s instruction was to just show them where to sign

One of the things that make marriages effective partnerships is each spouse doing the things he or she is good at and trusting the other’s judgment. If 1040 signing turns into a fire-drill, there is an indication of a possible flaw in the partnership.

The Dark Side Of Joint Returns

Married filing separately is usually a bad deal. Although two individuals might do better being single than married filing joint, marital status is not elective. There is a pretty pervasive sense that filing a joint return is almost mandatory, but in reality joint filing is an election. An irrevocable election. That means that if you file separately, you can amend to a joint return, but you cannot amend from joint to separate. Even though, a joint return might produce a lower tax, there is a significant downside. Joint and several liability. That means the IRS can collect the whole tax from either spouse.

When To Definitely Not Sign A Joint Return

If you have any doubt about the accuracy of the return, don’t sign it until you have satisfied yourself about possible discrepancies. If you have any reason to think that your spouse has unreported income, do not sign. If you are not confident that the total balance due is being paid, do not sign until you are satisfied as to how it is being covered. There is relief from joint and several liability under the theory of “innocent spouse”, but an attribute of an “innocent spouse” is not being aware that there is a problem with the return.

Just To Be Safe Consider This

If you refuse to sign a joint return, it may be, because of low income, that you do not have a filing requirement. Consider filing a separate return regardless. Sometimes, the IRS will take the position that a spouse consented to having a return signed “for her” and will hold her jointly and severally liable for a joint return she did not sign. Of course, if things are this ugly, you should be talking to your lawyer, but I have found many divorce lawyers are not sensitive to the nuances of joint and several liability, along with several other tax aspects of divorce.

Abuse

Abuse is another factor that can help with innocent spouse status. If you are coerced into signing a joint return, there may be relief, but you will have to be able to prove it.

Tax Preparers

Many tax preparers only deal with either the husband or the wife when preparing a joint return. Particularly when dealing with a return where you know the balance due will not be paid, you should be sensitive to the fact that the interest of the couple may not be aligned. The option of filing separately should be communicated to both of them.

You can follow me on twitter @peterreillycpa.