Originally published on Forbes.com.

Sometimes it seems the IRS is kicking people when they are down.That is how I saw the case of Karl Bobo who was in Tax Court over a deficiency of $7,175 for the year 2012.

Cash For Keys

The case is about the proper tax treatment of “cash for keys” programs. Elizabeth Weintraub explains how the programs work in Cash for Keys for Homeowners in Foreclosure.

Cash for keys is a way for homeowners in foreclosure — or tenants living in foreclosed homes — to receive cash in exchange for surrendering the keys and vacating the property. A bank generally reaches an agreement with the occupants of a foreclosed home, which requires the home to be cleaned and left in good condition. The agreement typically sets forth a specific date that the home will be vacated, including a promise from the occupants that they will not: Vandalize the home – Strip the home of light fixtures, appliance or copper – Leave pets behind

That last one about the pets kind of shocked me, but someone I know who cares a lot about animals told me that it happens a lot. Enough so that Elizabeth Weintraub also wrote Why Foreclosed Home Owners Abandon Pets, but I have a tax blog to run here, so I’ll have to move on.

Second HomeThe taxpayers had purchased a second home in North Carolina for $850,000. They made a 10% down payment and took out a non-recourse mortgage for the balance from Green Tree Services LLC. In May 2012, they started having difficulties and inquired about the possibility of loan modification. They were told that they were not eligible for loan modification, but that they could qualify for a “deed in lieu of foreclosure”. Given that the mortgage was non-recourse, it would seem that goes without saying but said it was nonetheless.

“Cash for keys” was part of the deal.

Under the terms of this agreement petitioners signed the deed over to Green Tree and in exchange the mortgage company forgave the balance of petitioners’ note on the property. Petitioners also agreed to vacate the property by a certain time and meet other specified requirements, including leaving the property in “broom-swept condition”, and in exchange petitioners would receive a cash for keys payment.

The taxpayers received $20,500 under the program.

An Errant 1099?

The way Green Tree reported things to the IRS created the difficulties.

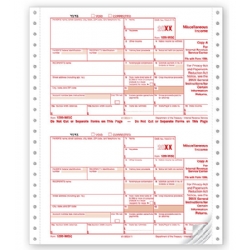

Green Tree issued a Form 1099-MISC, Miscellaneous Income, for the cash for keys payment in petitioner husband’s name and categorized the $20,500 in box 7 as “nonemployee compensation”. 4Green Tree also issued a Form 1099-A, Acquisition or Abandonment of Secured Property, to petitioner husband. The Form 1099-A reported an acquisition date of May 29, 2012, a loan principal balance outstanding of $716,426, and fair market value of the property of $607,500.

Their return was prepared by a CPA who figured that they had in effect sold their house for $736,926 ($716,426 plus $20,500) resulting in a loss of $113,074. (There is no discussion about whether the loss was deductible. I would think not.)

The problem was that 1099-MISC. The IRS took the position that the “Cash for keys” was a separate deal that should be taxed as ordinary income.

A Taxpayer Win

Karl and Kimberly Bobo went to Tax Court pro se (without an attorney). Given the relatively low stakes that was probably the only practical approach. And they won. The Tax Court saw it their way.

On the basis of this record we are satisfied that the deed in lieu of foreclosure and the cash for keys incentive are the results of a single transaction. Similar to the partnership in 2925 Briarpark, Ltd., which had multiple agreements relating to the exchange of the property, petitioners had two agreements with Green Tree stemming from the exchange of property: the deed in lieu of foreclosure agreement and the cash for keys agreement. Looking at the substance of the transaction the two agreements are inseparable; Green Tree would not have issued the cash for keys payment but for petitioners’ agreeing to sign over the deed to the property. Thus the cash for keys payment should be treated as part of the deed in lieu of foreclosure transaction and included in the amount realized on the North Carolina house.

Could This Have Been Avoided

One tax preparation point is worth mentioning here. I would have done the computations much as the CPA did and I would have also reported the $7,500 as income and then backed it out, which might have avoided a document mismatch. Frankly, I’m not sure that would have worked. And it is possible that that is what the Bobo’s CPA did and it got picked up anyway, but given the low stakes and the weakness of the IRS position, this really feels like everything was on autopilot from the point at which Greentree decided they needed to issue a separate 1099 for the “cash for keys”.

Other Coverage

Lew Taishoff, who covers the Tax Court with great thoroughness, had something on this decision – Jingle Mail. I might call Lew out on a fine point.

IRS claims what K&K got was ordinary income. And the servicing agent did give K&K a 1099-MISC non-employee compensation for the $20K, in addition to the 1099-A abandonment. But of course neither K or K worked for the servicing agent, so the 1099-MISC is strictly for the jingle money.

K&K’s trusty CPA filed their return showing the whole thing as COD.

COD stands for “cancellation of debt” and I don’t believe that was an issue in this case. The mortgage was non-recourse making the whole outstanding amount sales proceeds, but that is getting a little geeky.

Joe Kristan was kind of passionate on this one with “The keys will be extra” suggesting that this decision highlights the need for a “sauce for the gander” rule to punish the IRS for taking frivolous positions. He sees the lender having issued a 1099-MISC as a mistake, but perhaps it was just an abundance of caution on their part. As January approaches I once again reflect on how much the IRS could collect if it ever started issued penalties for all the 1099s that are technically required and not issued.