Most Recent Posts

Kent Hovind Remains In Custody – Judge Would Have Ruled Against Motion To Dismiss

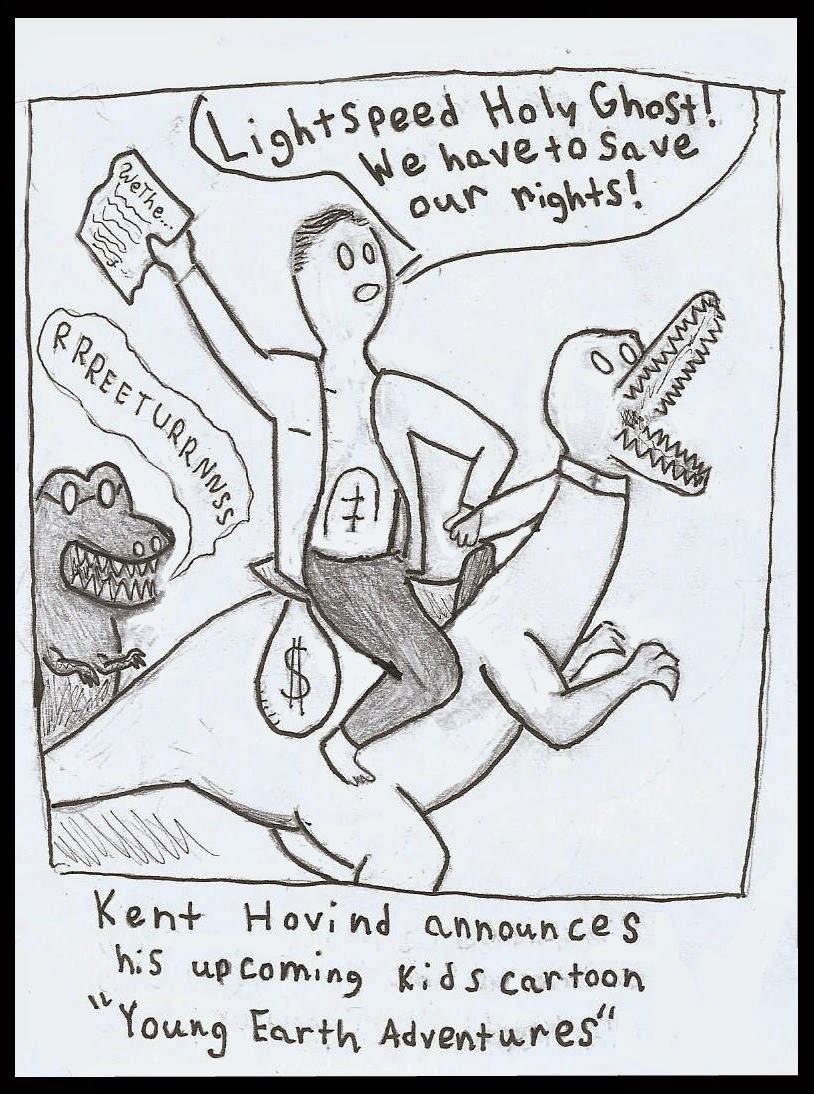

People who have been following the Kent Hovind trial were taken by surprise this weekend as the federal government moved to drop, without prejudice, the remaining charges against Hovind and Hansen (In March they were convicted on charges of contempt of court, but the jury did not reach a verdict on more serious fraud and conspiracy charges. Jury selection for retrial on those charges was scheduled to begin this morning.)

More or less at the eleventh hour, the United States Justice Foundation assisted Hovind’s attorney Thomas Keith and Hansen, who is pro se on this round, in submitting a motion to have the charges dropped. The United States requested a continuance to respond to the motion. Judge Rodgers indicated that she was not inclined to grant a continuance and scheduled oral arguments on the motions this morning with jury selection to follow, if the motions were not allowed. Then came the big surprise. The United States moved to dismiss the remaining charges without prejudice. (Meaning, as I understand it, that the charges can be refiled).

Entrepreneurial Cardiologist Denied Real Estate Pro Status By Tax Court

One of my mentors in public accountant once gave me some advice about the lease or buy issue. It is dated, because back in the day there was an investment credit. He said he once went through the analysis in depth considering all the factors. After that whenever a client called him to ask about a lease buy decision, he would tell him to buy and charge him a hundred dollars. (Back in the day a hundred dollars, was , you know, a hundred dollars.) When you lease you get to deduct whatever you pay throughout the term of the lease. When you buy you take depreciation deductions over the life of the property and deduct the interest payments as they occur. You don’t deduct the principal payments (Although you do in a sense, because of your depreciation deductions). It ends up being about timing.

Kent Hovind Not Facing Trial On Monday

Robert Baty's facebook site Kent and Jo Hovind v IRS has the text of a government motion to dismiss the remaining counts on Kent Hovind and Paul Hansen's indictment....

Kent Hovind In Pensacola – Looks Like No Trial On Monday

The current charges relate back to his 2006 conviction. Besides his ten year sentence, over $400,000 in structured funds were forfeited. Kent having no cash, property of Creation Science Evangelism, which was deemed an alter ego of Kent Hovind, was seized. Kent believes that his conviction will be reversed and on the advice of his real estate genius cellmate he filed a “Bivens claim” against prison officials who interfered with an appeal of his conviction. As a follow on to that he filed a “lis pendens” on some of the seized properties to warn buyers that the United States’s title to the property was in dispute. That is the basis of his contempt of court charge, on which he was convicted in March, and the fraud and conspiracy charges.

Heading For The Grand Review

Tonight I am starting off on my final Civil War Sesquicentennial adventure. It is not a "real time" affair. The Grand Review of the Armies took place on May 23 and...

Kent Hovind’s Innocence Narrative – Truth Some – Whole Truth Not So Much

As Kent Hovind faces another trial on May 18th he has honed the Hovindication narrative to a fine edge. Here is his latest summary as to what the case is all about. As...

California Attorney General Can Demand Full IRS Forms From Charity

The Attorney General argues that there is a compelling law enforcement interest in the disclosure of the names of significant donors. She argues that such information is necessary to determine whether a charity is actually engaged in a charitable purpose, or is instead violating California law by engaging in self-dealing, improper loans, or other unfair business practices.

IRS Not Grossly Negligent In Disclosure Of Exempt Application

Citizens Awareness Project actually does look like an entity that was set up to game the lack of transparency permitted to organizations exempt under 501(c)(4). According to its initial Form 990 for the year 2012 it received $2,535,000. It had no paid staff or occupancy expenses. Pretty much the whole $2.5 million went to two vendors. The $993,916.79 noted above to Stephen Clouse & Asooc and $1,449,952.10 to Direct Response LLC in Phoenix Arizona. The latter was to conduct research to measure the “current opinions of specific demographic groups and how such groups change over time”.

Religious Arbitration Clause Does Not Hurt Million Plus Gift Tax Exclusion

The IRS argues that the withdrawal rights were not “legally enforceable”. IRS starts out “hypothesizing that the trustees might refuse, without legal basis, to honor a timely withdrawal demand”. It admits that this an adverse ruling by the Ben Din could be appealed to state courts, even though the courts don’t like to upset arbitration decisions. The sense is that the “No soup for you” clause would scare them.

The Tax Court read the trust more closely and thought that the “ad terrorem” clause was much more limited. Basically, it was there to emphasize the trustee’s broad discretion to make distribution and would only be triggered if a beneficiary brought a suit that challenged an actual distribution to another beneficiary. Therefore the beneficiary did have an enforceable right to demand a distribution during the Crummey window. As with any upholding of Crummey powers, the fact that it appears that beneficiaries never do that, as far as anybody I have ever heard of knows, is not relevant.

Gallery Does Not Get Exempt Status And The Lusty Month Of May

You are similar to the organization described in Revenue Ruling 71-395. You were formed by a group of artists and are operating an art gallery open to the general public which displays and sells members’ artwork. One advantage of membership is listed as the ability to show works. In addition, like the organization in the revenue ruling, a committee consisting of artist members selects works that will be displayed and offered for sale. Additional members are admitted to membership by approval of the existing members. Your gallery is open free to the public on certain days and by appointment on others. Nearly all work is for sale, and you retain a commission of the original sales price of artwork that is sold. Consequently, like the organization in the revenue ruling, you are a vehicle for advancing members’ careers and are promoting the sale of members’ artwork. This serves the private purposes of your members, even though the exhibition of art may be an educational activity in other respects.