Originally Published on forbes.com on September 13th, 2011

______________________________________

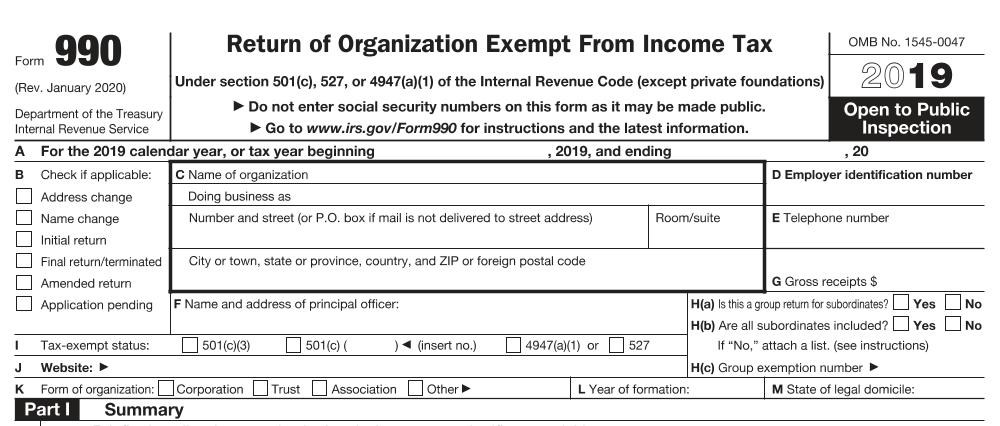

I both love and hate Form 990. I hate it because it is a real pain to prepare and review. I have to deal with it both for clients and also in my capacity as a volunteer. One of the downsides of being a CPA is that when you want to help a not for profit, they usually rope you into being the treasurer or chairing the finance committee. I love 990′s for the information they provide about not-for-profits. Most not for profits, except churches, are required to file them and they arepublic records. An easy way to access them is guidestar.org. Whenever I write about a case that in any way involves a not-for-profit, I will look at its 990 and I find it often adds an interesting dimension as in this piece on a facade easement donated to The L’Enfant Trust. Useful as 990′s are, I would not have thought there was a role for them in the War on Terror. Silly me. The First Circuit’s decision in U.S. v. Mubayyid has set me straight.

The case was an appeal of criminal convictions of Emadeddin Muntasser, Muhamed Mubayyid, and Samir Al-Mon. The government was also appealing the District Court’s overturning of the jury verdict on some of the counts. The case is largely about Form 990 with a particular emphasis on Question 76. Question 76 asked if the organization has engaged in any activities not previously reported to the IRS. Like supporting jihad for example. That is not generally thought to be a valid exempt purpose.

The defendants’ twenty-four day jury trial focused on the circumstances motivating Muntasser’s formation of Care in 1993; the defendants’ failure to disclose some of Care’s activities, such as the publication of certain newsletters from 1993 to 1997; and Care’s support for, and promotion of, Islamic jihad and fighters known as “mujahideen.” The government’s central theory at trial was that Muntasser had established Care in order to fraudulently obtain a tax exemption, so that contributions being used to finance mujahideen overseas could be deducted from individual tax returns as charitable donations.

Care was the successor to the Boston branch of an organization called Al-Kifah –

Among its activities, Al-Kifah’s Boston branch published a pro-jihad newsletter entitled “Al-Hussam,” which translates from Arabic as “The Sword”; it sold books and audiotapes extolling the cause of jihad; and it promoted sermons and lectures by like-minded Muslim leaders. It also solicited substantial charitable donations through the publication of an annual Zakat Calculation Guide. 4 Although the organization advertised itself as a tax-exempt charity, it had never been granted charitable status by the IRS.

There was some bad publicity, so Al-Kifah folded its Boston branch and essentially replaced it with Care International:

Following its incorporation, Care effectively replaced Al-Kifah’s Boston branch. It took over Al-Kifah’s mailbox address and deposited financial contributions into Al-Kifah’s bank account (though these contributions were eventually transferred to an account in Care’s name). Care’s activities also substantially mirrored those of Al-Kifah’s Boston branch, including the sponsoring of pro-jihad speakers, the sale of books and tapes advocating jihad, and the continued publication of the “Al-Hussam” newsletter.

It presented a somewhat different face to the Commonwealth of Massachusetts:

According to its articles of incorporation, Care was “organized exclusively for charitable, religious, educational, and scientific purposes including … human welfare, charitable and relief activities.”

The application to the IRS for exempt status (Form 1023) was also somewhat less than thorough:

Although the form asked for “a detailed narrative description of all of the activities of the organization — past, present, and planned,” Muntasser did not disclose Care’s hosting of religious speakers, its sale of materials advocating jihad, or its publication of the “Al-Hussam” newsletters (by that point, Care had already published at least two “Al-Hussam” newsletters in its own name). Nor did he disclose that Care’s orphan sponsorship program would target the orphans of martyred mujahideen. In response to a question asking for the details of the organization’s fundraising program, Muntasser stated that “mailings” “will commence within the next couple of months.” He did not specifically describe the “Al-Hussam” newsletters or the Zakat Calculation Guide as fundraising devices, nor did he attach them in response to the form’s request for “representative copies of solicitations for financial support.” Lastly, Muntasser denied that Care was an outgrowth of or successor to any other organization, despite Care’s obvious ties to Al-Kifah’s Boston branch.

Although the form asked for “a detailed narrative description of all of the activities of the organization — past, present, and planned,” Muntasser did not disclose Care’s hosting of religious speakers, its sale of materials advocating jihad, or its publication of the “Al-Hussam” newsletters (by that point, Care had already published at least two “Al-Hussam” newsletters in its own name). Nor did he disclose that Care’s orphan sponsorship program would target the orphans of martyred mujahideen. In response to a question asking for the details of the organization’s fundraising program, Muntasser stated that “mailings” “will commence within the next couple of months.” He did not specifically describe the “Al-Hussam” newsletters or the Zakat Calculation Guide as fundraising devices, nor did he attach them in response to the form’s request for “representative copies of solicitations for financial support.” Lastly, Muntasser denied that Care was an outgrowth of or successor to any other organization, despite Care’s obvious ties to Al-Kifah’s Boston branch.

The omissions apparently smoothed the application process:

At trial, the IRS employee who approved Care’s application testified that he would have requested copies of the “Al-Hussam” newsletter and the Zakat Calculation Guide if their existence had been disclosed in the application. He further testified that, if he had seen the Zakat guide, he would have requested further documentation of Care’s day-to-day activities. Similarly, if Muntasser had disclosed the relationship between Al-Kifah and Care, he would have requested information about Al-Kifah, including whether it was a tax-exempt organization in the United States.

The 990′s filed in subsequent years continued this pattern:

None of the Form 990s filed by the three defendants revealed that Care was publishing or had published the “Al-Hussam” newsletters, that Care was operating a website through which it solicited donations and provided access to articles from the “Al-Hussam” newsletters, that Care was regularly hosting pro-jihad speakers, or that Care was selling books and tapes on the subject of jihad. Although Muntasser had failed to disclose these same activities in Care’s initial application, Form 1023, each of the defendants answered “No” when the Form 990s asked whether the organization engaged in any activities that had not previously been reported to the IRS. Instead, each Form 990 filed by the defendants depicted Care as engaging in just four program services: food distribution, cash assistance to orphans and widows, medical assistance to refugees, and grants to other welfare organizations.

The government’s theory at trial was that the defendants, through a series of fraudulent Form 990 filings, intentionally concealed from the IRS the fact that Care’s activities substantially advanced two non-charitable purposes: financial support of the mujahideen and promotion of jihad. During their tenure with Care, each defendant filed at least one Form 990. Muntasser signed and filed Care’s Form 990s for the 1993, 1994, and 1995 tax years. He did so with considerable assistance from Waseem Yassin, an unindictedco-conspirator and an officer of both Care and Al-Kifah. For example, Yassin contacted an attorney to assist in the preparation of the forms, he provided the attorney with Muntasser’s materially false Form 1023 application for tax exemption, and he gave an incomplete description of Care’s activities to the attorney when that information was requested.

The Form 990s filed by the defendants were nearly identical, regardless of the preparer. Substantially mirroring the Form 1023 submitted by Muntasser in 1993, each return listed only the same four program accomplishments: food distribution, cash assistance to orphans and widows, medical assistance for refugees, and grants to other welfare organizations. As we explain below, however, the evidence showed that Care’s day-to-day activities and objectives were markedly different than those reported to the IRS. The consistency of the misrepresentations over a span of nearly ten years and the failure of the defendants to disclose precisely those activities that were most likely to jeopardize Care’s tax-exempt status provide strong circumstantial evidence that the defendants were operating under an implicit agreement.

Through its solicitations, Care collected nearly two million dollars in untaxed donations. Many of the donation checks received by Care during this time expressly indicated that the funds were to be used for “mujahideen,” “fighters,” “martyrs,” and “Jihad.” Some checks specified particular countries, or even particular groups of fighters, for which the funds should be used. For example, three checks presented to the jury bore the memo lines: “Bosnia mujahideen,” “Jihad Bosnia,” and “mujahideen Bosnia, 9th Battalion.”

Mr. Mubayyid offered a defense that anyone who has ever struggled with preparing Form 990 might have some sympathy with:

Mubayyid appeals from his convictions for filing false tax returns and for endeavoring to obstruct the administration of the Internal Revenue laws, contending that the question that the jury found he answered falsely was fundamentally ambiguous.

The Court wasn’t buying it.

As noted, Question 76 asks simply whether “the organization engage in any activity not previously reported to the IRS.” In elaborating on the reporting obligation, the guiding instructions demand an explanation of “any significant changes in the kind of activities the organization conducts to further its exempt purpose.” Taking his lead from the instructions, Mubayyid argues that the question asks only about “changes,” and that he was thus not required to report activities that were ongoing and unchanged, even if they had never previously been included in Care’s filings. He asserts that Care had engaged in no new activities in the relevant tax years, and that his answer to Question 76 could therefore not be found to be false. We consider this view of Question 76 to be unreasonable.

I’m not at all disappointed that these guys were nailed, but the case is still a little troubling. How many people who sign 990′s carefully read and understand all the questions? The forms have gotten even more elaborate then they were in the nineties. Preparers sometimes don’t understand the organization too well and the people who understand the organizations don’t understand the forms. If you go toguidestar.org and look at some random 990′s you will find some pretty vague descriptions. It is not unusual for the narratives to carry over from one year to another without much thought going into them. I don’t think we need to be concerned that a soccer league that morphed into a more general athletic organization that included T-ball and flag football would get in a lot of trouble becasue nobody told the accountant who prepared the 990 about the change. Still, if you are involved in a not for profit, make sure people are careful about the 990.

Note:

The decision is fairly lengthy with extensive discussion of issues about evidence and the nature of conspiracy, which some people might find interesting. U.S. v. MUBAYYID, Cite as 108 AFTR 2d 2011-XXXX, 09/01/2011