Most Recent Posts

Is Tax Court Rebelling Against Supreme Court?

The “not liable” argument appears to have a very powerful hold on the imagination of alternative tax theorists. You kind of almost have to admire someone like Mr. Thomas who racks up the sanctions making it. It might actually not be such a bad thing if the Supremes would take a couple of these cases and clear the air with a couple of 9-0 decisions. In the meantime, even if you are convinced of the validity of these arguments you should recognize that there is no point in raising them with the IRS or in the Tax Court.

Is Kent Hovind A Tax Protester?

What is really intriguing about the movement is that it seems to be immune from acknowledging its losses. When a former friend got caught up in the movement, I spent a lot of time looking into his various arguments. Before the courts lost their patience with arguments they considered frivolous, there were rulings on issues such as wages being income and the sixteenth amendment having actually passed. Those rulings made no impression. The answer is that “The courts are corrupt”.

Soldier To Tax Accountant – Rachel Millios EA

The legal aide job was Rachel’s introduction to tax work. The base legal group coordinated the IRS VITA program at Fort Campbell, which provided free tax returns to service members and military retirees. Rachel had completed her bachelor’s degree on-line while in the Army and used GI Bill benefits to get an MBA. After leaving the Army, she worked for the USO for a while, but then started working remotely for a virtual firm that prepares tax returns for expatriates. She took the IRS exam and earned the enrolled agent (EA) designation.

Applying Teapartygate Logic To Bridgegate

Reading every Tax Court decision and federal appellate decision concerning taxes along with a certain level of street knowledge inclines me to think that we are fast approaching that state at least with regard to people who have hopeless credit ratings and no money in the bank. Maybe the people who think we should have a much smaller government with much more restricted functions are right.

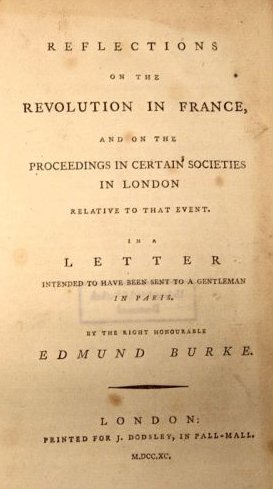

From Pawn Stars To Bridgegate – After Over Two Centuries The Burke Paine Debate Still Echoes

Our own political spectrum from far-right to far-left is something of a tangled skein of Burke’s communitarian conservatism and Paine’s largely, but not entirely libertarian, generational clean slate

Fort Lee Is More Than A Speed Bump On Governor Christie’s Presidential Road

The book that really inflamed Northern anti-slavery consciousness was Uncle Tom’s Cabin by Harriet Beecher Stowe. Stowe based her work on the non-fiction American Slavery As It Is. That work was assembled from primary sources including newspapers from across the South, by Theodore Weld, his wife Angelina Grimke, and her sister Sarah Grimke. They were living in Fort Lee, NJ at the time. Here is a simulated interview with Angelina Grimke.

Post Divorce Tax Intimacy Can Be Riskier Than Post Divorce Sex

Tax Court decisions to illustrate the hazards of post-marital tax entanglement are numerous, but the most recent is something of a standout. I should mention at the outset that the Tax Court believed the version of events laid out by Anthony W Roberts. His ex-spouse had a different version, which the Tax Court did not believe

Are IRS Property Seizures The Stuff Of Reality TV?

he idea that the vested guys and gals packing heat never say anything might create an interesting element. I can imagine cameo appearances by the Pawn Stars guys and some of the Storage Wars people to comment on the value of the goods being seized.

Pritzker Trust Dodges Illinois State Income Tax

By statute, the residence of the grantor at the time the trust became irrevocable subjects the trust to Illinois income tax. That was enough for the Sangamon County circuit court that had ruled in favor of the Revenue Department. In the appeal, the trustee argued that Illinois taxing the trust was unconstitutional since the trust no longer had any connection to Illinois.

How To Ranch Like Tom Cruise On A Lower Budget

The argument about whether the residences were integral to the operation of the ranch was all about what the residents were doing since apparently nobody was keeping a horse or a tractor in their garage. The discussion reminded me a lot of the type of discussion you will see in passive activity and hobby loss cases. Storm Mountain’s argument was, in part, that since the agricultural operation was not leased out, but rather run by the Homeowners Association, each of the homeowners, by virtue of membership and dues-paying was participating in agricultural operations.