Originally published on Forbes.com June 1st, 2013

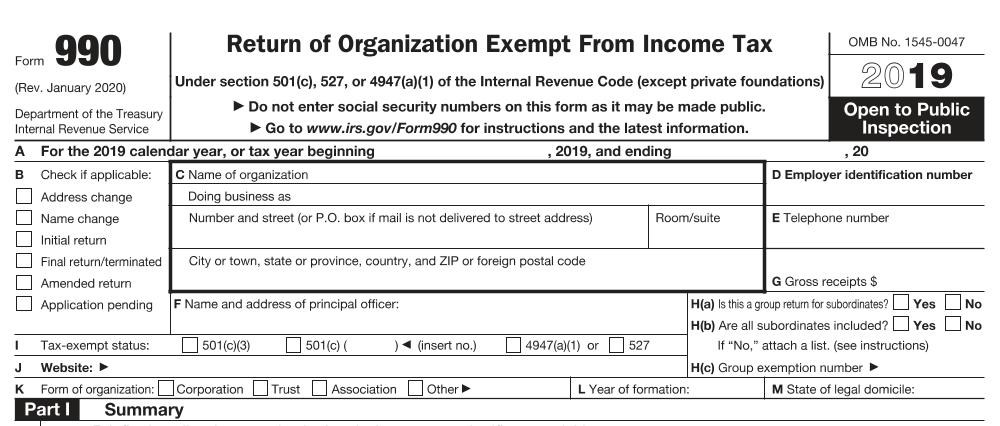

So now we have people upset that the National Football League is an exempt organization. Is that a big deal ? My immediate impulse when I learn of controversies like this is to take a look at the numbers to see if I can figure out whether anybody is getting away with anything. If the NFL is an exempt organization, it has to file Form 990, unless it is a church. Certainly, pro football serves a similar function to religion in the lives of many Americans. I think you could make a case for the NFL being a church, but it turns out that it is not. So here is its Form 990. What does the form tell us ?

Some Numbers

From the Form 990 we learn that the NFL has just over a quarter billion in revenue. Does that strike you as kind of low ? What with all those TV advertisements and everything. The thing is that money does not belong to the NFL. The bulk of the NFL’s revenue is membership dues. It also collects about half a million in fines and penalties and has slightly less than $200,000 in investment income. There are some people making good money working for the NFL. President Roger Goodell had reportable compensation of nearly thirty million. The really big money is not with the NFL. Rather it is with the 32 teams that constitute its members. From Part XIV of Schedule D, we learn:

NFL administers bank funds owned jointly by all 32 member clubs on their behalf. Additions during the year totaled $3,488,096,000 and distributions totaled $4,318,135,000. Beginning balance totaled $1,036,335,168 and ending balance totaled $206,296,207.

Yeah, I know, it is off by $39. It looks like they round the ins and outs to the nearest thousand, but the beginning and ending was rounded to the nearest dollar. Doesn’t stuff like that drive you crazy ?

What Is With The Exemption ?

We have a plethora of organization types that are exempt from taxation. Many, but not all, fall under Section 501(c). You have probably heard of 501(c)(3) and now thanks to the IRS Cincinnati gang that couldn’t sort straight you have heard of 501(c)(4). How high does it go ? It goes to 29. And then we move on to 501(d), which was introduced, inter alia, to accommodate the Shakers

Talk about true simplicity.

501(c)(3) is the most enviable status. Donations to 501(c)(3) organizations are deductible as charitable contributions (that is true of just a couple of the others, but lets keep it as simple as we can.) Recognition as a 501(c)(3) organization can also pave the way for state and local tax benefits. It also gives an organization an undeserved dose of credibility in some circles. Despite football’s quasi-religious status, the NFL is not exempt under 501(c)(3). It is exempt under 501(c)(6) which is defined as:

Business leagues, chambers of commerce, real-estate boards, boards of trade, or professional football leagues (whether or not administering a pension fund for football players), not organized for profit and no part of the net earnings of which inures to the benefit of any private shareholder or individual.

Another example of a 501(c)(6) organization is the American Institute of Certified Public Accountants. Not as good a deal being the President of the AICPA, Barry Melancon had to get by on just $1,634,068. Essentially 501(c)(6) organizations are not charities, because their members are trying to make money. The members, though, are trying to make money for themselves. They don’t really have an interest in having the 501(c)(6) make money. That is why it is not-for profit even though it is not a charity.

Is There A Tax Gimmick Here ?

The only gimmick I could think of is that the 501(c)(6) could set the dues higher than they needed to be. That would give the members a deferral of sorts, since belonging to your professional organization is an ordinary and necessary business expense. It is probably not something that the AICPA could pull off, since there are too many members, but the NFL with only 32 members probably could. The owners could sit around and say we are having a really great year, lets kick up the dues. Probably if it got extreme, the IRS would have a way of cracking down on that, possibly taking the position that the excess dues are not really ordinary and necessary. The odd thing is, though, that they are not doing that at all.

Does Being Tax Exempt Cost Them Taxes ?

The NFL had expenses in excess of revenue of $77,628,857 for the year ended 3/31/2012 and $52,195,407 for the prior year. Apparently, that is nothing new. The liabilities of the NFL exceeded its assets by $316,642,454 at 3/31/2012. Superficially, my reasoning would be that if the NFL was organized as an LLC, instead of as an exempt organization, the member teams would have had nearly a third of a billion more in deductions since inception. I’m sure it is more complicated than that, but I suspect that the motivation for the way it operates may be to keep liabilities off the balance sheets of the member organizations. It appears to me that if there is a game there, it is a GAAP (generally accepted accounting principles) game, not a tax game.

Superficially, it appears that, if the NFL were not an exempt organization, it would not owe federal income taxes, because it has not been making money. If you view the NFL in conjunctions with its member teams, it appears that it has the effect of increasing aggregate taxable income.

So what is everybody so upset about ? Maybe somebody will explain it to me.

You can follow me on twitter @peterreillycpa.