Most Recent Posts

Mobile Workforce Act Good Idea But May Need More Limits

I tried to imagine what it was like for somebody who was more peripatetic than I. It made me a little less of envious of the people with mysterious functions who did not have to worry about client service and billing and collection who wandered the nation inspiring us to apply the leverage model and fill in the white space.

It also made me happy that most of my away-from-home work was in Central Florida, where you have a right to carry and stand your ground and no stinking state income tax. I don’t carry and I am sure that I would run like hell, but one more state income tax return might have pushed CV past the tipping point.

SPLC Calls Family Research Council Hate Group – Should IRS Take Action?

The other very broad issue is whether the organization is meeting the definition that makes it exempt. Is it really educational? Is it engaging in politics? Is it really a church? You could probably come up with a worse way than having an accountant heavy organization making those determinations, but it might take you a while.

It’s not just because an accounting degree is a terrible education for that purpose. It’s also a cultural problem. If you task a group of accountants with collecting $2.5 trillion dollars, do you really expect them to take soft stuff that has only a remote potential for bringing in more money very seriously?

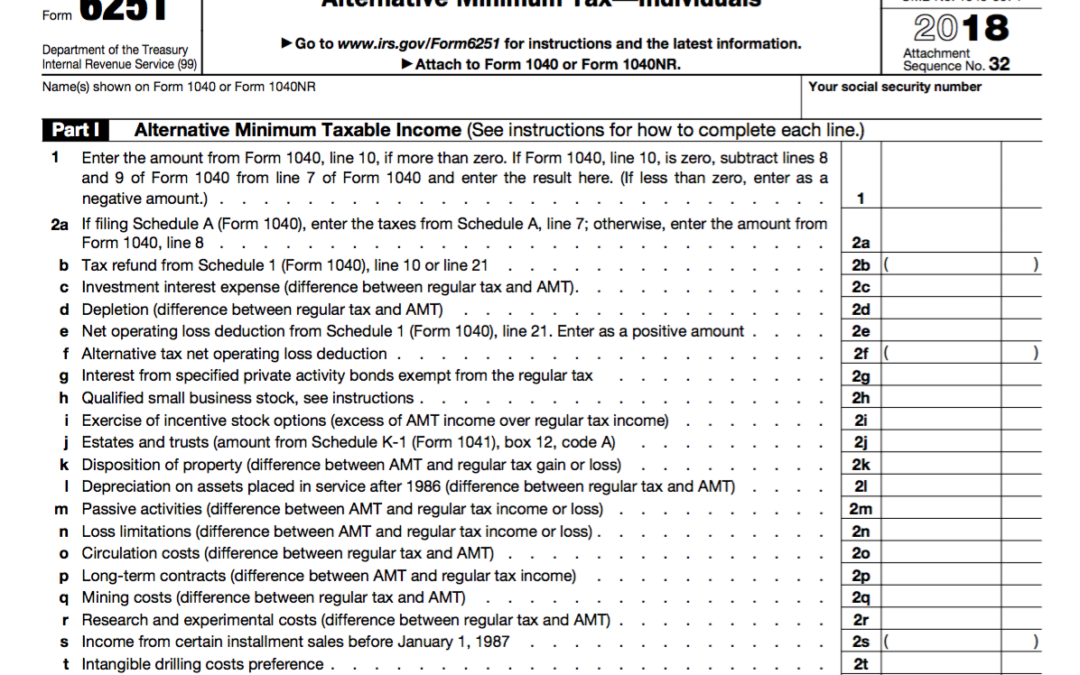

When Planning Never Forget The Alternative Minimum Tax

Surely you have been keeping track of your AMT basis in your S corporation stock.

Oh. You rely on your accountant for things like that. Well, I have to tell you. Your reliance is misplaced. If you have had the same accounting firm for all the years that you owned the S corporation and they used a good software package like Pro fx continuously for all those years, there is a chance that the number is available. If you switched preparers several times and they switched software, the chance that you have a good AMT basis number is pretty remote.

President Obama Will Be Missed At Gettysburg Address Commemoration

It is too bad that President Obama cannot make the ceremony, but just by being our President on that day, he is doing his part to commemorate the promise.

Actuary In Tax Court Beats Northwestern And IRS On Accuracy Of 1099-R

Contrary to respondent’s position, petitioner raised a reasonable dispute regarding the accuracy of the Form 1099-R. Although petitioner points to relatively minor discrepancies in NML’s records, we agree with petitioner that the discrepancies are of such a nature that their cumulative effect, compounded over the extended terms of the policies in question, would likely be significant and could very well alter the dates that the insurance policies lapsed.

We're With The Band – Kind Of

think trying to get a current deduction for backing their daughter’s music management career was probably a bridge too far. I would have gone for a more conservative approach that would have likely stood up and assured an ultimate ordinary deduction. Have the band, itself, organize as an LLC with Sara as one of the managing members. Give the Schlieverts a preferred interest with losses allocated based on positive capital accounts. There would be no Section 183 issue then. The passive activity rules would defer any deductions, but that is a lot better than having them entirely blown away.

Organizing Junk Mail Does Not Qualify As Manufacturing

In a modern interconnected economy, distinguishing between “manufacturing” and other activities is silly.

The law’s unwise distinction between “production” activities and other activities encourages taxpayers to try to qualify, and forces the courts to try to draw distinctions.

JD Salinger – Was January 27 2010 A Good Day To Die

Even more fantastic, was there a contingency plan in place in the event that death occurred late in December ? How hard would it be to post-date a death certificate under those circumstances ? It makes a good “ripped from the headlines” plot for Law and Order, but the income tax advantages of the step-up in basis are so sweet that it would actually be stupid estate planning.

Was JD Salinger Facing A Major Estate Tax Problem ?

The part of the litigation that would be really interesting to the Agent From Hell is this affidavit by Phyllis Westberg. She opines that a sequel to Catcher in the Rye written by Salinger would command an advance of at least $5,000,000. It would seem that the “complete history of the Caulfield family” would qualify as at least equivalent to a sequel. Throw that in with what may turn out to be the greatest World War II novels ever and some other stuff and AFH will be arguing that there must be something like $50,000,000 worth of manuscripts in that safe.

Study Shows Taxpayers With Balance Due More Likely To Cheat

Doctor Rees-Jones finds, however, that there is significant bunching near zero balance due and that bunching is more pronounced the higher the income. I suppose that you could attribute that to just being accurate in estimated payments. There is more.

The bunching at close to zero balance due is associated with what the Professor calls “income shocks”, the type of income events that are harder to predict