Most Recent Posts

Lafayette In Massachusetts In 1824 – August 29 Milton Quincy

How many people in this country would have been delighted with my situation at this moment, to see three distinguished men dining at the same table, with the reflections all brought up concerning the old days of the revolution, in which they were conspicuous actors and for their exertions in which, the country is grateful! – Charles Francis Adams grandson of John Adams

Lafayette In Massachusetts In 1824 – August 28 Medford

The minds of our countrymen traced your course with anxious solicitude, through the French Revolution, form your first success in the cause of Liberty, until the spirit of oppression confined you to a dungeon; and their hearts were gladdened, when, by the influence of Great and Good Washington, their Friend was a last set free. In the rich harvest you are now gathering of the expressions of esteem and gratitude of this numerous people, whose freedom and happiness your exertions so essentially contributed to establish, we hope you find some compensation for all your trials, sacrifices, and sufferings-and we feel much complacency-that, in this respect you have gained so complete a triumph over the Monarchs of the world.

Lafayette In Massachusetts In 1824 – Augusts 2? Dorchester

According to Levasseur, Governor Eustis invited Lafayette to visit the camp at Savin Hill. They arrived around noon. The camp was occupied by the Guards of New England. Engaged in target practice. The militia invited Lafayette and the Governor to fire a shot with their own hand. The General’s shot struck the target a little above the center. He then dined at Governor Eustis’s home. The front of the house was beautifully decorated and fireworks were exhibited on the lawn.

Lafayette In Massachusetts In 1824 – August 27 Charlestown

This joyful occasion revives high national feelings and recollections and touches the springs of gratitude by reminding us of that interesting period of our history which gave to our country a gallant Hero, and the rights of mankind a steadfast Champion. While we participate in the thrill of delight which everywhere hails the visit of our illustrious friend, we cannot suppress the peculiar emotion of our hearts on receiving you, Sir, on the memorable heights of Bunker. On this holy ground, immortalized by the deeds and sacred to the manes of Revolutionary Heroes:- Over these heights, Liberty once moved in blood and tears – her chariot in wheels of fire. Now she comes in her car of peace and glory; drawn by the affections of a happy people, to crown on these same heights, with civic honors, a favorite Son,

Lafayette In Massachusetts In 1824 – August 26 Boston Cambridge Harvard Phi Beta Kappa

“Welcome, friend of our fathers, to our shores. Happy are our eyes that behold those venerable features. Enjoy a triumph, such as never conqueror or monarch enjoyed, the assurance that throughout America, there is not a bosom, which does not beat with joy and gratitude at the sound of your name.

Lafayette In Massachusetts 1824 – August 25 Cambridge Harvard Commencement

We bid you welcome, General Lafayette, to this most ancient of the seminaries of our land. The Overseers and Fellows of the University, the Professors and other officers, the candidates for the academic honors of this day, and the students, tender you with their respectful, their affectionate salutations. We greet you with peculiar pleasure, at this literary festival, gratified that you regard the occasion with interest, and espouse the attachment, which as members of a republic, we cannot fail to cherish to the cause of learning and education.

Lafayette In Massachusetts August 24 1824 – Roxbury Boston

In the last surviving Major General of the American revolutionary army, we recognize a benefactor and friend from a distant and gallant nation; who, inspired by a love of liberty, subjected himself in his youth to the toils and hazards of a military life, in support of our rights. Under our illustrious Washington, you were instrumental in establishing the liberties of our country, while your gallantry in the field secured to yourself an imperishable renown.

Lafayette In Massachusetts August 23 1824 – Walpole Dedham Roxbury

A cavalcade of gentlemen escorted him to the residence of Revolutionary War veteran Governor William Eustis (1753-1825) in Roxbury where he would spend the night. As he passed through Roxbury around 1:00 AM the Roxbury corps of artillery fired a salute of artillery and rockets. Governor Eustis and Lafayette embraced when he arrived at the mansion around 2:00 AM.

Lafayette In Massachusetts In 1824

…there never was nor will be such a meeting in this or any country ……

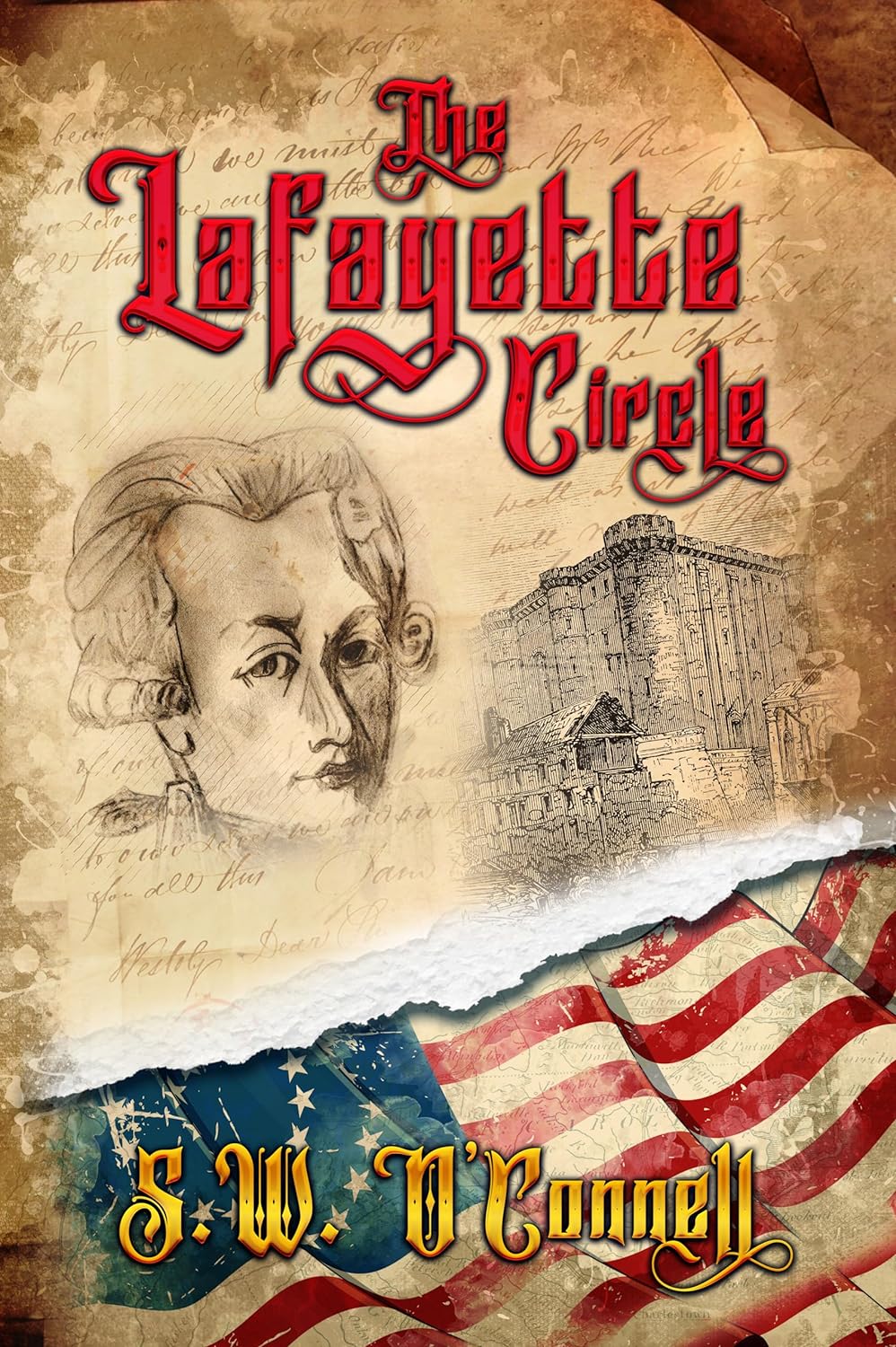

Author Of Farewell Tour Spy Thriller Reflects On Lafayette

S.W. O’Connell is a retired US Army intelligence officer who has served in a wide variety of counterintelligence assignments around the world. Calling on both his...