Most Recent Posts

Strong Language In Partnership Agreement Might Help With Expense Deductions

The other lesson is more subtle. It would be a good idea for professional partnerships to look closely at the expense language in their agreements. Particularly in partnerships with “Eat what you kill” compensation structures, the agreement should be very clear that partners might be expected to spend money on all sorts of things that might not be reimbursed.

Non-Custodial Parents Out Of Luck When Form 8332 Withheld

If the custodial parent is withholding a signed Form 8332 that you are entitled to, there are a couple of approaches. Filing your return without the required form is not one that I would recommend. My own view which may be of limited applicability is to just forget about it and don’t claim the exemption. This is clearly the best course if both you and your ex are going to end up leaving money to the same kids.

Clergy Out In Force To Defend Their Housing Tax Break

Professor Edward Zelinsky of Yeshiva University. Professor Zelinsky has written that Section 107(2) is constitutionally permissible although not necessarily good tax policy.

Professor Zelinsky has commented that when taxation meets religion, you are always going to have a problem either from the tax authorities looking into the religious organization or from them policing the boundary of the exemption. I am really grateful to Professor Zelinsky for clarifying that.

No Money For April 15 1040 Balance Due? Don’t Panic!

You can request an extension of time to file even though you don’t have the money to send in with it. This gets you out of the late file penalty, although it does not help with interest. The other advantage of going on extension is that it will be six months longer before your payment plan commences.

Easement Valuations Not So Easy Anymore

One development is the recent Tax Court decision in the case of Gordon and Lorna Kaufman. The Kaufman’s easement deduction had been disallowed on technical ground in an earlier Tax Court decision, but the First Circuit overturned that decision. I covered the First Circuit decision here. So the Tax Court got the case back in order to decide what the value of the easement was.

The problem with valuing the easement was that the property was already subject to a lot of restrictions due to its location in Boston’s South End Landmark District. Giving up your rights to change the façade of a building in such a neighborhood can be a bit like me renouncing my superpowers. That ended up being the Tax Court’s conclusion on valuation. The court went along with the IRS expert’s criticism of the taxpayer’s appraiser

Bitcoins Not Tax Fairy Dust – Second Life Still A Tax Haven?

There are sixteen questions. Nine of the questions (Questions 3,8,9,10,11,12,13,14,15) are there to drive home the point that when you are paying or receiving virtual currency, you have the same obligations and tax consequences as if you would if you were paying or receiving dollars.

No Margin For Error When Using IRA Rollover As Bridge Loan

Although petitioners argue that their intent was to effect a rollover, it is well established that a taxpayer’s intention to take advantage of favorable tax laws does not determine the tax consequences of his or her transactions.

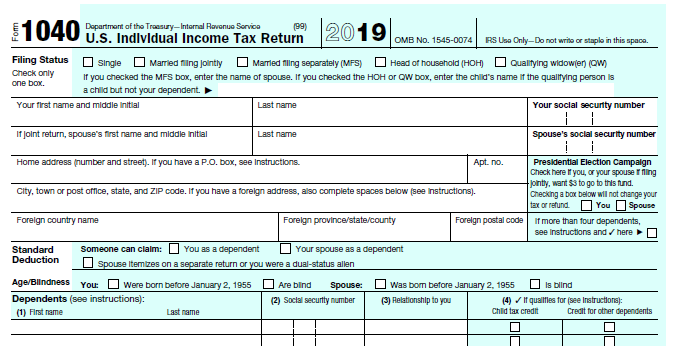

Do Some Looking And Thinking Before Signing Form 1040

Of course, your CPA, with whom you play golf, will assure you, as you are sipping single malt scotch together, that his people are all over the latest developments. The sad truth is that that fellow’s primary job is play golf with you and make you feel good about his firm.

Building Repair Deductions – Thirty Per Cent Of What?

There may be more categories in the future. You need to determine whether a particular expenditure is a “big deal” within each of those categories. What is interesting is that the assessment is not made based on dollars, but rather on physical reality. The regulations appear to allow some very large expenditures that somebody just looking at invoices would capitalize.

Hedge Fund, TEFRA And Community Property Give Woman Tax Nightmare

I have a general against the grain belief that joint returns are a bad idea (or at least not that good an idea) for couples who are in the process of splitting. It is possible that I might modify that a bit for people in community property states. They end up getting stuck with a split of much of the property. Apparently, but for the ill-considered amended partnership return, the whole matter would have slid by, but the Tax Court’s ruling is that Ann was supposed to pick up that income even though she was not a partner.