Originally published on Forbes.com.

The indictment of NBA veteran Kermit Washington for activities involving his charity, the 6th Man Foundation (d/b/a Project Contact Africa) might be viewed as something of a cautionary tale for donors, board members, founders and the public. As Congress has crippled the IRS in its ability to monitor the exempt sector without providing any replacement, there will be more and worse abuse than is alleged to have happened here and the bulk of it is sure to go undetected. The statement by US Attorney Tammy Dickinson on the indictment indicates that the alleged abuse was uncovered as part of a larger investigation into software piracy.

Lesson One – Don’t Rent Out Your Not-for-profit Status

Operation Software Slashers was an investigation into a $100 million software piracy scheme. One of the pieces is described this way

Davachi managed and maintained the online presence for the Project Contact Africa charity by a person identified in court documents as Individual F, in exchange for a payment to Individual F of approximately $2,000 per month beginning in early 2012. By using the charity’s account to sell his items through the charity store, Davachi saved thousands of dollars per month in various fees that he would have otherwise had to pay ]eBay. During this time, the Project Contact Africa eBay account took in approximately $12 million in revenue, and PayPal sustained losses of approximately $908,231 due to the waived fees.

I’m going to go out on a limb and say that it is is a pretty good bet that Kermit Washington was “Individual F”. From reading the news release about Davachi’s conviction, it appears that Individual F was not at all hands on in the whole scheme. And if all he got out of it was $2,000 a month, he hardly qualifies as a criminal mastermind. It looks more like he was approached by somebody offering free money for using his charity’s name. Turns out the free money is awful expensive.

Lesson Two – Boards Are Responsible

Some of the most rewarding experiences I have had have been from serving on boards of not for profits, but there was this one experience that was something of a nightmare. Mr. Washington is charged with aggravated identity theft for listing one person as a board member (secretary) without, you know, telling them about it. You have to wonder what the other officer, who is listed as president might be going through, assuming she is someone who was just trying to help Kermit out as opposed to someone in on the scheme. (You can get the name from the 990, but it appears to be pretty common which is why I am not including it here.)

I spoke with Amish Mehta , Not-for-Profit Practice Leader at Friedman LLP. He indicated that state attornies general issue guides to explain the responsibilities of board members. Be sure to read something like Right From The Start: Responsibilities of Directors of Not-For-Profit Corporations issued by New York before accepting your first board position. If whoever is recruiting you indicates that you will not be expected to do much, exercise extreme caution before accepting.

Lesson 3 Check Out The Form 990

According to the indictment, Kermit Washington was indicating to potential donors that his organization had no administrative costs at all. In reality, that would be an indication of a charity with inadequate controls. The zeal to maximize the percentage of donations that go to the mission is laudable, but you do need a greater or lesser degree of management. Regardless, the 2012 Form 990-EZ for the 6th Man Foundation shows about $90,000 in contributions of which nearly $65,000 went to clinic supplies. The balance went to overhead type expenses like rent and telephone. No salaries. So Mr. Washington may have been engageing in what Donald Trump calls “truthful hyperbole”. On the other hand, it may well be that any additional money he raised to the extent it was actually deposited in 6th Man would mean more clinic supplies.

Amish Mehta has more detailed advice about checking out organizations you are thinking of giving to.

I always encourage donors to do their due diligence before giving to any charity. Such due diligence should consist of looking at their Form 990 to get a sense of their financial picture and where they are spending their money as well as their website and speaking with other donors that give to such a charity. Take a look at their board make-up, who serves and if it appears to be a well-rounded board. Also review the charity on Charity Navigator, Guidestar and the Better Business Bureau. As regulators are demanding more transparency by not-for-profits, donors must be vigilant in their own due diligence.

Lesson 4 – Do You Really Need Your Very Own Foundation?

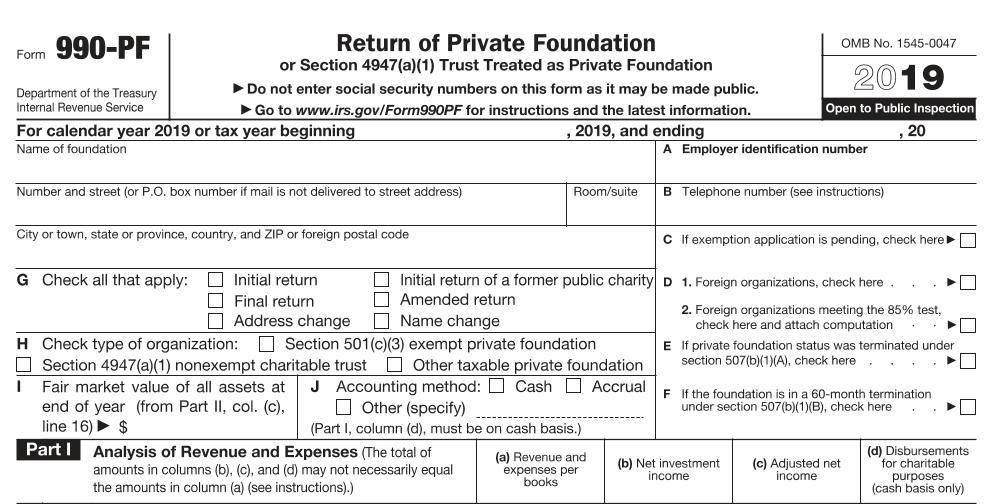

One of the classiest philanthropic moves I have ever noted is Warren Buffett’s decision to make his large charitable contributions to the Bill & Melinda Gates Foundation Trust. According to the Foundations’s Form 990-PF, Buffett gave the foundation over $2 billion worth of Berkshire Hathawaystock in 2014. Buffett could certainly afford to create another foundation, but the canny old business guy sees that his charitable dollars can get a free ride on somebody else’s infrastructure.

This principle is applicable at much more modest levels. A hint of why Washington decided to set up his own foundation comes in this story about how he got started based on his reaction to events in Riwanda in 1994.

I called Doctors Without Borders and the Red Cross. I didn’t have any success speaking to a person, just to an automated teller telling me how to donate money. When I called the Northwest Medical team in Beaverton, Ore., my luck changed. They were operating 10 minutes from where I was living, and got a person on the line that was able to talk to me and give me information. They also knew who I was and were very thankful that I called so I decided to donate to them. I don’t remember how much I donated on my credit card, but I did happen to say to them before I hung up that one day I would like to go and see for myself what the conditions were really like. They said, you can go with us next week, we’re taking a group over.

I too have a little skepticism about large scale charities that have become institutions. Given the number of trips he made to Africa, it seems Washington wanted to be hands on. Still, he probably could have found an established charity that could have served as an umbrella for his efforts. Then he would not have faced the temptation to do the rather dumb things that he is alleged to have done.

Lesson 5 Don’t Depend On The IRS

In certain circles the notion is that recognition as 501(c)(3) charitable organization is something of a seal of approval. It never was and the IRS’s ability to weed out abuse, never that great, has been seriously degraded. Accepting for the sake of argument, the charges against Washington, 6th Man appears to be a good charity gone bad, but still doing some good work. The only reason the bad part was uncovered was because of a much larger investigation into software piracy.

It was the intellectual property theft that seems to have had the Justice Department energized. I can understand why companies like Microsoft need to be protecting their intellectual property, but I find it distressing that the clinic supplies might not be flowing anymore. It would be really great if the Bill and Melinda Gates Foundation adopted Kermit’s clinic.