Originally published on Forbes.com.

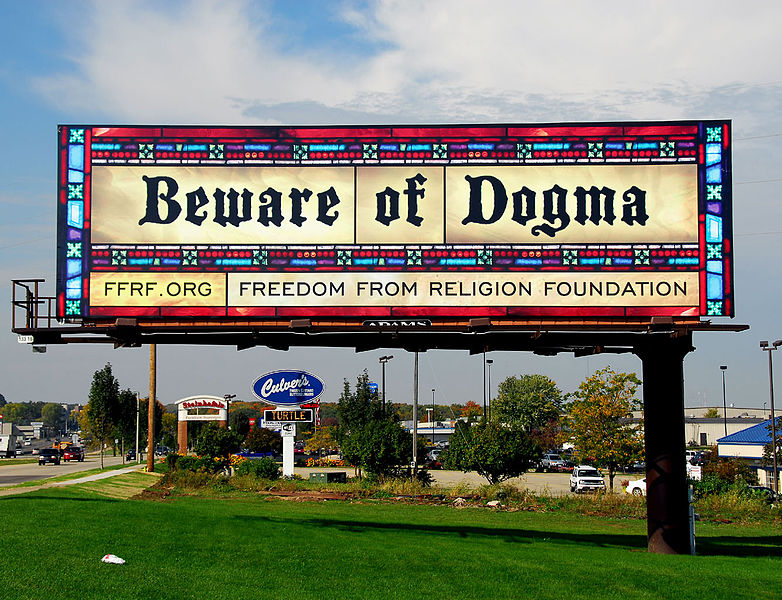

Greedy televangelists have something more to worry about than another John Oliver send-up. The Freedom From Religion Foundation is once again on the hunt for the parsonage exclusion, which Oliver highlighted at around 9:50 in his Our Lady of Perpetual Exemption skit last year

About Parsonage

The parsonage exclusion (Code Section 107(2)) allows a “minister of the gospel” to exclude from income:

…the rental allowance paid to him as part of his compensation, to the extent used by him to rent or provide a home and to the extent such allowance does not exceed the fair rental value of the home, including furnishings and appurtenances such as a garage, plus the cost of utilities

Parsonage is a modest tax benefit to modestly compensated clergy. From what I can gather many would be happy to trade it for a FICA match rather than having to pay self-employment tax. That’s most clergy though.

Unlike a similar housing benefits for members of the military and people working abroad, there is no dollar limitation in Code Section 107. Televangelists and the mega-pastors of the mega-churches can and do take income-tax-free housing allowances in the hundreds of thousands.

The Clergy Likes Their Tax Break

You will hear some clergy complaining about housing allowance abuse, most notably, my blogging buddy and go-to guy on all matters evangelical, Reverend William Thornton. Reverend Frank Benson Jones, author of Stop The Prosperity Preachers, thinks the break attracts the wrong type of person into ministry, believing that when the profits are eliminated the prophets will remain.

For the most part though, defense of the clergy housing break is a great source of ecumenical spirit. In the last round of litigation there was an amicus brief in defense of the constitutionality of Section 107 that included among others The International Mission Board of the Southern Baptist Convention, The Greek Orthodox Metropolis of Chicago, The Islamic Center of Boca Raton, and The International Society of Krishna Consciousness.

The Last Round

In the forefront of the fight against Code Section 107 is the Freedom From Religion Foundation. The constitutionality of the exclusion is extremely dubious, but, up till now, they have had to deal with the problem of standing. Basically, you can’t bring a lawsuit to complain about somebody else’s tax break. FFRF tried to get around this problem by paying some of their officers housing allowances and then suing on the basis, that since they were obviously not ministers of the gospel, they were being treated unfairly by not being able to exclude their housing allowances.

Judge Barbara Crabb saw it FFRF’s way ruling in November 2013 :

It is DECLARED that 26 U.S.C. § 107(2) violates the establishment clause of the First Amendment to the United States Constitution.

With respect to the merits, I conclude that § 107(2) violates the establishment clause under the holding in Texas Monthly, Inc. v. Bullock, 489 U.S. 1 (1989), because the exemption provides a benefit to religious persons and no one else, even though doing so is not necessary to alleviate a special burden on religious exercise.

That is the only time a federal court has ruled on the constitutionality of the cash parsonage exclusion.

Standing Not A Problem This Time?

A year later, the Seventh Circuit overturned Judge Crabb’s decision not on merits, but on standing. The FFRF officers had not jumped through the hoop that Judge Crabb considered unnecessary – applying and being turned down for a refund. That was remedied in the spring, so they are back and earlier this week Paul Streckfus of EO Tax Journal reported on their progress having picked up the story from the Evangelical Council For Financial Accountability

The federal government who has the responsibility for defending this provision of the tax code made its first filing in the case, and in doing so, conceded that based on its understanding of the facts FFRF has the legal standing required to challenge the housing allowance exclusion (while maintaining there is no standing to challenge the exclusion for parsonages).

While this is simply a procedural update—there has been no decision by the court on the merits—it is an important one. FFRF’s previous attack on the housing allowance was ultimately rejected by the appeals court based on standing.

With standing now conceded by the federal government in this case, this removes an important barrier to allowing FFRF to proceed for the time being with its latest challenge to the housing allowance at the federal district court level.

Some Comments

I reached out to my parsonage brain trust for comments on this development. Professor Adam Chodorow of Arizona State University wrote:

The court in the prior case laid out expressly what FFRF needed to do to get past standing. It did it. Thus, the government really had no choice but to concede standing. Now it gets fun.

Professor Edward Zelinsky of Yeshiva University who has expressed the nuanced view that exclusion of cash housing allowances is constitutional despite being bad tax policy wrote on the latest development:

It is understandable that the federal government concedes standing as to Section 107(2) and not Section 107(1). The former addresses cash housing allowances and the latter addresses housing provided in-kind. The plaintiffs have received cash housing allowances. They make no claim to have received taxable housing provided in-kind. Hence, the have standing as to the former and not the latter.

This dispute over standing has little (or nothing) to do with the fundamental constitutional question: Is Section 107(2) a reasonable accommodation to prevent church-state entanglement per the Supreme Court’s Walz decision or is the controlling analogy the Court’s decision in Texas Monthly.

In Walz, the Court upheld against First Amendment challenge New York’s property tax exemption as applied to churches. In Texas Monthly, the Court struck on First Amendment grounds Texas’ sales tax exemption for religious publications.

These are important issues about which reasonable persons can disagree in good faith. That disagreement has little (or nothing) to do with the more technical “case or controversy” issues of standing.

Professor Samuel Brunson of Loyola University wrote:

Last time FFRF was suing, I thought that, but for standing, they’d win on 107(2), but that standing would knock them out.

I’m still skeptical of 107(2) (and 107(1) for that matter, though I think the government’s right that FFRF lacks standing to challenge it) from a policy perspective, but Establishment Clause jurisdiction is so inchoate that I’m no longer sure how the challenge will come out. I would be completely unsurprised if the district court held for FFRF. The Court of Appeals may hold for FFRF, though I’m not sure it will. And all bets are off, I think, at the Supreme Court level.

I mean, I really wish I could put together a coherent Establishment Clause theory and explain why 107(2) is or is not constitutional, but I don’t think the jurisprudence is clear enough to make an educated guess. Whichever way it goes, I’m curious to see how this turns out.

Background

This story has been going on for my whole blogging career. I did a summary of older coverage right after Judge Crabb’s decision in 2013, which you might find handy if you want to know more.