Most Recent Posts

I Still Think The Income Tax Is Constitutional

In my mind, the misreading of Brusahber is not that significant in that there is still a very clear statement that Congress has the power to lay and collect taxes from whatever source derived.

Brushing Up On Brushaber -How IRS Misstatement Fueled “Tax Protesters”

The Sixteenth amendment did not authorize a non-apportioned direct income tax. To explain this we should review the bidding so to speak going back to the beginning.

Not Enough Milk For The Starving Children To Justify Tax Exemption

One of my personal jokes was thinking about going over to the dark side and starting a dubious charity. What would I call it? I was thinking that it would be a charity that provided veterinary care to the dogs of children of veterans with cancer

Judge Toro Does Not Budge On Paul-Adams Quarry Trust

I suspect that we will be seeing similar decisions coming out of the Tax Court until some the appellate courts start weighing in on last’s years decisions.

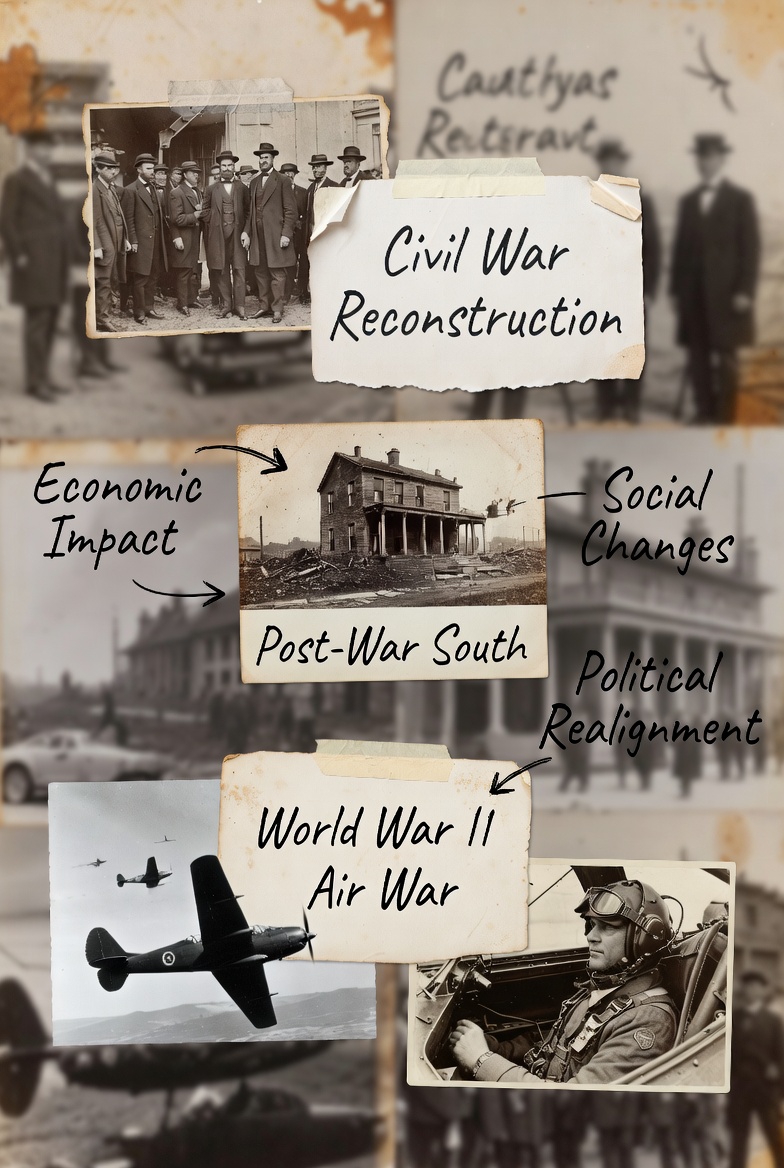

Facing The Terror Of History

Anyway now we are in a campground in Georgia. There is an American flag and below it is a Confederate flag and below that the Gadsen flag.

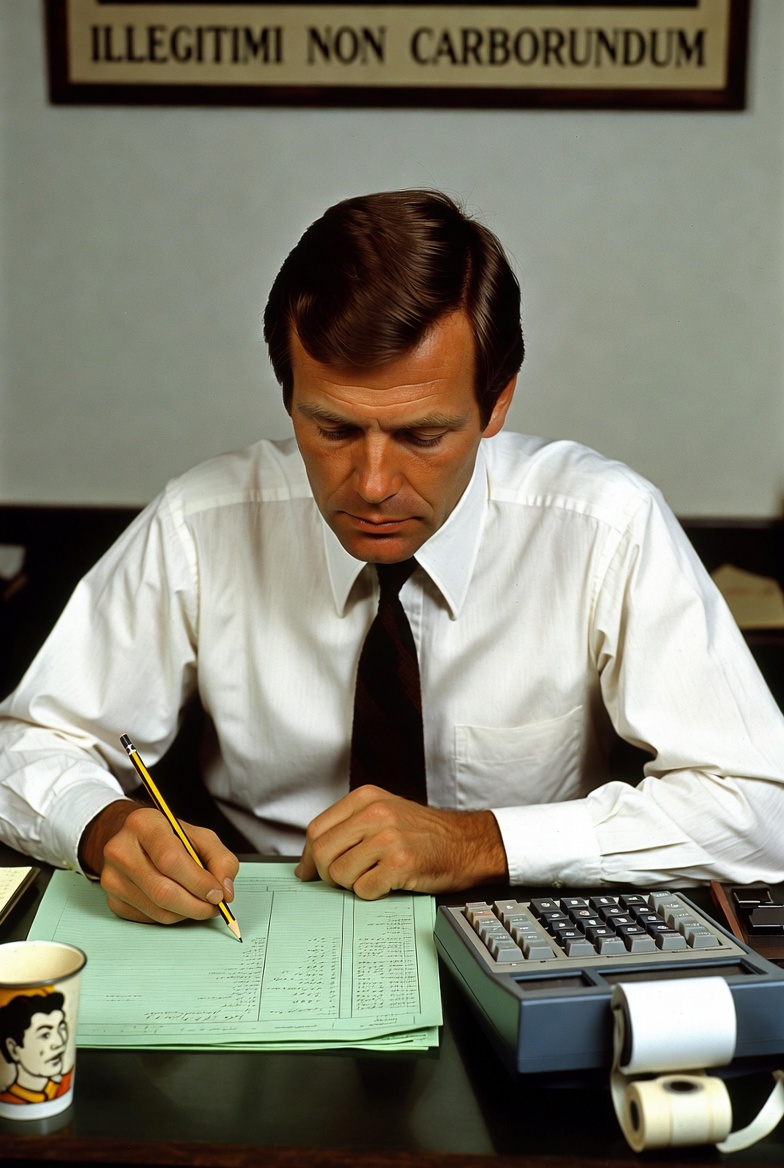

Green Sheets and Pencils – Accounting And Tax Prep In The Eighties

I think one of the things that made the long hours tolerable was that a lot of it was spent almost meditatively engaging in fourth-grade math that did not require a lot of judgment

Baker McKenzie On The Risks Facing Global Companies In 2026

For those centered on small businesses and individuals, the report’s importance lies in its big-picture warnings as a “canary in the coal mine.” Trends starting at the global level often filter down

Conservation Easement Tax Deduction Coverage Round Up

The Senate Finance Committee report on syndicated conservation easement transactions released on August 25, 2020, is a dramatic development. I have been covering conservation easement tax deductions for nearly a decade and think that a summary of that coverage might be timely. Articles are in reverse chronological order with brief explanations where the title is not self-explanatory.

Was Denmark Vesey Framed?

Charleston brings up feelings of both excitement and dread. Parents might want to consider ways to prevent their children from engaging with history, It can seem pretty harmless, but someday they will be old. Even if they lead a very soft life, they will sometimes experience what one of my Teaching Company lectures calls the “terror of history”. Beneath the moonlight magnolias southern hospitality veneer of Charleston, I knew it would be there, so I persuaded Evie that we should dive right in.

The Dinosaur Adventure Land Jeep Heist – A Different Point Of View

It was great talking to Heather. She told me that she was born in Buffalo NY, but her parents moved her to Alabama when she was four. Clearly she learned to speak in Alabama. I would characterize her as feisty.