Originally published on Forbes.com Feb 11th, 2014

Pastor Frank Benson Jones of Pentecostal Temple Church of God In Christ in Compton CA does not sound like someone you would expect to be aligned with the Freedom From Religion Foundation. At the end of his brief autobiography, he writes:

Because of what God has done for me, and how He has protected me and brought me out of some very dangerous situations and blessed me with salvation, I love Him “with all my heart, and with all my soul, and with all my mind.” (Matt 22:37) My service to Him comes before everything and everyone. I have written the above, so you will know how I was and from where God has brought me. I am not the same because “if any man be in Christ, he is a new creature: old things are passed away; behold, all things are become new.” (2 Corinthians 5:17), and I thank God for calling me “out of darkness into His marvelous light.” (1 Peter 2:9)

An Improbable Convergence

Nonetheless, when it comes to the FFRF lawsuit, that I regard as most significant, Pastor Jones lines up with FFRF. In August, Judge Barbara Crabb ruled that FFRF has standing to pursue its lawsuit demanding that the IRS require churches to file Form 990. Not-for-profit organizations are subject to a very high level of transparency. Want to know what the President of Harvard makes? A few clicks on guidestar.org will get you to Form 990. You’ll have to do some scrolling from there.

I don’t know whether you will be disappointed or pleased to find that the President of the NFL makes more than twenty times what the President of Harvard makes, but that is the type of stuff you can find out from 990s. If you want to know the salaries of Steve Furtick, the mega pastor of Elevation Church in Charlotte, NC or David Miscavige, the head of the Church of Scientology, don’t bother looking at guidestar.org. Churches are exempt from filing Form 990.

The Freedom From Religion Foundation objects to the apparent privileging of churches by not subjecting them to the same requirements as other not for profits, like, for example, FFRF, itself. Pastor Jones wants churches to file 990s for a different reason. He believes that publishing the salaries and housing allowances of Prosperity Preachers, who often ordain family members, would wake people up to the abuses of those ministries. His main reason is for the good of the churches, something that FFRF is, at best, indifferent about. Pastor Jones believes that if the profits could be removed from churches, only the prophets would remain. Lack of financial transparency, in his view, is one of the things that attracts people into ministry, who really don’t belong in it.

Lord Won’t You Buy Me A Mercedes Benz?

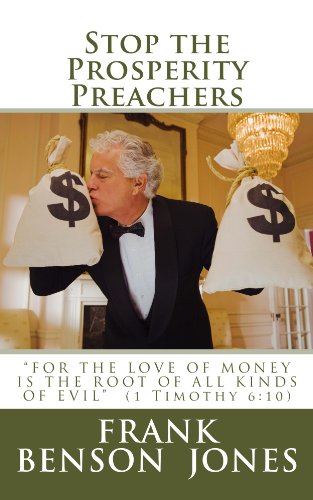

Pastors Jones’s big concern is the exploitation of the poor by “prosperity preachers” who promise their followers returns of 30, 50 or 100 times on their donations. In his book $top The Pro$perity Preacher$, he suggests that the only people who become prosperous from following their teachings are the preachers themselves. If their method is so surefire, he wonders why they ask poor people for donations:

Ask them to just keep sending their money to each other, and they should get 30, 60 or 100 times their offerings. If their doctrine is true, the prosperity preachers could see their money multiply very rapidly by just sending money to each other and not asking the congregations or public to give them anything.

Pastor Jones’s biggest concern is that he believes the prosperity gospel is a false teaching and he is warning believers that, Janis Joplin to the contrary notwithstanding, Jesus did not die so that you can have a fine automobile.

Pastor Jones writes:

If more people would read and study the Bible, the prosperity preachers would lose most of their current appeal because more people would see the flaws in the prosperity messages They would see that Jesus did not come into the world to make us financially rich. He came that we might be saved from sin and have everlasting life in the glory of God’s heavenly kingdom.

Pastor Jones is not alone in being perturbed by the prosperity preachers. My blogging buddy, Reverend William Thornton, to whom I refer all matters evangelical, wrote me:

I deplore prosperity preaching and would call it a false and insidious gospel that is both spiritually and materially harmful. It is not the Gospel of Jesus whose sole possession of any value was the robe that his executioners refused to divide and for which they cast lots. It is foolish to think that Jesus, who once compared the difficulty of a rich man getting into heaven to a camel going through the eye of a needle, would have all of his faithful followers be overflowing with material wealth. I do acknowledge, and with some sadness, that there is a sizable market for prosperity preaching.

Would Transparency Help?

Pastor Jones believes that prosperity preachers conspire with one another to keep the game going. From time to time, an inspirational speaker “evangelist” will be invited in.

Any evangelist who preached to a congregation that the pastor should obey 2 Corinthians 8:20-21 by giving full financial disclosure to the congregation would not be invited back to that church and would probably be put on the undesirable list by other prosperity preachers who heard of the evangelist’s message. Any evangelist who is known for failing to support a pastor’s right to maintain the confidentiality of a church’s finances would be committing economic suicide and would eventually not be welcomed by the prosperity preachers who could afford to give such an evangelist the largest offerings.

Pastor Jones believes that exposing the large salaries and tax-free housing allowances might help people see through the prosperity preachers.

The government has established legislative safeguards in many areas of finances in an effort to protect the American people from fraud and deception. Now it is time to establish some legislative safeguards that will force the Laodicean prosperity preachers to pay their fair share of taxes and to stop them from misleading and exploiting the poor.

I find it strange and appalling that the salary of the president of the United States is made public; the salaries of the members of the Senate and the House of Representatives are made public; the salaries of every state governor are made public; but the salaries of pastors and church employees are kept confidential and top secret.

Requiring churches and religious organizations to file an IRS form 990 would in no way impede the constitutionally guaranteed freedom of religion, but it would help to expose those greedy preachers who are using the constitution to conceal their improper accumulation of wealth at the expense of American citizens.

For what it is worth Reverend Thornton thinks that a proposal to require churches to file From 990 would create a firestorm.

What About The Housing Allowance?

Pastor Jones believes that the tax-free housing allowance for ministers as it currently stands is bad for religion. Like myself and Reverend Thornton, he believes that much of the abuse could be fixed by putting in a dollar limit. He believes that it would be better to repeal it entirely rather than leave it in place without a dollar limit.

The government must plug this leak in the tax code and limit the size of the tax-free parsonage allowance.

About Pastor Jones

I think Frank Jones may have edged out Morgain McGovern as the most colorful person I have ever interviewed. (Give her time. She is a lot younger than Reverend Jones). Before starting in the ministry, he was a pilot first in the Air Force and then for United Airlines, at a time when African Americans were just starting to be allowed into the ranks of commercial pilots.

For a while, he was a Black Panther and was called to testify before the House Unamerican Activities Committee. He told me that growing up in Kansas City, his grandmother insisted he belong to some church. He shifted to Catholic, because of the shorter services. Pastor Jones is very impressed with Pope Francis and the renewed emphasis on concern for the poor. I will be keeping in touch with him and you may see more about him here.

You can follow me on twitter @peterreillycpa and you can follow Pastor Jones @FrankBensonJonz

Trackbacks/Pingbacks