Most Recent Posts

Tax Court Denies Amway Losses – Again

My first suggestion is that if you want to have a side business to make personal expenses deductible (which is something that you should not do at all, by the way), Amway is about the worst thing to pick. People with persistent Amway losses do not do well in Tax Court. The other is that if you expect that a side activity will ultimately be profitable, you might want to consider suspending the losses under Code Section 469. Although in principle, this does not immunize you from being attacked under Section 183, as a practical matter it does since you are not getting a current benefit. You will get the benefit when the activity becomes profitable or you abandon it.

Football Dad Beats IRS In Tax Court

Weakness in the dependency exemption system that the Form 8332 was supposed to solve. The system is based on the assumption that there will be a custodial parent designated, but that is not necessarily the case. I’ve seen in practice that it can be a rather murky question.

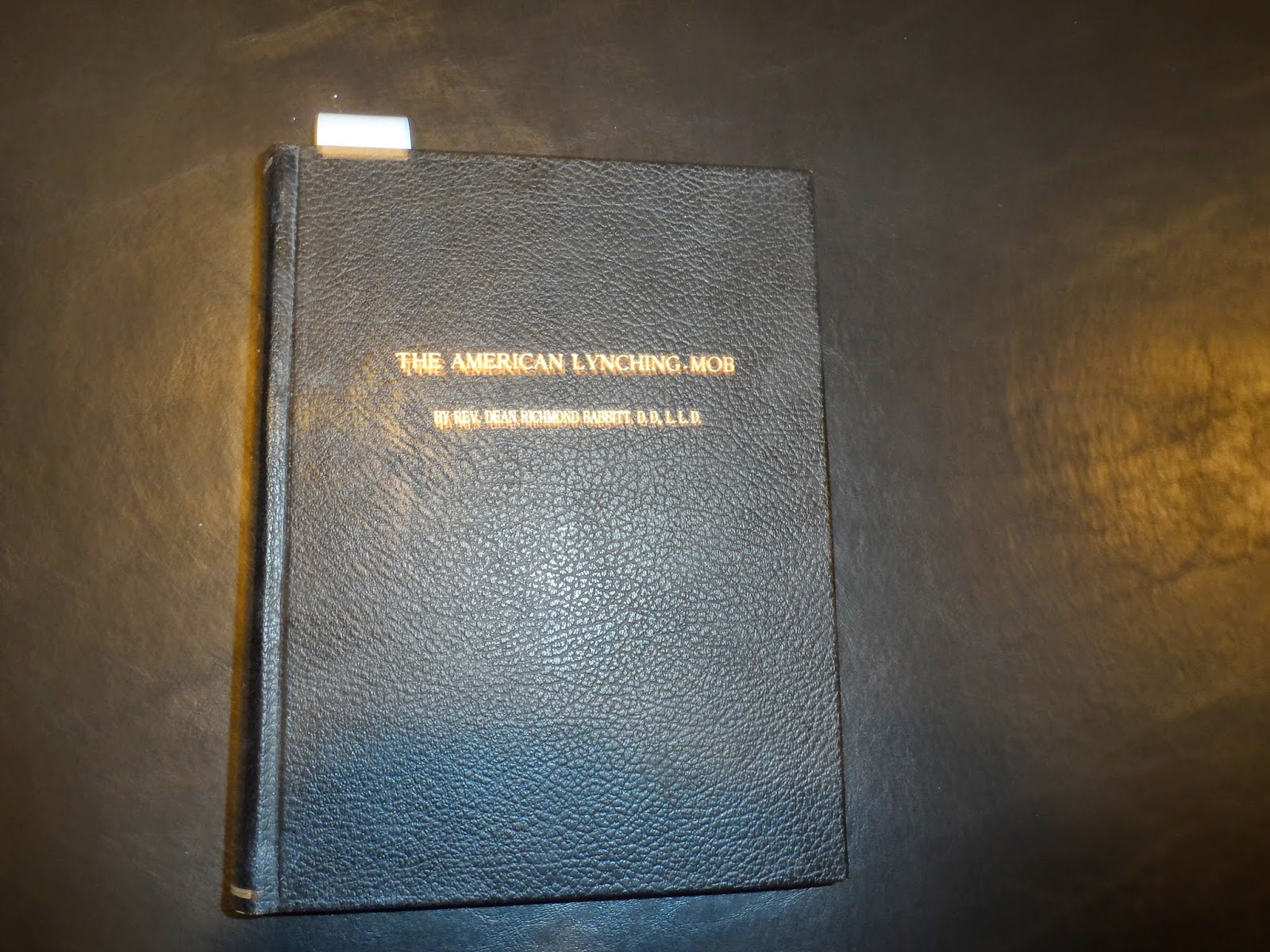

The American Lynching-Mob by Rev. Dean Richmond Babbitt, DD, LLD

The American Lynching-Mob is an unpublished typescript. It is nicely bound which I thought might have accounted for it being passed among collectors since 1906, but it...

Horse Breeder/Lawyer Wins In Tax Court. Was It Worth It?

Pretty much everything I know about the horse breeding business, I’ve learned from reading Tax Court decisions. The appeal of working with animals quite a bit bigger than I who appear to defecate quite a bit escapes me. Also, the stories in the Tax Court lead me to believe that the business consists of calamity following misfortune or as my blogging buddy, Robert Flach would put it, one GD thing after another.

Mr. Tolin’s focus in the years in question was on a stallion named Chosen Choice. Chosen Choice’s racing career had been cut short by injuries, but he had done well enough to have potential in the post-racing career of the successful stallion.

Court Approves Tax Sale Of New Mexico Property For Less Than 1% Of Its Value

It almost looks like the Valenzuelas pulled a reverse snooze/lose on the Snyders. They told the judge that the property was worth more than 100 times what the Snyders paid for it and the Snyders didn’t object in the proper manner, so the Court gave the Valenzuelas summary judgment. But not so fast, says the appeal court.

Sawyer Taxi Heirs Midcoast Fortrend Deal – Could Have Been Worse

In the end, the Sawyer Trust is not responsible for the entire corporate tax that Fortrend dodged, but it does have to give back the premium it received over the net asset value of the companies it sold (Cash on hand less correct corporate tax). The IRS had wanted to get nearly $20 million in corporate tax from the Trust. The decision limits the recovery to $13.5 million, before interest and penalties. It is still quite painful when you consider that an S election in 1987 would have legitimately avoided the entire problem.

IRS Chief Counsel Has To Decide If Nail Polish Is A Luxury

Taxpayer’s contributions of wrinkle creams, hair gels, perfumes, hair sprays, hair texturizers, curling irons, hair dyes, nail polishes, epilators, and hair restoration treatments (the “Donated Products”), are not “qualified contributions” that are eligible for the enhanced deduction under I.R.C. § 170(e)(3), because they are not needed for the care of the ill, the needy, or infants under I.R.C. § 170(e)(3)(A)(i) and Treas. Reg. § 1.170A-4A(b)(ii).

Bill Cassidy Providing Emergency Assistance To Wealthy Televangelists

On its face, providing a special tax benefit to “ministers of the gospel” seems blatantly unconstitutional, since it would only apply to Christians. The IRS early interpreted the statute more broadly to include many who would not otherwise want to be considered “ministers of the gospel” – rabbis and cantors for example. Hence the preservation of the clergy tax benefit has broad ecumenical support with, for example, Southern Baptists joining with the Russian Orthodox and Krishna Consciousness and Islamic organizations to file an amicus brief supporting the government’s appeal of Judge Crabb’s decision.

Kansas Hungry For $40 Million Tax Slice Of Pizza Hut Franchisee’s Profits

This is where it gets a little lawyerly. Mr. Bicknell’s attorneys want to argue that the regulations should not apply in his case since they were issued after he moved. They have other problems with the regulations such as unconstitutional vagueness. DOR argues that they are relevant since the bulk of the assessment relates to 2006. The Court of Appeals ruled that the challenge to the regulations is premature.

Tax Court Views Ballpark Guesstimates As Fields Of Dreams

If you are involved in a money-losing side activity (or money-making if your income is over the NII threshold), try to keep contemporaneous records of the time you spend. Ideally, you should cross-reference the time log with invoices and e-mail print-outs, and vendor invoices. Of course, if your goal is to be featured in one of my blog posts, it might not happen, since there is a decent chance that you win at appeals. Whatever you do, never refer to whatever reconstruction you come up with as a “ballpark guesstimate”. That will cause you to strike out.