Most Recent Posts

Jonathan Schwartz Brings Filmmaker’s Eye To The Kent Hovind Trial

Kent Hovind is one of the leading lights in the field of Young Earth Creationism, the notion that there is scientific evidence for a hyper-literal reading of the Book...

As It Opens In Kent Hovind Trial Government Focuses On Hansen’s Extensive Filings

Kent Hovind one of the leading lights in the field of Young Earth Creationism, the notion that there is scientific evidence for a hyper-literal reading of the Book of...

Government Focusing On Codefendant Hansen As Kent Hovind Trial Commences

Prosecutions for tax related offenses are very rare. Their purpose is to encourage compliance. This had me wondering, along with the Hovindicators – Why Kent Hovind? The initial volleys of the government indicate that their primary target may be Paul John Hansen, for whom defiance of government authority is a vocation. It has been more of a hobby to Kent Hovind, who focuses on winning souls, exposing the lies of evolution and warning about the coming New World Order.

Little Drama Outside As Jury Selection In Kent Hovind Trial Proceeds Smoothly On Day One

Ben Shefler reporting from the Pensacola federal court house on Day 1 of Kent Hovind trial. Jury selection was held Monday for the trial of Kent Hovind and co-defendant...

Kent Hovind Supporters Getting Organized

Janet Yang is a free-lance journalist who will be covering the Kent Hovind trial. Here is her account of events at Red Roof Inn in Pensacola last night as...

Looks Like Kent Hovind Not Capturing Much Sympathy

Reverend William Thornton who is my go to guy on all matters evangelical has not seen any Hovind coverage other than what I provided him. So it may well be that Hovind ownership on the internet only encompassed a rather small echo chamber.

On Eve Of Kent Hovind Trial – With The Hovindicators Under The Blood Of Jesus At The Red Roof Inn

Wiley Drake is one of the most prominent supporters of Kent Hovind, who goes on trial this morning in Federal District Court in Pensacola on tax related charges. When...

Lois Lerner Out From Under Freedom Path Lawsuit For Now

In count IV, Freedom Path challenges as unconstitutional the IRS’s use of certain policies and procedures to target conservative organizations for heightened review of applications for tax-exempt status. Although the IRS’s adherence to these policies and procedures may ultimately culminate in a final decision regarding Freedom Path’s tax-exempt status, the use of these policies and procedures neither marks the consummation of the IRS’s decisionmaking process nor determines Freedom Path’s rights or obligations or precipitates legal consequences.

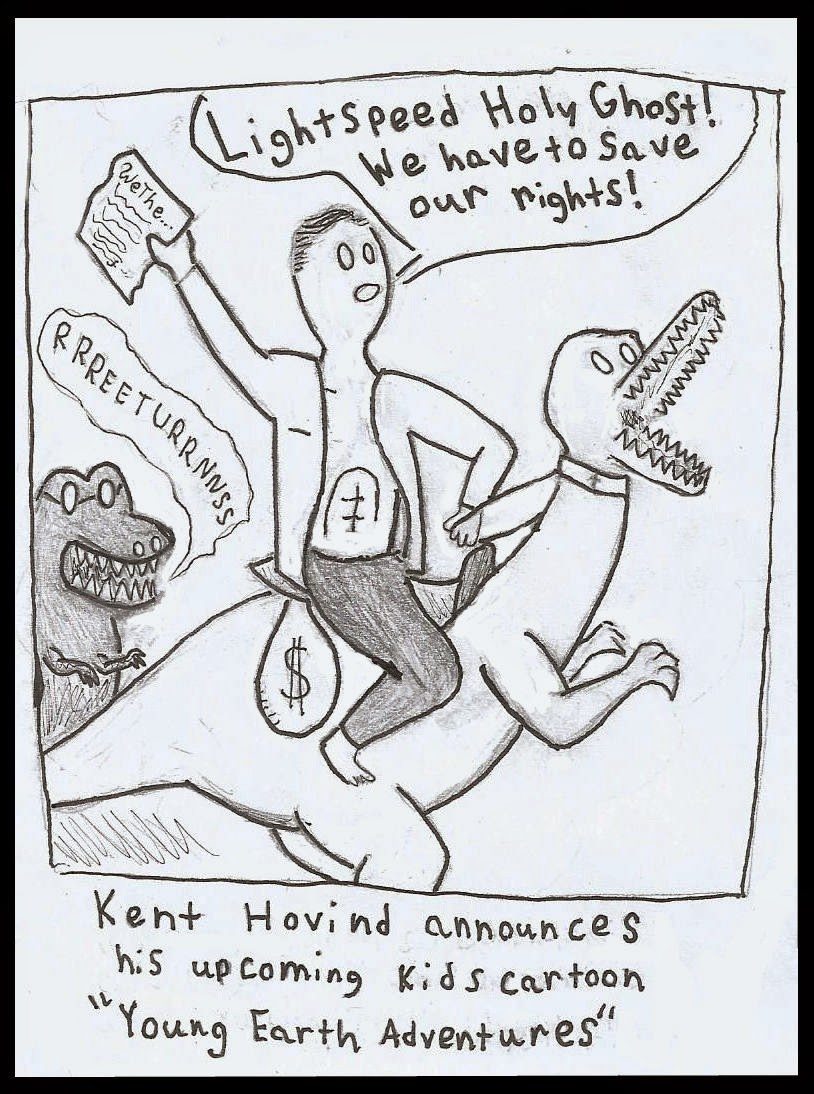

On Kent Hovind – Worth A Thousand Words

My friend and fellow Son of Xavier, John Sundman, author of techo thriller Acts of The Apostles (Not to be confused with the fantasy novel of the same title by somebody...

Will Christian Soldiers Be On The Streets Of Pensacola As Kent Hovind Goes To Trial?

The expert who gives me just a tad of optimism for Kent Hovind is William McGane who has written about lis pendens. Apparently lis pendens is a very privileged filing. The only way that filing one is fraudulent is if there is absolutely no sort of litigation to which it refers. Jury instruction that Hovind’s public defender is seeking focuses a lot on the element of willfulness and Hovind in his statements has been indicating that he is not that up on all the details. So a lack of willfulness defense just might work. The Hovindicators have been promoting jury nullification, so a hung jury is not out of the question.