Most Recent Posts

Was CPA Tax Evader On The Lam Or Hiding In Plain Sight?

Apparently, there were rumors and unconfirmed reports that he was in the Caribbean at the time of his indictment. Does someone roaming around the Caribbean doing the romantic stuff they do down there, end up with a yearning to return to Ohio and resume working in public accounting and selling insurance? Seems like the stuff of an inspirational family drama or perhaps a sitcom.

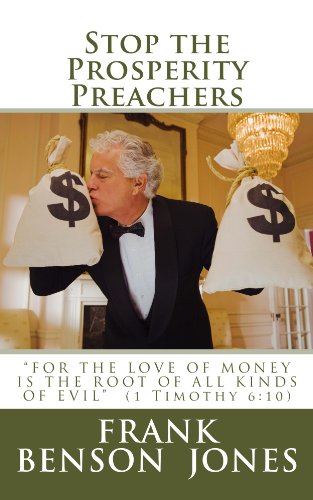

Pilot To Black Panther To Pastor Calls For Financial Transparency In Churches

Pastor Jones wants churches to file 990s for a different reason. He believes that publishing the salaries and housing allowances of Prosperity Preachers, who often ordain family members, would wake people up to the abuses of those ministries. His main reason is for the good of the churches, something that FFRF is, at best, indifferent about.

Benefit Of Clergy – Why Special Tax Treatment For Ministers Needs To Go

What we really need is the Clergy Tax Reform Act Of 2014. The Act would repeal Code Section 107 in its entirety and the provisions in the withholding, social security, and self-employment sections dealing with ministers. Essentially, clergy would be treated like everybody else. According to Reverend William Thornton, many moderately compensated clergy would feel fine about this solution.

Alaska Denies Permanent Fund Dividend To Career Marine

LtCol Ross’s case follows right behind that of Richard Heller who missed out on his initial permanent fund dividend because of an extra-long tour in Iraq with the 172nd Infantry Brigade – the Arctic Wolves.

Tax Court Cuts No Slack On Strip Joint Fraud Penalty

There are a lot of concerns about the whole “gentlemen’s club” phenomenon. The greatest one is probably the exploitation of the “dancers”. This can be facilitated by the fiction that they are independent contractors. I doubt that there are any statistics on the level of dancer tax compliance, although you can find groups like We Are Dancers, which encourage tax compliance.

The Dog That Did Not Bark – IRS Issues Adverse 501(c)(4) Rulings To Deafening Silence

An interesting question about the whole scandal narrative is how it would look if it turned out that many of the groups that the IRS “targeted” were in fact inappropriately claiming 501(c)(4) status. Tea Party Patriots Inc, for example, spends a lot of energy talking about how all those intrusive questions were harassment, but what if it turns that, in fact, all those phone calls that TPP Inc made telling people that November 2012 was the last chance to stop Obamacare from turning the country into a cradle to grave welfare state could be viewed as political?

Flap About NFL Tax Exemption Seems Silly

Years ending March 31, 2012, and March 31, 2011. There are losses in both years – $77,628,857 and $52,195,047 respectively. Those years are not anomalous. The National Football League has liabilities in excess of assets of $316,642,454 Superficially, it would appear that the 32 member teams of the NFL have increased their aggregate cumulative tax liability by over $100,000,000 due to the method of organization that they have chosen.

KPMG Tax Partner Denied Mulligan On Sketchy Tax Shelter

The IRS served two summonses on KPMG on March 19, 2002 for its role in promoting SOS transactions. In March 2004, shortly after KPMG gave the IRS a list of SOS participants including the Bergmanns, they filed an amended return for 2001 removing all the previously-claimed losses and reporting and paying an additional $205,979 in taxes. At no point did the Bergmanns concede that the losses were improperly reported or foreclose themselves from taking another position on a later amended return

Obama Administration Weak On Church State Separation? Clergy Housing Allowance Appeal

The interesting question is whether President Obama thinks that 107(2) is constitutional. In the case of DOMA, he ordered the Justice Department to stop defending a statute that they determined was unconstitutional. Green Party Presidential candidate Jill Stein indicated that she likely would have ordered the Justice Department to not defend the housing allowance.

Is Tax Court Rebelling Against Supreme Court?

The “not liable” argument appears to have a very powerful hold on the imagination of alternative tax theorists. You kind of almost have to admire someone like Mr. Thomas who racks up the sanctions making it. It might actually not be such a bad thing if the Supremes would take a couple of these cases and clear the air with a couple of 9-0 decisions. In the meantime, even if you are convinced of the validity of these arguments you should recognize that there is no point in raising them with the IRS or in the Tax Court.