Most Recent Posts

Trump Tax Plan Would Increase Deficit By Over $10 Trillion

For perspective, according to this site projected federal revenue for fiscal year 2015 is $3.2 trillion. So on a lazy math basis, we could call it a third. You know the old joke about a billion here a billion there, pretty soon you are talking about real money. Doesn’t work that way with a trillion. A trillion is real money all by its lonesome.

Trump’s Plan Inverts Traditional Tax Planning Makes Carried Interest Moot

Trump’s scheme would seem to make it so everyone will want to be an independent contractor and that ordinary business income will be the most favored type of income. Whatever he thinks, the transition to this system will not be simple. Right now the IRS fights with S corporations that pay meagre or no salaries to avoid employment taxes. Now we will add a 10% income tax spread to the mix. What the policy rationale is for taxing an independent contractor at 60% of the maximum rate for an employee is a mystery to me.

The other question to ask is who will want to defer business income with a 401(k) or the like, since the payout might be taxed at a higher rate than the deduction yields in savings.

A Slick Estate Planning Trick And Intimations Of Mortality

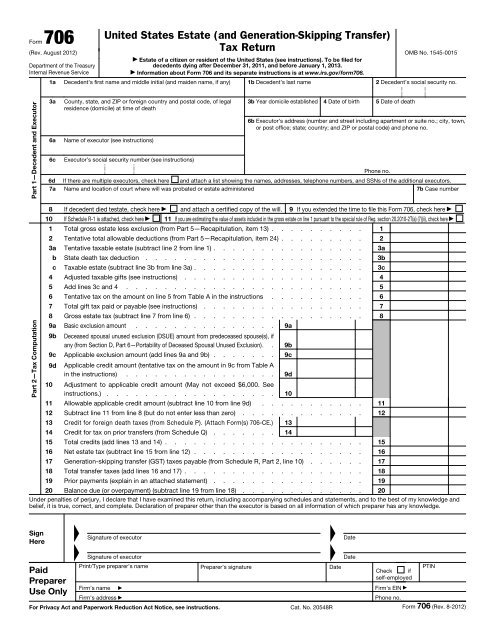

Although they are figured on the same cumulative unified tax table gift taxes are actually lower than estate taxes. Quite a bit lower. Let’s talk large estates where the unified credit is not that significant and likely was used up with gifts in the past. $100 million passing through an estate at the current top marginal rate of 40% leaves $60 million for the heirs. Prior to death that same $100 million could support a gift of over $71 million and the resulting gift tax of nearly $29 million.

Noted Catholic Historian Not Surprised By Dorothy Day Reference In Pope Francis Speech

The other day I included in a tax post on the IRS and church endorsements of political candidates, the fantasy that Pope Francis might endorse his biggest fan among the...

Yogi Berra’s Sayings Worked Their Way Into Tax Decisions

As is my habit when the prominent pass, I had to check whether he had been involved in tax litigation. I didn’t find anything and my Thomson Reuters Checkpoint is pretty comprehensive and my research skills are pretty good. After all, tax blogging is 90% good research; the other three-quarters is creativity. Nonetheless, Yogi Berra has influenced the tax world through his wisdom and is likely the most quoted baseball player in the body of tax material.

The Tax Code Explained & Why It Matters In This Presidential Race (No, It’s Not 70K Pages)

Two quick examples. Somebody comes before the Tax Court and says that they don’t believe wages are income. The Tax Court tells them that they are wrong – so wrong in fact that they are going to be sanctioned for making a stupid argument. People keep doing it anyway, which adds to the body of case law. Organizations that don’t qualify for exempt status apply for it and are turned down. That adds to the body of private letter rulings, which thanks to the Freedom of Information Act are no longer entirely private. There is no way I can conceive of to prevent that body of material from continuing to grow.

Tax Rules Forbid Churches From Endorsing Candidates, Will IRS Take Action?

The Alliance Defending Freedom is very upset about that rule and has started a movement called “Pulpit Freedom Sunday”. In 2014, over 1600 pastors made election speeches and sent tapes of them to the IRS more or less daring them to do something about it. The IRS response was underwhelming enough to spark a lawsuit by the Freedom From Religion Foundation, which they withdrew after the IRS somehow convinced FFRF that it would not remain supine on the issue.

Estate Tax Hits 100th Birthday And Paul Caron Calls For Many Happy Returns

I had a bit of an email exchange with Professor Caron asking him to clarify where he is on the ideological spectrum, but he preferred not to say. He indicates that he tries very hard to make the TaxProf Blog an impartial source for tax news and information. I have to say that I think he does a pretty good job, and that is not just because he highlights my stuff from time to time (Of course, it’s not like that hurts either. Just saying.)

Jeb Bush Tax Plan Could Disrupt Real Estate And Small Business

A much more disturbing thought, one for which I will not try to construct examples is what happens with firms that borrow to finance receivables, inventories and to deal with irregular cash flow. During periods in which inventory and receivables are stable there might be a pretty good match between taxable income and after-tax cash flow. The notion that you could run into a rough patch during which there is barely enough operating income to cover your interest expense, but you are still generating taxable income because the interest is not deductible is frightening.

Jeb Bush And The Spirit Of 1986

If you have been considering a major charitable gift, don’t put it off, since charitable deductions will be more valuable in 2015 and 2016 due to lower marginal rates. If you are approaching full retirement age do whatever you can to defer compensation in anticipation of that payroll tax break.

If you are a highly leveraged entrepreneur in a high tax state you might like the Bernie Sanders plan better than the Jeb Bush plan.

The thing about the Tax Code being 80,000 pages and tax accountants writing the Code might seem petty, but, since I have taken on the project of rewatching West Wing on Netflix, I have decided to adopt a “Would Jed Bartlett make a mistake like that?” standard. I’ve also decided that any candidate that promises to make Allison Janney press secretary has my vote.