Originally published on Forbes.com.

Pay attention. This is one of my posts with an important lesson rather than an entertaining story. The lesson comes from a Tax Court decision – TCM 2018-140. You will find out the taxpayer’s name if you read the case, but my practice in cases like this is to use a different name since he might not want to be made more famous by this decision. We’ll call him Joe. In 2010, Joe had two debts discharged. One was for $64,045 and the other for $300,134.

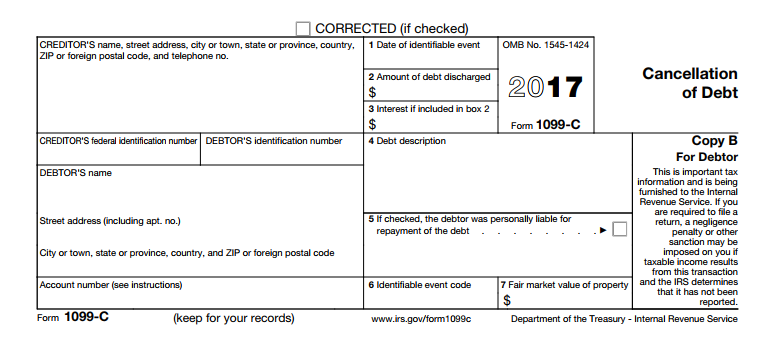

Each of the servicers sent him Form 1099-C. And of course, they each sent a copy to the IRS. Joe did not have a really strong year income-wise in 2010, so he thought he did not need to file a return, which is why he ended up in Tax Court facing over $150,000 in tax and penalty. It did not go well. The lesson is to not be Joe. Don’t just ignore Form 1099-C. I could leave it at that, but that would be too short a post. So let’s look at the decision a bit and then consider what Joe should have done and the happy result that likely would have produced.

The Decision

It was pretty ugly. Here are some high points.

Although petitioner received those Forms 1099-C, he chose to ignore them when the time came to file his Federal income tax return (return) for 2010. Instead, petitioner determined that because he did not earn wages that year he did not have an obligation to file a return for 2010, and he acted accordingly.

Right there Judge Nega is letting you know things are not going to go well for Joe. He “chose to ignore them when the time came to file”. That is pretty harsh.

Joe had trouble figuring out exactly which debts related to the discharges, but he thought that one involved his principal residence, but he did not offer any proof that it was his principal residence. Judge Nega seems to imply that he cut Joe some procedural slack, that was not taken advantage of.

At the close of trial, recognizing petitioner’s initial confusion and in order to provide petitioner an opportunity to establish his principal residence claim, we signaled that we might be amenable to a joint motion to reopen the record or the filing of further stipulations or concessions. On March 30, 2018, we issued a corresponding order directing petitioner to provide respondent with any documents relevant to his principal residence claim by May 14, 2018, and directing respondent to file any related motions or a status report by June 14, 2018. On June 14, 2018, respondent filed a status report indicating that petitioner failed to correspond with, or provide any documentation to, respondent despite his repeated attempts to engage petitioner. Accordingly, we decide this case on the basis of the record as submitted.

Here is one of the key items.

While petitioner testified as to his economic misfortune and entered into evidence a handwritten document listing purported assets and liabilities, the record lacks any further substantive evidence, documentary or otherwise, to corroborate his insolvency claim. On the record before us, we find that petitioner has failed to carry his burden of proving that he was insolvent at the time the debts at issue were discharged, and we accordingly hold that he is ineligible for the insolvency exception.

Note. In Tax Court, Joe has the burden of proving he is insolvent. He has that burden in actual fact. Had Joe filed a Form 1040 claiming insolvency, he would have had that burden in principle. But he would only have had that burden in actual fact if his return was audited. It was very easy for a computer to note that the 1099-Cs with Joe’s social security number were not reported. From there it is all on autopilot. Had Joe filed and claimed insolvency, human intervention would have been required in order to challenge his assertion. More on that later.

Failure to file and failure to pay penalties were also upheld.

But What If?

If those loan servicers know their business, it seems pretty unlikely that Joe was solvent to the extent of over $360,000 after the discharge. I don’t know. Maybe he is a really good negotiator. For the sake of argument let’s assume there is a good argument for insolvency. Joe could have filed his Form 1040 and attached Form 982. Take a look. Check box 1(b) Discharge of indebtedness to the extent insolvent or maybe 1(e) for residence interest. Then in Box 2 go for the gold and write in $364,179. That should appease the computers anyway. And even if it gets looked at, at least there is no failure to file. I’m not going to get into Part II. It only matters if you have tax attributes that you need to reduce.

If you want to be thorough you should got to Publication 4681 and fill out the worksheet on Page 6. Note at the top right-hand corner that it says “Keep for your records”. That means you don’t have to send it in with your return. So you could wait till they ask for it to fill it out. And if they never ask for it, well you saved some time.

Had Joe taken those simple steps, I would put the odds at well over 90% that his return would have sailed through the system.

The Moral

Don’t ignore 1099-C (or 1099 anything actually). Don’t be Joe.

Other Coverage

I did not note that Lew Taishoff had covered this case, which is pretty unusual. Mr. Taishoff covers the Tax Court with intense thoroughness. He alerted me though that he actually had without mentioning it by name.

The three T. C. Memos cases today, 8/29/18, are a trio of no-substantiations. Judge Judy and others of her ilk have much to answer for; people think they can go to court with no paper, no witnesses, and a sob story. Well, they can, but if they have burden of proof they’re sunk.

That reinforces my point about avoiding going to court, if you don’t have any evidence. Reilly’s Laws of Tax Planning Prime Directive – If you don’t have documentation, at least have a plausible story – does not work as well in Tax Court as it might at the agent level.