This was originally published on Passive Activities and Other Oxymorons on June 9, 2011. There is a followup to it on forbes.com, that talks of another minister who got caught up in the corporation sole scam. An appeal on that case has recently been decided by the Fifth Circuit, and forbes.com coverage of that decision will be coming soon.

____________________________________________________________

Thomas F. Chambers, et ux. v. Commissioner, TC Memo 2011-114

U.S. v. MAGGERT, Cite as 107 AFTR 2d 2011-XXXX

“For we are taking pains to do what is right,not only in the eyes of the Lord but also in the eyes of men.”2 Corinthians 8:21 From the Evangelical Center for Financial Accountability Seven Standards of Responsible Stewardship

He said he talked to Jesus all the time. Even when he was driving his car. That killed me. I just see the big phony bastard shifting into first gear and asking Jesus to send him a few more stiffs. From The Catcher in the Rye.

The First Amendment tells us that the government should not establish religion. On the other hand, it also tells us that the government is not supposed to interfere with the free exercise of religion. People with a very secular perspective like the Freedom from Religion Foundation focus on the first aspect. Deeply religious people might focus more on the second. The tension shows up in the relationship that IRS has with churches. It is very hands-off not requiring the level of reporting that other not for profits are subject to. On the other hand, it is put in the awkward position of having to decide what is and is not a church. Although this seems to contradict the establishment clause it is necessary so that the sphere of religion where government is hands-off does not become a gaping hole that tax cheats drive trucks through. The favorable tax treatment of churches, that in my view is mandated by the free exercise clause, is, quite predictably, a magnet for “phony bastards”. Two recent cases illustrate this problem.

U.S. v Maggert is an extreme case:

Maggert, a dentist, worked for several dental offices as an independent contractor. In 1998, Maggert and his wife attended a seminar by American Rights Litigators (“ARL”) and Eddie Kahn at which they were told they did not have to pay federal income tax. Maggert relayed this information to his accountant, who counseled Maggert against ARL’s advice and ended their professional relationship when Maggert persisted. Maggert dissolved his professional association, Mark S. Maggert, D.D.S., P.A., and, from 1998 to 2005, did not file a federal tax return or pay federal income tax.

Eddie Kahn, by the way, was Wesley Snipes “tax adviser”. I might have missed that if I wasn’t following Joe Kristan’s blog. Joe frequently gets to the same cases I do, usually before I do.

Beginning in 2002, Maggert instructed the accountants for the dental offices where he worked to make his paychecks payable to Total Business Systems, LLC, a Florida corporation, or to Mark’s Word of Faith International, a Nevada corporation. The accountants complied and issued Form 1099s, using the corporate identification numbers for these organizations rather than Maggert’s social security number. Maggert deposited the paychecks into accounts he opened in these organization’s names and withdrew money from the accounts on a regular basis (over $40,000 in 2002, over $52,000 in 2003, $178,000 in 2004 and $128,000 in 2005, for a total of $398,600).

The articles of organization for Total Business Systems, LLC identified the managing member as Geneva Holdings, Inc., in Australia and the registered agent as Ronald Saltzer. The articles of organization were signed by Saltzer and Alan R. Horne, the “Director” of Geneva Holdings, Inc. Saltzer admitted that he knew nothing about Total Business Systems, LLC or Geneva Holdings, Inc., and had never met Maggert or Horne. Saltzer had agreed to act as the registered agent and sign the articles of incorporation in exchange for a meal provided by Eddie Kahn.

Panhandlers are facing a generational problem right now. I sometimes want to shake the guys to explain to them that they can’t be Vietnam veterans if they are more than a couple of years younger than I am. Offering to be registered agents could open up a whole new field. Somebody once explained to me that one of the ways to get an individual to take on unlimited liability so you could have a partnership was to trade a bottle of Thunderbird for the signature. I wonder if cheap wine sales went down when they put in the check the box regulations. At any rate on to the religious patina of the plan.

The articles of incorporation for Mark’s Word of Faith International listed Maggert as the “Presiding Patriarch (Overseer).” Maggert’s wife signed the articles of incorporation as a witness and “Scribe.”

It can be the little things that screw up a plan. If Dr. Maggert wanted to be Patriarch, why couldn’t he have made his spouse “Chief Priestess” rather than something that sounds like the medieval version of secretary and reminds you of Pharisees ? Maybe she would have been more enthusiastic.

Maggert’s wife admitted there was no such religious organization and that Maggert was not a spiritual leader or priest

We really don’t want the IRS inquiring as to who is really a spiritual leader or a priest, but it is these type of shenanigans that makes it necessary. Sadly, I think that the IRS agents who are tasked with dealing with this nonsense get a little jaded, which may have been part of the problem in the Chambers case.

The case of Thomas Chambers is much more troubling. It was not being proposed that he be deprived of his liberty but the IRS was asserting a 75% fraud penalty, which is about as bad as it gets short of doing time. It is pretty clear that Reverend Chambers (and I’m not being ironic with the Reverend) was not running a tax scam:

Mr. Chambers is an ordained minister who, during the years in issue, was the sole pastor of Biblical Church Ministries (sometimes also referred to as Biblical Church or Biblical Church and Global Ministries). Before he founded Biblical Church during 2003, Mr. Chambers had been the senior pastor of Pilgrim Bible Church since 1991. He resigned from his position at Pilgrim Bible Church because he wanted to concentrate more on global evangelism and planned to be out of the country for many weeks during the year. However, about a dozen of his former congregants at Pilgrim Bible Church asked him to continue leading them in studying the Bible on Sunday mornings. Mr. Chambers agreed to continue leading them in Sunday worship with the understanding that he would be ministering abroad a number of weeks during the year and that someone else would lead worship when he was absent.

On the other hand, if he had been endeavoring to make himself look like he was running a tax scam, he would have been hard pressed to find more effective means than what he stumbled on. It is fairly clear that in his choice of organizational structure Reverend Chambers made a mistake.

During 2003 Mr. Chambers organized Biblical Church as a “corporation sole” under Utah law. He designated himself as “overseer” of Biblical Church. As overseer, he had full control over the corporation sole, including the authority to amend its articles of corporation sole and appoint his successor. During 2006 petitioners transferred the ownership of their home from themselves as individuals to Mr. Chambers as overseer of Biblical Church, a corporation sole.

A corporation sole is a way to associate ownership of property with the holder of an office. Who owns all those church buildings and schools that make up a Catholic diocese? The bishop does as a corporation sole. This can come as something of a shock to parishioners as a lengthy drama in Worcester Mass several years ago illustrates. On the other hand you don’t have to worry about your parish becoming affiliated with another denomination, which can happen with a congregational polity. I suspect that Reverend Chambers chose corporation sole because it fit a “strong pastor” model of church governance that was consistent with his theology. Then again, you can’t rule out bad advice.

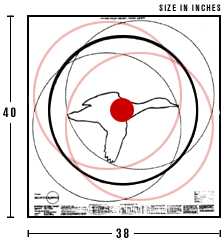

Unfortunately it is also a property ownership device that is part of one of the IRS’s dirty dozen. Unless the office holder is subject to removal by some higher authority (other than the highest authority that we are all ultimately subject to) corporation sole is an excellent scamming structure. Too excellent. I think that when he chose corporation sole Reverend Chambers painted a target on his back.

Here is a portion of Revenue Ruling 2004-27:

The Service is aware that some taxpayers are attempting to reduce their federal tax liability by taking the position that the taxpayer’s income belongs to a “corporation sole” created by the taxpayer for the purpose of avoiding taxes on the taxpayer’s income. The Service also is aware that promoters, including return preparers, are advising or recommending that taxpayers take frivolous positions based on this argument. Some promoters may be marketing a package, kit, or other materials that claim to show taxpayers how they can avoid paying income taxes based on this and other meritless arguments.

By choosing “corporation sole” Reverend Chambers made himself look like a duck.

Mr. Chambers followed through on his plans to participate in many overseas evangelism trips. In addition to his job as a pastor at Biblical Church, he is on the staff of e 3 Partners, 3 an organization that is exempt from tax pursuant to section 501(c)(3). Mr. Chambers’ role with e 3 Partners is “church planter”, and his primary responsibility is to lead short-term mission trips to other countries, where he trains local pastors and other volunteers in evangelism.

e3 Partners Ministry is a substantial organization. According to their most recent 990 they grossed over 18,000,000. They have many hallmarks of legitimacy. Not the least of which is having an accounting firm with a blogging partner. I think the IRS phony church hit squad should have backed off when they saw that Reverend Thomas was affiliated with them. When I looked at the board I saw a substantial business person I happen to know who is honest as the day is long and sharp as tack.

The team members were responsible for raising their own funds for each trip, but e 3 Partners coordinated fundraising by receiving donations on behalf of individual team members and using those donations to pay trip expenses for those team members. Portions of the funds raised by all of the team members were directed to the team leaders, like Mr. Chambers, who were responsible for handling all of the day-to-day expenses the team would encounter on the trip. Before each trip, e 3 Partners deposited funds into a bank account provided by the team leader, who then withdrew the cash needed for the trip. All expenses incurred during the trip had to be documented by receipts, and the team leader was responsible for returning any unused funds to e 3 Partners at the end of the trip. During the years in issue Mr. Chambers received into his personal bank account numerous deposits to cover trip expenses from e 3 Partners, and the parties agree that such funds were properly excluded from petitioners’ income.

So apparently if the Reverend Chambers had followed his first impulse and devoted all his time to foreign missions under the supervision of e3 Partners, he wouldn’t have had any tax problems or at least not ones of the magnitude that he encountered.

During both 2005 and 2006 petitioners maintained a personal checking account at M and T Bank (M and T account). Petitioners also maintained checking accounts for Biblical Church at National Penn Bank (National Penn account) and the Bank of Lancaster County (Lancaster account) (collectively, the Biblical Church bank accounts or the church bank accounts). Petitioners were the only authorized signatories for the Biblical Church bank accounts. The name listed on the church bank accounts was “Biblical Church and Global Ministries”, but petitioners usually deposited checks made payable to “Biblical Church” into the National Penn account and checks made payable to “Global Ministries” into the Lancaster account. Biblical Church had two bank accounts because Mr. Chambers was trying to separate funds for the church itself from funds that were intended to support its overseas mission trips. He had originally planned to save some of the church funds to purchase a building; but because he was very passionate about the mission work, he put most of the money toward missions.

Petitioners opened the Lancaster account before they had obtained an employment identification number (EIN) from the Internal Revenue Service (IRS). They told the bank representative that they had applied for an EIN but had not yet received it. The bank representative nonetheless allowed them to open a bank account, and she typed all of the information required on the new deposit account coversheet but left blank the space for the EIN. She then printed out the new deposit account coversheet, had petitioners sign it, and instructed them to inform the bank as soon as they received the EIN from the IRS. The bank representative’s actions in setting up the account, printing out the new account coversheet, and leaving blank the space for the EIN were consistent with protocol established by the Bank of Lancaster County at that time.

We have a saying that it is better to be lucky than good. A corollary of that might be that it is worse to be unlucky than bad. I suspect Reverend Chambers piece of bad luck with the EIN might have been what really got the IRS swat team that was working him over excited.

At some point, a nine-digit number was handwritten in the space for the tax identification number on the new account coversheet. The nine-digit number written on the new account coversheet and subsequently associated with the Lancaster account is the Social Security number of a minor child unrelated to petitioners, not the EIN assigned to Biblical Church. The minor child who was assigned the Social Security number was not an account holder at the Bank of Lancaster County when petitioners created the Lancaster account.

His next misstep would appear to many of us to be the act of a godly man, who is also humble.

During the years in issue petitioners performed part-time janitorial work for Superior Walls of America, Ltd. (Superior Walls). Petitioners were paid $13 per hour for performing cleaning services about 15 hours each week. Mr. Chambers intended the compensation from Superior Walls as a fundraiser for his mission trips and for Biblical Church. He spoke with the financial controller at Superior Walls and explained his desire to perform janitorial services as a fundraiser for Biblical Church. Pursuant to an agreement with Superior Walls, instead of paying petitioners themselves for the work, Superior Walls paid Biblical Church directly. Mr. Chambers executed a Form W-9, Request for Taxpayer Identification Number and Certification, on behalf of Biblical Church, which he submitted to Superior Walls, claiming to be exempt from Federal tax withholding.

Unfortunately one of the things that scamsters do with phony churches is assign their income to them. This would probably be the first instance of somebody doing it with the $13 per hour he was getting for mopping floors. And lets not forget that Reverend Chambers actually did spread the Gospel in foreign places. On the other hand by assigning his income, modest as it was, to the “corporation sole”, Reverend Chambers was walking like a duck.

Petitioners later learned that the law required them to report the compensation from Superior Walls as taxable income, and they began to report the compensation as income during 2006. Petitioners reported their income from Superior Walls during 2006 on a Schedule C attached to their Form 1040, U.S. Individual Income Tax Return.

That was a bit of unducklike behaviour that the Tax Court noted with approval.

Then there is the matter of the language in the governing document that to the IRS indicated a “tax-hostile” entity

This Corporation Sole is a full-time Ministry and Spiritual Order which *** is mandatorily excepted by an “unrestricted” right, as referenced in United States law Title 26, §§ 6033(a)(2)(A)(i) and (iii), § 1341(a)(1) and § 508(c)(1)(A), from any form of taxation and from filing any returns or reports/documents ***

Although the Tax Court noted that the objectionable language was “largely a recitation of the tax law applicable to all churches”, that is part of the style of tax protester rhetoric which frequently includes quotations from valid authority, ofter wildly out of context. So Reverend Chambers with that governing document was talking like a duck. (Although there is nothing to indicate that Reverend Chambers was constantly seen in the company of ducks, there is a chance that he purchased his paperwork from one). It is interesting to note that in the entire body of tax authority the term “tax-hostile” entity only appears in this case. I wonder if it is a coinage by the agents who have to deal with this stuff. I used to have a third shift job in a hotel where a lot of cops would stop by to take their breaks. They often referred to a crime that was not in the statute books called B and A, which stood for “being an asshole”

During the years in issue, the deposits into the Biblical Church bank accounts primarily consisted of numerous small checks written by individuals. Members and regular attendees of Biblical Church wrote checks that accounted for the largest number of deposits. Many of those individuals contributed a regular tithe or offering. Other checks were written by individuals who made only a few donations during the years in issue. Some checks were written by other churches. In total, about 50 individuals and three churches wrote at least one check to Biblical Church during the years in issue

The Tax Court was able to get Reverend Chambers out of a significant part of the trouble he had gotten into, primarily it appears from naivete. First of all they determined that the Biblical Church was a church.

Biblical Church satisfies many of the criteria. Mr. Chambers is an ordained minister, the church has a distinct legal existence as a corporation sole, the church has been meeting regularly on Sundays since 2003, its worship services include a core group of 15 to 25 attendees who exclusively attend Biblical Church, its worship services are consistently held at the same place, and Mr. Chambers teaches recognized Christian doctrine. On the basis of the foregoing, we conclude that Biblical Church is a church.

That did not solve the problems entirely. Reverend Thomas had unfettered control of the various accounts. Some of the expenditures went for personal purposes

The IRS reconstructed petitioners’ income for the years in issue by examining the deposits to the M and T account, the Lancaster account, and the National Penn account. The IRS did not include deposits into the Northwest account when it reconstructed petitioners’ income. However, the parties have included bank statements and canceled checks from the Northwest account among the stipulated exhibits before the Court. Those records show that petitioners used the debit card from the Northwest account to pay for numerous purchases at Wal-Mart, K-Mart, Staples, Dollar General, and a variety of other retailers, as well as many purchases at gas stations and restaurants. Petitioners wrote checks on the Northwest account to pay for many household expenses, including their gas bills, cable bills, and sewer bills. They also wrote checks to a tile company, a chimney sweep, a mattress store, a dentist, a newspaper, a mechanic, and a cement company.

Petitioners contend that even if some of the expenses paid from the Northwest account were personal, those amounts are not includable in petitioners’ income because they were for the purpose of providing a home for Mr. Chambers, a minister of the gospel, and therefore are exempt from taxation under section 107. However, in order for a minister’s housing allowance to be exempt from taxation under section 107, it must be designated as a housing allowance by an official action of the church in accordance with section 1.107-1(b), Income Tax Regs.

I think the Tax Court may have missed a chance to cut Reverend Chambers a break here. They had recognized that the church was a church and he had transferred ownership of the house to the entity so this was arguably not a rental allowance situation. They did prevent the IRS from piling it on to some extent.

The deposited checks in 2005 include federal income tax refund checks. In light of the circumstances and facts of this case, respondent is unwilling to concede that those refunds were correctly and properly made to petitioners. Therefore, respondent does not concede that those refunds are non-taxable in 2005. It appears that respondent is contending that petitioners are liable for deficiencies in income taxes from prior years and is attempting to recover some of those deficiencies by including petitioners’ tax refunds from 2004 in their income for 2005. Respondent cites no authority that would permit such a determination, and we find none. Accordingly, we conclude that petitioners’ Federal tax refunds should not be included in their income for 2005.

But there was only so much they could do. The Chambers had sold gold coins inherited from Mrs. Chambers father to help with church expenses. In their reconstruction of income the IRS treated these amounts as income and the Chambers did not have sufficient evidence to refute the presumption of correctness.

Respondent’s contention is based on the premise that Mr. Chambers stated that Mrs. Chambers inherited the gold coins directly from her parents, which would contradict Mrs. Chambers’ testimony that petitioners used cash they inherited from Mrs. Chambers’ parents to purchase the coins. However, Mr. Chambers never clearly explained where the gold coins originated. In addition, he separately testified that petitioners had received cash from the inheritance. Although petitioners’ testimony regarding the gold coins was somewhat difficult to follow, we do not find it contradictory. Nonetheless, because petitioners have the burden of proving that the $30,281 should not be included in their income and because petitioners failed to provide any evidence to corroborate their testimony, we conclude that petitioners have failed to carry their burden of proof that the income from the Surgical Resources Business Trust checks should be excluded from petitioners’ gross income.

The big thing that the Tax Court did do for Reverend Chambers was making the 75% fraud penalty go away. Acknowledging all the various things that Reverend Chambers had done to make himself appear like a duck, they could clearly see that he wasn’t one. Most important was the determination that there was an actual church there.

There are some other interesting aspects of the case that I have glossed over. I recommend it as a good read. I think it is worth commenting on how Reverend Chambers might have avoided these problems short of just working for organizations like e3 Partners, that have good infrastructure in place. He might have looked at the ECFA Standards and Best Practices for Churches. In the interest of full disclosure, I should probably say that the churches I have attended would not qualify for ECFA membership. Most Unitarian Universalists have a different theological perspective than that required by Standard 1. Our principles do encourage us to heed “Wisdom from the world’s religions which inspires us in our ethical and spiritual life” ECFA’s standards and best practices clearly fall in that category. One excerpt from the standards might have been particularly apt for Reverend Chambers Biblical Church:

Every member shall be governed by a responsible board of not less than five individuals, a majority of whom shall be independent, which shall meet at least semiannually to establish policy and review its accomplishments.

If the group of people that asked Reverend Chambers to stay on as their preacher even while working on his evangelical missions did not include five people capable of seeing that mundane matters like setting a salary for him, most if not all of which could have been excluded as parsonage, then he really should have passed.

I have been sparing in my criticism of the IRS in this case. I have often commented on how ill-qualified I am to work for them. If I was in charge of the team that was working on this I would have said “This guy is a real minister. Let’s leave him alone and go fight crime someplace else.” ignoring the laundry list of duck-like characteristics that he was exhibiting. What would be very sad is if this case ends up being viewed as an instance of the Satanic IRS persecuting the godly. If you are of the mindset to look at it that way, I’d point you to ECFA who will teach you how to avoid even the appearance of impropriety.

I haven’t seen a lot of commentary on this case. At least one blogger has observed that it was quite a harsh result. I’ve seen the identical commentary in more than one place, so I am not sure of the original source.

Trackbacks/Pingbacks