Most Recent Posts

Conservation Easement No Deduction For Hypothetical Vineyard

Mr. Mountanos had three experts testify about the valuation. The IRS did not even bother to have their own expert. They just cross-examined the taxpayer experts. The IRS has a presumption working in its favor that the highest and best use is the current use. If the highest and best use is the current use, a conservation easement is worthless. Mr. Mountanos had experts who indicated that 287 or the ranch’s 882 acres could be converted into a vineyard. The balance could be subdivided into 22 residential parcels – hypothetically speaking.

Other than that, Mrs. Lincoln, how did you enjoy the play? The ranch is totally surrounded by federal land. There is an access easement, but it is restricted to single-family use and there is no indication that the Bureau of Land Management would alter the easement. Then there was the matter of water rights. Apparently it takes water to grow grapes. Who knew? Then there was the small matter of whether there would be any demand for a vineyard if the logistical obstacles were overcome.

Jerome James Taxed As California Resident While Playing For SuperSonics

A couple of kids and a house makes for a domicile, so California had him. The question then becomes how long California gets to keep him. There is a serious problem for Mr. James at this point. Once California has him as a domiciliary, the burden of proof shifts to him to prove that he has established domicile someplace else.

A Bit Of Ancient History Dead Sea Scrolls In Tax Court

I think I find this story irresistible because of the way it mixes the mundane and the fantastic. The Dead Sea Scrolls shared an address with what was locally known as the “toilet museum”. The image of somebody packing the Dead Sea Scrolls in a car and driving from Worcester to Manhattan to pick up a check just seems way too ordinary. Seems like there should be a couple of Mossad agents or somebody from Opus Dei involved.

John Bierwirth’s Grumman Takeover Defense Led To Pension Litigation

You have to wonder whether, in the heat of fending off a takeover attempt, it even crossed the mind of Mr. Bierwirth and the other trustees that using the pension assets for that purpose was even ethically dubious, much less something that opened them to personal liability. I remember that around that time, our firm was still doing Form 5500 for client pension funds.

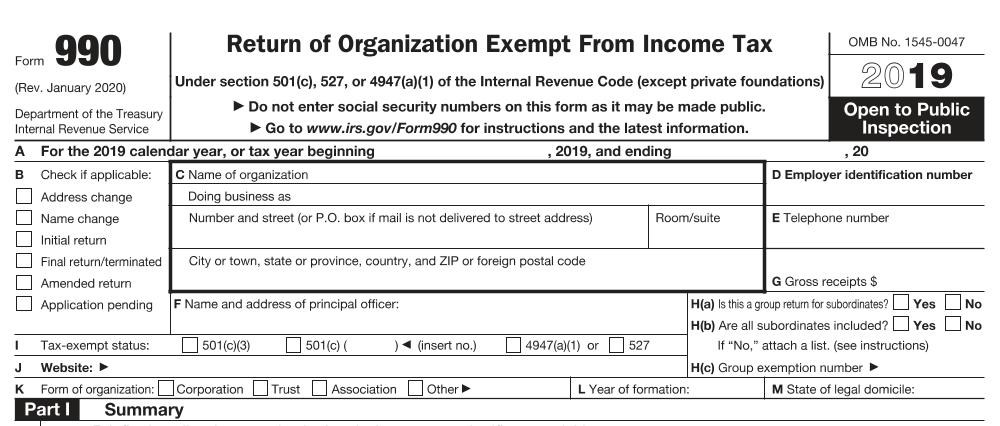

NFL As Tax Exempt Less Than Meets The Eye?

Essentially 501(c)(6) organizations are not charities, because their members are trying to make money. The members, though, are trying to make money for themselves. They don’t really have an interest in having the 501(c)(6) make money. That is why it is not-for profit even though it is not a charity.

In Defense Of Special Tax Breaks

Affordable housing is another one of those things that we can’t totally rely on the free market to provide, particularly since the 1% are less attached to the free market when it comes to zoning in the neighborhoods where they live.

Tax Reform – Should Partnerships And S Corporations Follow The Same Rules ?

The biggest difference between S corporations and partnerships is probably the fact that owners have basis in their share of the partnership’s liabilities

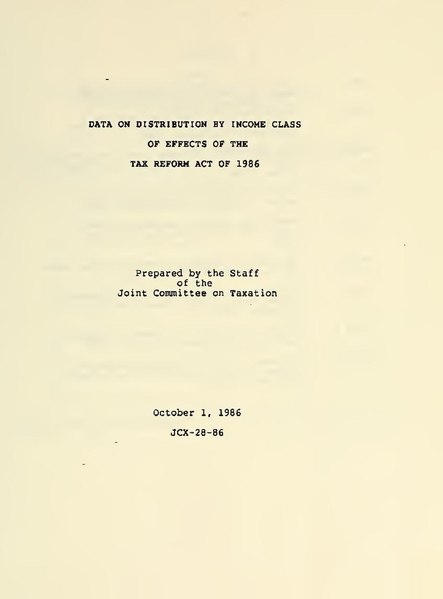

Current Tax Reform Push Less Promising Than 1986

The primary theme is “Hooray for tax simplification, but not in my back yard”. There was one exception that I noted, 3M Company would throw the R&D credit and accelerated depreciation under the bus in exchange for lower rates. Of course, after we get the Internal Revenue Code of 2014 enacted, they might be back in 2016 explaining how much better things were when we had an R&D credit.

White House Agrees DOMA Should Be Repealed But Dianne Feinstein Not A Traitor

While many countries mandate the use of the metric system by law, the U.S. Congress has repeatedly passed laws that encourage voluntary adoption of the metric system. We use a mixture of metric and customary units depending on the context. We also have a long tradition of voluntary standards and our bilingual system of measurement is part of that tradition.

Creation Science Hall Of Fame Granted 501(c)(3) Status

The Creation Science Hall of Fame inducted Kent Hovind a few months ago. The discussion of Dr. Hovind’s legal struggles in his CSHOF bio, if you will excuse the expression, evolved over time. At one point there was a fairly elaborate characterization of him as a tax protester, but Hovind himself denies that he is a protester. So ultimately discussion of Dr. Hovind’s tax problems in his CSHOF bio became extinct.