Most Recent Posts

Report On IRS Targeting Of Conservatives – No Christmas Pony For Darrell Issa

The other implication of the report is that the IRS should simply have ignored allegations that 501(c)(4) groups were breaking the law and not have investigated at all. If you are willing to acknowledge that there might have been a law being broken or an envelope being pushed past the breaking point, the notion that you had one bureaucrat who became zealous about the matter is hardly surprising. In the end, she accomplished little other than slowing down some applications as each approach she brain-stormed proved unworkable. The report is highly critical of senior leadership for not more quickly unsnarling the problem once they became aware of it, but anybody who has worked with the IRS knows that once anything gets snarled, it will take a while to unsnarl it.

So I recommend that if you are interested in the matter you read the report with an open mind. Even though it strongly adopts one narrative, all the material for a different narrative is there. That is why the New York Times can headline its coverage “Probe Fails to Link IRS Scandal to White House” while Ben Shapiro’s Truth Revolt headlines “Issa Releases Damning Report On IRS Scandal” and leads with “Issa’s report contained emails which seemed to indicate there was visceral hatred of the Tea Party by IRS workers.” Frankly, even if I just strongly disliked someone, I could come up with something better than calling them “icky”.

If Only Obama Had Taped Conversations

The just before Christmas report of Darrell Issa's Committee on Oversight and Government Reform is probably a big disappointment to promoters of the IRS scandal...

You Need Partners To Have A Partnership

Originally published on forbes.com. Estate of Lois L. Lockett, et al. v. Commissioner, TC Memo 2012-123 One of the most fundamental principles of partnerships is that...

United States v. Hansen & Hovind

I have been following the Kent Hovind tax drama for over two years, but my friend and most constant commenter Bob Baty keeps much more on top of it. Kent is nearing...

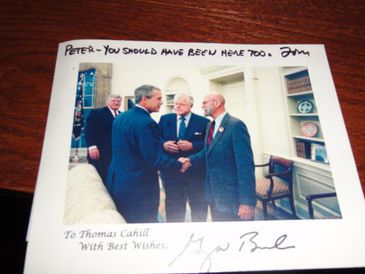

Tom Cahill Forgives The FBI

My friend Tom Cahill has given me permission to republish his letters home from his voluntary exile in France. This is the first in the series. It will be daily until...

Phantom Mares And Real Trucks Don’t Make For A Winning Horse Loss Tax Case

Still, if the notion of the horse business being part of the dealership business had been better executed, it might have worked. An approach that occurred to me would have been to have the operation, but not the real estate, inside a single member LLC that was owned by one of the dealerships. With that approach rather than a big nasty negative number on a Schedule F, the transactions would have just made the positive number from one of the S corporations somewhat lower. Frankly, this borders on audit lottery advice, but it is really the filing position that is consistent with the unified business argument.

My exposure to dealership accounting is somewhat limited. At Joseph B Cohan and associates in the 1980s, my buddy Mikey handled the dealerships and I had the low income housing tax shelters, but I picked up a bit here and there. That makes me think that there might be practical issues that would foreclose running the horse business through the dealership books, since “the factory” can have specific requirements about how the dealership keeps it books. Still, it might have been worth looking at

Is IRS Ninth Circuit Salus Mundi Win A Pyrrhic Victory?

So the interesting question is what will happen if transferee liability is found against Salus Mundi. There may be some theory that could be used to attack the estate of Professor Diebold for handing out all the Foundations resources while the sword of Damocles was over its head. Something tells me that the IRS will not be able to chase the recipients of the Foundation’s largess. You never know, though. If in a couple of years the IRS auction notices include a large pile of Indo-European scholarly works, you’ll know what happened.

Tax Court Rules Wounded Warrior Can Take His Time With The Trash – Merry Christmas

While noting the absence of logs, Judge Kerrigan indicated that the testimony of the couple was quite credible and allowed for the fact that Mr. Lewis’s disabilities would cause him to take more time with many of the tasks. Judge Kerrigan did her own “ballpark guestimate” of the weekly routine activities and arrived at 650 hours. She of course did not call it a “ballpark guestimate”, which is the kiss of death in a 469 case. The one GD thing after another of non-routine repairs and trouble with tenants easily adds another two hours a week.

The Wheels On The Easement Void The Deduction

Conservation easements seem to have generated quite a bit of tax litigation. The problem with them from a tax administration viewpoint is that there is a lot of opportunity for collusion of the two sides to the contract. The big tax savings that the donor is getting are not coming out of the hide of the receiving entity. On top of that, an easement donor mainly motivated by the deduction will not be very, if at all, concerned about whether any real conservation goals are being met.

Court Rules Churches Can Continue To Conceal Financial Information

The standards of the Evangelical Council on Financial Accountability require that member organizations provide audited financial statements on request. ECFA is concerned about the effect that financial shenanigans have on non-believers citing Paul’s letter to the Corinthians which states “For we are taking pains go do what is right, not only in the eyes of the Lord but also in the eyes of men.”

The strongest voice I have noted for church financial transparency is that of Reverend Frank Benson Jones. In his book Stop The Prosperity Preachers he argues that lack of transparency is one of the things that draws the wrong type of people into ministry. He believes that if the profits were removed, only prophets would remain.