The New York Times has come on some interesting fragments of Donald Trump’s tax records. Janet Novack has already posted on the article, if you want a summary. I’ve got some nits to pick with how the New York Times analyzed the situation, but I will start off with wondering what Trump’s former accountant was thinking.

An Over-talkative Preparer

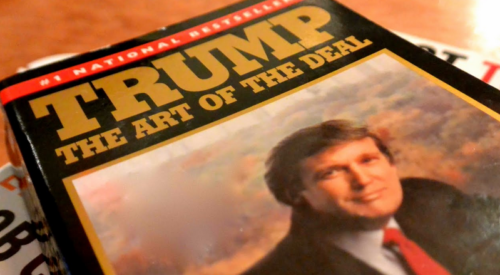

I’ve really got to give the New York Times credit for hunting down Jack Mitnick, Trump’s accountant, who is mentioned in Art of The Deal, with his name misspelled.

Jack Mitnik, my accountant, calls to discuss the tax implications of a deal we are doing. I ask him how bad he thinks the new federal tax law is going for real estate, since it eliminates a lot of current real estate write-offs.

I tried to find Mitnick , but dammit Jim, I’m a tax blogger not an investigative reporter. The Times managed to hunt Mitnick down and even got him to talk. They noted that he is 80 years old semi-retired, a lawyer and CPA and living in Florida. My inner investigative reporter could not help but note that Mitnick does not seem to have a Florida CPA license, unlike me. Florida expects its CPAs to take a substantial portion of their continuing professional education in accounting rather than tax topics, which is beyond tedious, so I’ll probably let mine go before I am 80.

Jack Mitnick’s New York license – 019266 – is inactive, making Mitnick, in my mind a former CPA and his garrulous response to the New York Times confirms that.

Mr. Mitnick, 80, now semiretired and living in Florida, said that while he no longer had access to Mr. Trump’s original returns, the documents appeared to be authentic copies of portions of Mr. Trump’s 1995 tax returns. Mr. Mitnick said the signature on the tax preparer line of the New Jersey tax form was his, and he readily explained an obvious anomaly in the way especially large numbers appeared on the New York tax document.

In the extremely unlikely event the New York Times ever gets its hands on a return of interest that appears to have my signature, here is what they get – How can somebody so stupid be working for the New York Times? Either I didn’t prepare that return, which means I have nothing to say or I did prepare that return in which case I have even less to say. – Of course, we can’t rule out that Mitnick had Trump’s permission to say what he said to the Times. Regardless, I kind of envy Mitnick. I think he has likely achieved one of my life goals – Qualifying to have my obituary in the New York Times.

A Muddled Explanation

The meat of the New York Times story is that the state tax returns from 1995 that the Times received show that Trump’s federal adjusted gross income for 1995 was big-time negative ( -$915,729,293). The tax analysis that the Times does from there is a little confused.

But the most important revelation from the 1995 tax documents is just how much Mr. Trump may have benefited from a tax provision that is particularly prized by America’s dynastic families, which, like the Trumps, hold their wealth inside byzantine networks of partnerships, limited liability companies and S corporations.

The provision, known as net operating loss, or N.O.L., allows a dizzying array of deductions, business expenses, real estate depreciation, losses from the sale of business assets and even operating losses to flow from the balance sheets of those partnerships, limited liability companies and S corporations onto the personal tax returns of men like Mr. Trump. In turn, those losses can be used to cancel out an equivalent amount of taxable income from, say, book royalties or branding deals.

Better still, if the losses are big enough, they can cancel out taxable income earned in other years.

They are confounding flow through of losses from partnerships and S corporations with the Net Operating Loss. A Net Operating Loss could be created by flow through losses or it could be created by direct losses on a return. What makes an NOL is that on net, there are more losses than income allowing the excess to be carried forward or back. There is something else though. The unevenness in income is not something to be envied. When individuals have net operating losses, they tend to lose much of the benefit of their itemized deductions.

Leverage Works Both Ways

Nobody thinks that Trump started with $916 million which he expended on deductible items to create a loss. He did it with other people’s money – debt. The thing about debt is that you might have to earn money to pay it back in which case you have taxable income without cash flow. Those of us who lived through that era remember well the pain of clients dealing with the burned-out tax shelters that had gone through the dreaded cross over. There were three ways out of a burned-out tax shelter. One was this complex maneuver with grantor trusts that did not actually work. The other two which did work were to give it to your wife and divorce her or die.

Of course, Trump likely did not actually earn all the money to pay back his debts. He may have gotten out of them. If he did there is another problem. Cancellation of debt income. To grossly oversimplify, if on January 1, 1996 Trump got out from $916 million in debt either by selling property or having the underlying entities go through some sort of bankruptcy workout, he would have either gain in excess of cash in the amount of $916 million or $916 million in cancellation of debt income.

Again to stay on the surface there are circumstances under which cancellation of debt income is excluded from taxable income. There is a price though. You have to reduce your favorable tax attributes, with Net Operating Losses first on the list, although there is an election to apply the reduction to depreciable basis, which allows the NOL to be preserved and the can further kicked down the road.

Regardless, the implication on the Times article that Trump would be able to sit back and have no federal tax for the next 15 years is way off and there is something else worth mentioning. He may have had to pay federal income tax even in 1995.

The Dreaded AMT

How could Trump with $916 million in negative adjusted gross income have a federal tax liability in 1995? The Alternative Minimum Tax is a parallel tax system that is the bane of the existence of people like Trump. It creates a much broader base on which tax is applied at a somewhat lower rate – maximum of 28%. The AMT allows for a net operating loss deduction (there will be separate AMTNOL that is likely lower than the regular NOL), but it is limited to 90% of alternative minimum taxable income.

Now if you look at the page from Trump’s New York return in the Times article, you will see that he had negative federal AGI of over $6 million even without the “Other Income” of $-909,459,915 which made Mitnick’s software burp. You will also note that New York adds over $43 million and subtracts over $41 million. Those are likely mostly depreciation adjustments, which New York is much less generous with than the federal government. AMT adjustments are not identical to New York adjustments. Still there are enough big numbers floating around there to create the possibility that Trump’s AMTI for the year was positive. If it was, there is another wrinkle. The AMTNOL is allowed only to the extent of 90% of AMTI. So it is possible that the feds got something from “The Donald” even in 1995.

In order to beat the AMT every year after that, Trump would have had to keep running harder and harder to stay in the same place. He might have been able to do it, but I would rate the chance of him having paid nothing in federal income tax in the last two decades as pretty low.

He Did Pay Some Income Tax In 1995

It is worth noting that New Jersey managed to hit him for almost $100,000 in 1995. Under New Jersey rules his total income was $19,558,089 of which $1,468,267 was attributable to New Jersey. Essentially New Jersey only wants to be your partner when you are making money. Other states that would likely have dinged the Donald if he had had operations there are Pennsylvania and Massachusetts. And then there is New Hampshire. Don’t get me started.

Other Coverage

This story is way too hot for me to do my normal “other coverage” summary which usually consists of Lew Taishoff, Joe Kristan and one or two others. I have to make note of this piece by Katy Abbot – Jack Mitnick, Donald Trump;s Tax Accountant: 5 Fast Facts You Need To Know.

Mitnick, a 1956 graduate of New York City College and a 1960 New York University Law School grad who has held his New York law license for 55 years, suddenly found himself a hero to Twitter users when the New York Times story appeared online.

He is not a hero to this twitter user. I can’t say that in over 30 years I have never inadvertently disclosed something I should not have, but Mitnick’s action in breaching client confidentiality is beyond the pale. I can’t say for certain what specific rules he broke, if any, but I think he violated the code that most CPAs live by. What was he thinking?

Trackbacks/Pingbacks