Most Recent Posts

Massachusetts Hits Staples For $10 Million On Sham Interest Deductions

The cause might have been hopeless, but some attention to detail might have helped. This case makes me wonder how solid many other corporate tax schemes would turn out to be if subject to much in the way of scrutiny. Accountants tend to think that journal entries are deeply meaningful, but it seems that whenever they are tested in court, judges are dismissive of “mere bookkeeping entries”.

Irwin Schiff Famed Tax Protester Dies In Prison

When I first encountered Schiff’s arguments in the nineties I was so impressed by how well put together they were, that I found it difficult to believe that they were constructed by someone who believed them, as citations always checked out, but were wildly out of context. Irwin, however, has proved his sincerity. That doesn’t make his arguments right, but it does merit some grudging admiration.

I was sad that Peter Schiff was not able to bring his father home for his last days,

Montana Court Rules For And Against Online Travel Companies

It strikes me that this particular dispute illustrates one of the downsides of federalism,. The same issue is being fought all over the country with disparate results. It may be the type of thing that it would pay to have some sort of uniform law on. I have not found anything going on in that area, but I would be happy if one of my commenters embarrassed me on that.

Why Don’t We Eliminate The Charitable And Mortgage Interest Deductions?

The only two things I will eliminate are the charitable contribution and the mortgage interest deduction. The reason I picked them is because in most, if not all, of the Republican plans, those are the only two itemized deductions that are kept. Frankly if you blew those away, I think you would end up with a lot of non-itemizers, except in the high tax states, but let the chips fall where they may.

Santorum 20/20 Flat Tax Might Be Hard On Many Small Businesses

A progressive rate table may be a good or bad idea, but it is really not that complicated. Even if you are doing a return by hand figuring out the tax on a progressive table once you have gotten to taxable income could be turned over to a bright fourth grader. Boiling the 29 line Schedule A down to 2 lines might seem like a massive reduction in complexity, but all the various Code Sections that address potentially abusive transaction will need to stay in some form or other and you will still need special provisions for insurance companies and financial institutions. So the page count will not come down all that much, but the page count is not a real problem, since nobody is affected by all the pages and regular people only have to worry about a few of them

A Twisted Tale Of New Jersey Use Tax

On this audit the state took the position that J&J needed to pay use tax on all the parts used to assemble warmers regardless of where they are sent. New Jersey was thus demanding use tax on pieces of metal, plastic and glass that were in the state for a couple of days being assembled into a warmer that went to another state.

Democrats Have Civil Debate With No New Tax Positions

He was handed a chance to embarrass Sanders over Sanders conscientious objector status in Vietnam while Webb was a decorated Marine. He passed on that, while still indicating that he, Webb, was most qualified to be Commander in Chief. Webb stood out when foreign policy was discussed by mentioning China’s activities in the South China Sea and its cyberwarfare.

His best line was right at the end when the candidates were asked about who the enemies they had made were. Webb went last and after Hillary mentioned the Republicans and Bernie mentioned Wall Street, Webb said it was probably the guy who threw a grenade at him, but that guy is not around anymore.

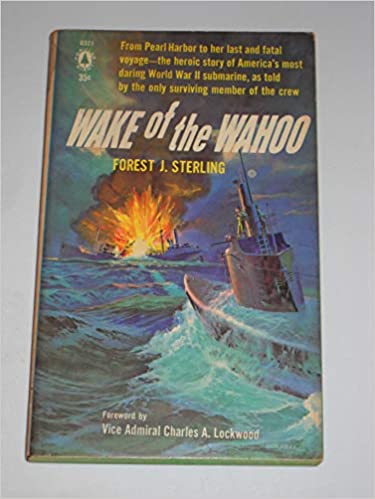

Some Unique WWII Memoirs

I really like memoirs and biographies. There are three that I just finished. I would recommend two of them as really good reads. The Yeoman Wake of The Wahoo by...

Live Blogging From Debate Night With We Want Bernie Worcester

I'm live blogging the Democratic debate from the Sahara Restaurant on Highland St in Worcester. I arrived early and snagged a table with an electric outlet. As of...

Hillary’s Tax Proposals Will Make Things More Complicated

Clinton’s worst proposal for those of us who would like to see an Internal Revenue Code with fewer bells and whistles is a temporary tax credit (two years) for companies that establish profit sharing plans. Robert Samuelson nailed it in his analysis.

Hillary Clinton has just given us an object lesson — presumably unintended — demonstrating why our tax system is such a complex mess. The main reason is this: Politicians of both parties cannot resist the temptation to use the tax code to promote the latest political fad or to please favored constituencies.

As a tax adviser, I can tell you this. I would be only recommending looking at this credit for somebody who was going to do something like it anyway, which by the way is the way the research credit works in the world that I play in. Experts go in and identify all the things the company does that can plausibly be considered research.

A lot of firms that have bonuses as part of their compensation scheme – like many accounting firms – would all of a sudden have profit sharing plans (at least for a couple of years). Of course there will be safeguards to prevent that type of abuse- adding a few more thousand words to the Code or the regulations.