Originally published on Forbes.com.

My heart goes out to Bob McCullough of EcoVest. The Department of Justice ruined Christmas for him and now Senators Wyden and Grassley are lousing up Easter. They are kicking off an investigation of syndication of conservation easements with letters to McCullough and thirteen other lucky promoters of conservation easement deals. The names were picked out of a database compiled by Brookings. Here is an example of one of the letters.

Some Background

Conservation easements (or facade easements if you are in the big city) are probably as close as you can come to a free lunch in tax planning if you have the right motivation. Suppose you have a beautiful pasture and you want it to be a pasture forever. You go to a qualified not-for-profit and give them an easement so that you are renouncing your development rights.

You get an immediate tax deduction and possibly a break on the real estate taxes and you have an assurance that when you are gone, there will be somebody keeping an eye on the property. And you still have the pasture.

How Big A Deduction And For What?

That’s the interesting part. There is not a lot of buying and selling of easements going on, so the value of the easement you are giving to the land trust or conservancy is generally valued indirectly. You value the property at its “highest and best use” (i.e. what will bring you the most money) and subtract the value of the property as restricted.

The highest and best use is going to be something hypothetical. This is where things can get out of hand. The development to bring the property to its highest and best use is not something that actually has to be executed. So there can be a tendency to think big and assume away minor obstacles like zoning. There was one case where the proposed development didn’t even fit on the parcel. I mean – So what? It’s not like you were going to actually build it.

On top of the valuation issue, there are times when the donee organizations are a little sketchy and won’t really be able to enforce the easements. And sometimes the conservation or public benefit of the easement is altogether dubious. Sometimes easements are given on properties that are already so restricted that there is no real value to them. I compare those to me renouncing my superpowers.

Syndication

Syndicated easements bring things to a whole new level. Investors put money into a partnership. The partnership acquires property and presents a development plan for the partners to vote on. Do you want to go forward with the plan which will bring you a ton of money in the future or do you want an immediate tax deduction at a multiple of your investment? On the EcoVest deals, they have always voted to donate. The multiple tends to be around four.

I have always thought that there has to be something wrong with that model. Do they find very silly people to buy property from? Or are they, you know, engaging in a bit of what our President called “truthful hyperbole” on the highest and best use?

I did figure out how it might work in principle after Bob McCullough explained the program in a conference call last month, but I’m still pretty skeptical.

The Questions

If Senators Wyden and Grassley get good answers to their questions in the letters, it should become real clear as to whether conservation easement syndicators are creating legitimate entities that serve conservation ends while allowing the little guy to participate in the tax benefits or are essentially running scams like the Big 4 accounting firms were promoting back in the Son of Boss days.

Each promoter is asked to answer questions about particular deals that their name is associated with in the Brookings database. McCullough is associated with 26 deals from Arcadian Quay Holdings LLC to White Sands Holding Village LLC. Here are some of the key questions paraphrased.

When was the partnership formed? When was the property acquired? How much did it cost? When did the investors come in? When was the donation made? Which 501(c)(3) received the easement? Total amount of deductions? Total amount of equity invested?

Did the appraisals include dates acquired and cost of the property acquired? Did anybody ever vote to develop the property?

There’s more including extensive document requests. I will be looking forward to what the hearings turn up.

Reactions

Andrew Bowman CEO of the Land Trust Alliance had a statement on the inquiry.

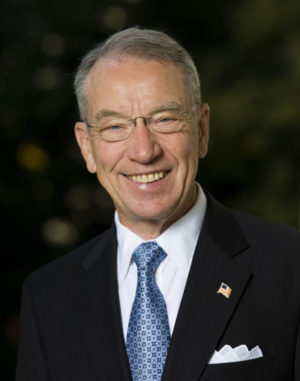

The Land Trust Alliance and our 1,000 member land trusts welcome the U.S. Senate Finance Committee’s thoughtful and timely probe of conservation tax benefit abuse. This investigation led by Senate Finance Committee Chairman Chuck Grassley (R-Iowa) and Ranking Member Ron Wyden (D-Ore.) is the right step toward permanently ending this abuse. It shines a bright light on transactions that disguise a profitable tax shelter as a charitable donation.

Also, we are especially grateful for the committee’s appreciation of the very legitimate purposes conservation easements continue to serve. Only a handful of the more than 2,000 conservation easements completed annually are the work of bad actors abusing the system. But these actors must be stopped.

This is why the Alliance has endorsed the Charitable Conservation Easement Program Integrity Act. It allows honest conservation donations to move ahead, unimpeded. It preserves the good reputation of our nation’s land appraisers and conservationists. It stops bad actors from profiting. It safeguards taxpayers. And it provides Congress a concise and sensible solution that’s ready for passage.

Bob McCullough of EcoVest is taking it gamely. Here is the statement from EcoVest.

EcoVest looks forward to cooperating with Congress to strengthen and improve the private sector’s role in conversation efforts,” said Bob McCullough, the company’s chief financial officer. “We have been actively trying over the past three years to work with lawmakers to stem abusive conservation easements and create best practices. We welcome Congress’s engagement on this important issue.”

I want to thank Stephen Small for alerting me to this development.

Other Coverage

Richard Rubin of WSJ was out in front with the story, as he was with the EcoVest story, ruining Christmas for Bob McCullough.

In some cases, people are offered the opportunity to buy into a partnership and quickly get tax deductions worth more than their initial investments. Promoters describe these transactions as an efficient way to conserve land and shift tax benefits from landowners who don’t have the income to take deductions to people who do. But critics inside and outside the government say they often rely on exaggerated, unrealistic appraisals.

Michael Cohn has something on Accounting Today.

“There are very legitimate purposes for the conservation easement provisions of the tax code,” Grassley said in a statement. “But when a handful of individuals cook up a scheme to cash in at the expense of federal revenue and in violation of Congress’s intent, something needs to change. There’s no reason that the rest of the taxpaying American public should be left with such a raw deal. This is just our first step in getting to the bottom of how these tax provisions are being abused, and it will inform what else ought to be done to fix the problem.”

Trackbacks/Pingbacks