Most Recent Posts

IRS Eases Up On War Tax Resisters

If a taxpayer submits a document with a frivolous argument to the IRS, a penalty under section 6702(a) will apply only if the taxpayer files a purported tax return that either does not contain information on which the substantial correctness of the self-assessment may be judged or contains information that on its face indicates that the self-assessment is substantially incorrect. I.R.C. §6702(a)(1).

Pot Growers Exempt Application Goes Up In Smoke

Your activities violate this general principle. Your primary activity, facilitating and organizing transactions between members who cultivate and possess cannabis, is illegal under Federal law. You enter into agreements that give you title to the cannabis grown by your members. Once you obtain title, you process, sell, and otherwise dispose of it as you decide. Federal law does not recognize any health benefits of cannabis and classifies it as a controlled substance.

IRS Kills Tax Exemption Of Foundation Pushing Eternal Life

The IRS also raised concerns about the independence of the foundation’s grant-making. The Foundation had no written grant application form and no published criteria for grant selection, the IRS complained. Moreover, Saul Kent, the founder of the Foundation and major shareholder of the Buyer’s Club, serves on the boards of companies that have received annual grants from the Foundation. As this old Los Angeles Times article reports, Kent is a longtime advocate of cryonics who received national attention in the late 1980s when he had his late mother’s head surgically removed for freezing.

Government Lawyers Advocate For Atheism As A Religion

Someone make the case that Joe Sixpack has to pay taxes on his income and doesn’t get any exclusion for his singlewide complete with a deck and a mangy dog sleeping under it, while Kenneth and Gloria Copeland live in an 18,280 square-foot lakefront parsonage on 25 acres valued at $6.2 million and exclude hundreds of thousands of dollars from income taxes under the housing allowance

Charity Begins At Home But Cannot End There

To be attached to the subdivision, to love the little platoon we belong to in society, is the first principle (the germ as it were) of public affections. It is the first link in the series by which we proceed towards a love to our country, and to mankind.

Misinformation Causes Loss Of Senior Property Tax Rebate

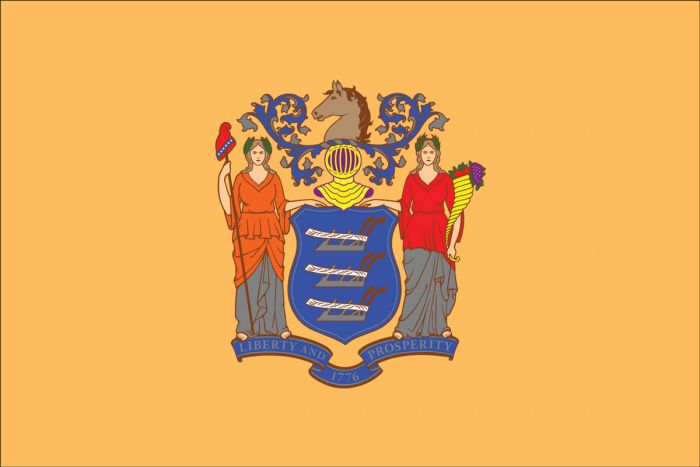

So if you have paid New Jersey’s high property taxes for ten years you are entitled to some consideration in being able to spend your retirement years in the Garden State and not be forced into joining the Sun City cult.

S Election For Cash Basis C Corporation Fraught With Peril

Document the obligation of the company to pay out bonuses based on accrual income, make entries to reflect the obligation and pay them within two and a half months. Make the payments even if you may have to loan money back for working capital and, of course, be rigorous about executing notes if that is required.

Doctor Dino – Kent Hovind May Lose In Court But Will Never Give Up

Kent Hovind is known as Doctor Dino. One of the implications of YEC is that people and dinosaurs must have been running around at the same time. That is why Kent Hovind opened Dinosaur Adventureland allowing for a combination of family fun, Biblical truth and sound science education (from a YEC viewpoint)

Military Retirement Pay Veterans Benefits And Divorce Make For Tax Confusion

At the end of the day, this case is about how the benefit of converting from military retirement pay to veterans benefits should be divided. If the case had gone the other way, half the benefit would have gone to the ex-spouse. The simple guiding principles should be that when in doubt you go with the disabled veteran, but, of course, those judges can’t just come out and say that. As a practical matter, divorce agreements allocating military retirement payment should probably explicitly address what happens if the pay is reduced due to veterans benefits.

Windsor As A Precedent – Much More Than Taxes

Essentially what they are saying is that they don’t have a dog in this fight. They wanted to turn the money over to the Court and let the prospective beneficiaries argue about it. Cozen O’Connor knows it has to be pay somebody, but wants the Court to say whom. Since the Cozen O’Connor plan explicitly incorporated ERISA language in its plan document, the constitutionality of DOMA was critical to the decision.