Most Recent Posts

Real Estate In Your IRA – How Not To Do It

Mr. Dabney honestly believed that the purchase was appropriate, even going to the trouble of obtaining a scrivener’s affidavit when he discovered that the property had been titled in the wrong name. He ensured that the funds were wired directly from the Charles Schwab IRA to Chicago Title when he first purchased the Brian’s Head property and directly back into the IRA after he had sold the property. Furthermore, the property was undeveloped, and Mr. Dabney ensured that it was being held solely for investment purposes.

Although he was mistaken in his understanding of the law, it was reasonable under the circumstances for Mr. Dabney to believe that he had not received an land.

Warning to Occupy Wall Street – Rape Can Still be Part of the Penalty

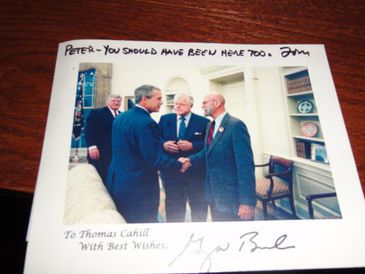

This was originally published on forbes.com on October 8 2011. It is a guest post by Tom Cahill. There are three words that I considered cutting, but left alone,...

CPA Faces Prison For Letting Client Deduct Personal Expenses

According to documents filed with the court, Couchot admitted that for tax years 2006 through 2010, he assisted in the preparation of false individual income tax returns for a group of individuals associated with the Cadillac Ranch restaurants, which caused a tax loss of over $191,000 to the IRS. On May 15, 2014, Jon Field from Dublin, Ohio, along with Eric Schilder, of Marion, Ohio, and Paul Butler, also from Dublin, pleaded guilty to tax charges related to Cadillac Ranch.

California Court Rules That Research Fee On Electric Rates Not A Tax

According to Proposition 13 passed in 1978 any tax increase has to be approved by a two-thirds vote of the Legislature. Proposition 26, passed in 2010, adjusted the meaning of “tax” to include certain fees and charges. The burden of showing that a charge is not a tax is on the state or the locality. SCE argued that EPIC is a tax. The Court noted that the distinction between a tax and a fee can be a bit blurry, but found that EPIC falls on the fee side of the blur.

Freedom From Religion Foundation On Clergy Housing Income Tax Break

Although it is a bit tangential, it is worth noting that Biblical scholars who do not hold with the “inerrancy” of the canonical books, do not believe that Jesus actually said most of the things he is reputed to have said. The “Jesus Project” took an organized approach to this controversy and had scholars vote on 1500 versions of 500 items attributed to Jesus in any extant work from the first three centuries of the Common Era. The “Render Unto Caesar” quote ranked eighth as something that it is likely Jesus actually said. Besides the three synoptic Gospels, it also shows up in the Gospel of Thomas (“Turn the other cheek” comes in first, for whatever that is worth).

Did IRS Target Israel? Suit By Pro-Israel Z Street Will Move Forward

This lawsuit much like Teapartygate confirms me in my view, that the evaluation of whether an organization’s purposes should allow it exempt status is not something that the IRS should be doing. There are credits for historic buildings, but it is not the IRS that decides whether the buildings are historic. The same principle should apply here.

Dietrich Mateschitz’s Red Bulls Will Be Paying Harrison NJ Some Real Estate Tax

The Red Bulls did have a reasonable basis for not paying. That was the deal they had made with the town’s Redeveopment Authority, which leased them the land on which they built the stadium.. They kind of slipped up though, because somebody forgot to talk to the assessor.

Ranch Heiress Shows IRS She Is Real Cowgirl

Ms. Marion is not quite as colorful as her great grandfather who founded Four Sixes. Apparently the story that the name of the ranch comes from the four of a kind hand that won Captain Samuel “Burk” Burnett his first cattle in a poker game is apocryphal, but it is such a good story that it gets repeated. The only way you could improve it is by having the cattle baron he was betting against holding aces over eights.

Massachusetts Court Considers Global Warming In Property Tax Case

You might wonder why the Town of Hawley fought this case so hard. Apparently, the woods to people ratio in Hawley is high enough that exempting a lot of forest could be a real hardship. If you take a look at the vicinity of Hawley on google maps, you will note that there is no local shortage of trees. In the last census, the town had a population of 337. The town’s website indicates that it may not be done with the struggle

Church 501(c)(3) Status Is A Good Deal – Do Not Ruin It With Corporation Sole

The court ruled that the Gunkles’ depositing of funds into the Pastoral Account as donations and assigning their income to Bruce’s corporation sole based on their vows of poverty lacked substance and were unavailing, as were their contentions that they were acting as agents of the corporation sole.