Most Recent Posts

Evolution Of A Hovindologist

Last week, Sam and Dan of God's Property Radio ran my interview with Kent Hovind with commentary on the front end and the back end. They included the still anonymous,...

Mr. Koskinen’s Last Chance To End The Form 3115 Madness

I did a short survey to an extremely small unscientific sample of tax preparers asking if they expected to do one of more Forms 3115 for virtually every trade or business client. It’s running about half. As it stands now, I’m leaning toward the tree killing side, but I don’t have many returns to do and they almost all extend, so I can pretty much wait and see. I suspect that the people who are saying this is overblown will turn out to be right. It will be like those blurbs we put on our emails that we thought were required by Circular 230, but why take the risk. So realistically, if the IRS does not take action to stem the flow Ogden will only be hit with 5 or 6 million pointless forms, since there are people more courageous than me who will not be intimidated and people more clueless than me, who will miss the whole drama.

Oil Rig Manager Does Not Qualify As Foreign Resident

Petitioner’s ties to Louisiana during 2007-2010 were at least as strong as, if not stronger than, those of the taxpayer in Lemay. Throughout this period petitioner owned a house in West Monroe that he had built. While he was overseas his first wife, his second wife, and his daughter lived in this house or in his parents’ house, also in West Monroe. During his off-duty periods petitioner regularly returned to West Monroe for an average of 23 days per period to be with his family. His business affairs were generally handled by his mother, whose address in West Monroe he used as his mailing address. His driver’s license, voter registration, bank accounts, and motor vehicles were all centered in Louisiana. His ties to Sakhalin Island, by contrast, were entirely transitory and did not extend much beyond the bare minimum required to perform his duties there

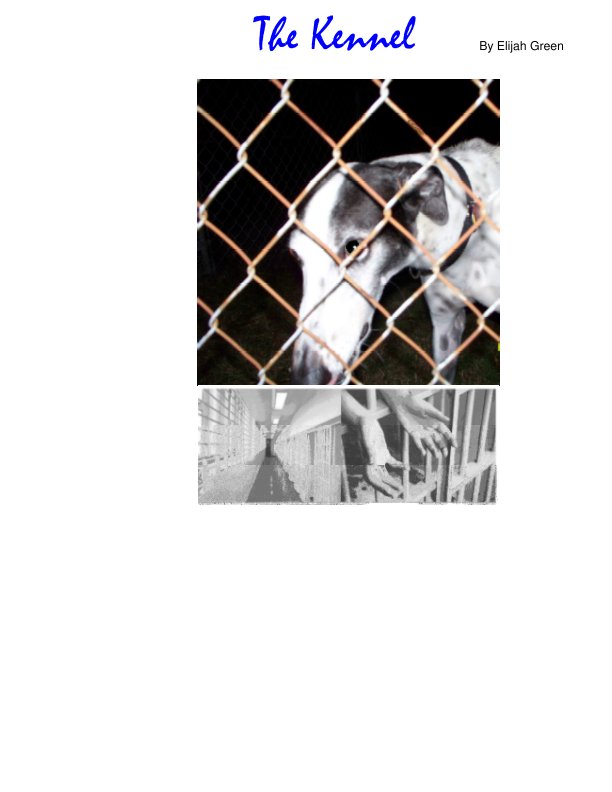

An Awesome Critique Of The Prison Industrial Complex By One Who Knows It Well

The Kennel by Elijah Green is a brilliant send-up of the prison industrial complex. It is short, just 41 pages. The work is divided into two parts. The first is a...

Repair Regs And Tax Pros Are Like Headlights And Deer

The regulations totally refer to the physicality of the building and except for some de minimus rules make no reference to dollars. The regs say that if you have 10 roof mounted HVAC units and you replace three of them, you can expense that. CSG takes that and makes the logical leap that if you have carved out $100,000 of the original building cost to HVAC and you have a bill for less than $30,000 you can expense it, more than $40,000 you have to capitalize with a gray area in between. At any rate that is what I understood the rep to have presented. I voiced my objection to that not reflecting what the regulations said and he indicated that might be true, but what else can you do and, of course, their IRS insiders had given the nod to this reasoning.

Don’t Use The IRS To Address Koch Political Spending

In the end the concern about dark money is an ad hominem argument. I’d like to think that we are smart enough to look at the merits of ideas without knowing who is pushing them. Of course from here on in, progressives will be able to use the lack of transparency to attribute any support received by their opponents to the Koch brothers. Play it that way and let the IRS stick to collecting taxes.

Kent Hovind – Trial Delayed – Documents Uncovered

I have been following the tax travails of Kent Hovind, Doctor Dino on forbes.com for over two years. As his trial on new charges approaches he has been rallying...

A Free Kent Hovind Might Have Backing For A Bigger Better Dinosaur Theme Park

There’s more but Ernie actually gave me a better summary in an e-mail a couple of weeks ago

I could debate the subject of persecution of Kent, but then I would have to raise all the same issues of the Knights cavalier, the illuminati, the holy grail, the ark of the covenant, etc. because all of those relate back to the fallen angel, Satan and his dominion of earth and it’s Governments, so only well studied real Bible believing Christians would buy into my debate, so I’m best not debating Kent’s persecution over creation views and it’s foundation in Genesis, although I feel strongly those are the reasons. Personally, I believe as I’ve heard it said it’s not about the Muslims and the Christians, it’s not about black or white, but it is about the haves and the have nots. And they use the secret societies and governments to persecute those who expose their plots.

Richard Hofstadter identified this type of viewpoint as a perennial of American history, “the paranoid style – the existence of a vast, insidious, preternaturally effective international conspiratorial network designed to perpetrate acts of the most fiendish character”. Writing in 1965, Hofstadter observed “Today the evolution controversy seems as remote as the Homeric era to intellectuals in the East”. Sadly Hofstadter died in 1970, so he is not available to weigh in on the persistence of the controversy. I don’t think it would have surprised him.

Moneygram Loses Big In Tax Court And Nobody Seems To Care

Moneygram ended up with a loss of over half a billions dollars. Even though C corporations don’t get a favorable rate on capital gains, they are still limited in their ability to take capital losses, much as individuals are. Whether Moneygram’s loss was capital or ordinary depended on whether or not it is bank. Moneygram, of course argued that it was a bank and the IRS argued that it was not. It turns out that it is not a bank, because —- Well, because the Tax Court says it is not, but of course there are reasons.

Latest Hovindication Developments

I have been following the tax controversy surrounding Kent Hovind a/k/a Doctor Dino for over two years. As he nears the end of a long sentence on a variety of tax...