Originally published on Forbes.com.

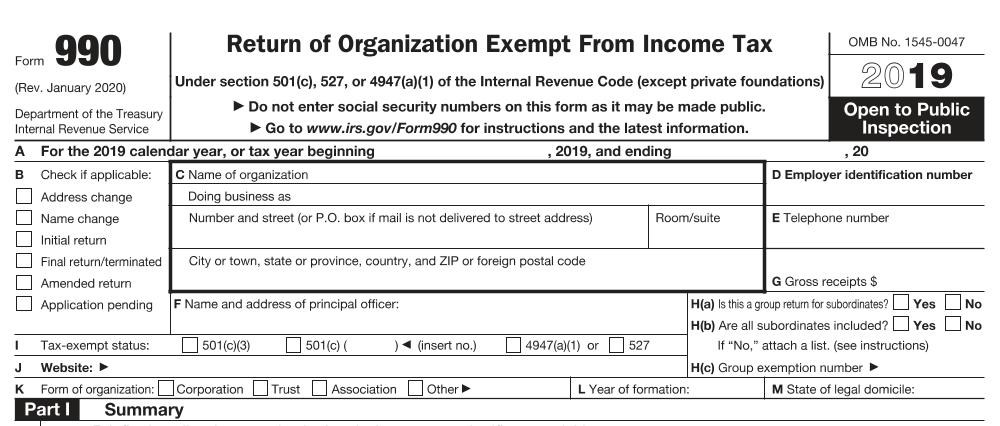

Reverend Frank B Jones is taking aim at the lack of financial transparency in churches. He has started a petition drive to require churches to play by the same rules as other not-for-profits and file Form 990 with the IRS every year. The title of the petition Expose The Prosperity Preachers give you a pretty good sense of what his agenda is.

American citizens are being financially deceived with governmental approval. When the U.S. government allows churches and religious organizations to operate without giving full financial disclosure, those churches and organizations can, and many do, exploit and deceive their members. The government has demanded full disclosure from all other charities, but has allowed churches and other religious organizations to operate in absolute financial secrecy. It is time for the United States congress to pass laws requiring all churches and religious organizations to file the annual IRS Form 990.

For The Good Of Religion

The Freedom From Religion Foundation had taken a run at this issue in court. Even though FFRF has to file a Form 990 itself, Judge Barbara Crabb ruled that FFRF did not have standing to challenge the church exemption from filing Form 990. Of course, FFRF is perceived, not without reason, as an anti-religious organization.

Reverend Jones is coming from a different space. He thinks the exemption from filing a Form 990 is bad for churches. In his mind, it is one of the things that attracts the wrong people into ministry – con artist prosperity preachers of the type sent up by John Oliver last year. Reverend Jones believes that once the profits are removed, only the prophets will remain.

In his book Stop The Prosperity Preachers Reverend Jones goes on at some length about how the exemption from 990 filing facilitates clergy con artists.

I have heard of some churches that require the members of the staff to sign non-disclosure agreements, and that is a sure sign the church is doing something wrong. Requiring churches and religious organizations to file an IRS form 990 would in no way impede the constitutionally guaranteed freedom of religion, but it would help to expose those greedy preachers who are using the constitution to conceal their improper accumulation of wealth at the expense of American citizens.

What About Self-Regulation?

The problem with transparency that Reverend Jones identifies is something of a self-inflicted wound on American churches. It is a particular bane of one-man ministries. The problem has been recognized. The Evangelical Council for Financial Accountability has transparency as one of its seven standards.

Every organization shall provide a copy of its current financial statements upon written request and shall provide other disclosures as the law may require. The financial statements required to comply with Standard 3 must be disclosed under this standard.

An organization must provide a report, upon written request, including financial information on any specific project for which it has sought or is seeking gifts.

One of the founders of ECFA was the Billy Graham Evangelistic Association. According to the wikipedia article, threat of government action was one of the motivations in EFCA’s founding. On the other hand, Billy Graham is famous for striving to avoid even the appearance or temptation of scandal. There is the Billy Graham Rule:

During his career, evangelist Billy Graham vowed never to meet, eat, or travel alone with a woman other than his wife, a strategy to protect his marriage and to avoid the even the appearance of an inappropriate relationship.

Reverend William Thornton, my go to guy on all matters evangelical, recently wrote about the possible need to modify the Billy Graham Rule for the computer age. Like Reverend Jones, Reverend Thornton has problems with prosperity preachers.

I deplore prosperity preaching and would call it a false and insidious gospel that is both spiritually and materially harmful. It is not the Gospel of Jesus whose sole possession of any value was the robe that his executioners refused to divide and for which they cast lots. It is foolish to think that Jesus, who once compared the difficulty of a rich man getting into heaven to a camel going through the eye of a needle, would have all of his faithful followers be overflowing with material wealth. I do acknowledge, and with some sadness, that there is a sizable market for prosperity preaching.

On the other hand Reverend Thornton believes that a requirement that churches file Form 990 would be intrusive.

A Bit Of Irony

As it happens, the Billy Graham ministries have recently changed their IRS status to “an association of churches”. Now why would the do that?

The reason for the change, said Mark DeMoss, a Graham spokesperson, is primarily to avoid the intense work required to file a 990, which he described as “onerous.”

“It takes a full-time person a big part of a year just to prepare the 990 and when you are also having to prepare audited financial statements anyway, it is a bit of an extra burden,” he said.

As it happens audited financial statements do not require the same level of detailed compensation disclosure. Just saying.

A Voice In The Wilderness

Reverend Jones has not attracted a lot of attention with his petition as far as I can tell. Religious leaders might want to take note and ponder whether the exemptions and privileges that they cling to so fiercely might be counter-productive to their mission.