Most Recent Posts

Ohio Businesses Should Brace For Use Tax Tsunami

The Ohio use tax has only been on the books since 1936. It takes a while for the word to get out. So when the state decided to get serious about collecting use tax from the over 300,000 businesses that look like they should be paying it, they started with an amnesty program, which ended yesterday – May 1, 2013

Tough IRS Position Means More Trusts Will Get Hit With New ObamaCare 3.8% Tax

The companies involved in the ruling were making money, but the passive activity rules were relevant because of an AMT gotcha, that references the passive activity loss rules. In computing alternative minimum taxable income, research and development costs have to be capitalized and amortized over ten years if you are not materially participating in the activities.

Fifth Avenue Inspirational Shopping Not Doing Business

Although it was not mentioned in the ruling, it would probably be a really bad idea for New York to assert that activities like that would create corporate nexus. It would put a serious dent in convention business if sending your people to a trade show would create nexus. Trying to tax corporations because they send people to your state to look at what they might want to buy there would be really dumb. Dumber than New York turned out to be:

To Attack Abortion, Kansas Mucks Up Its Tax Code

One of my great wishes is that taxation should be declared the Switzerland of the culture war. Setting tax policy to raise the right amount of revenue without distorting the economy is challenging enough without bringing other issues into it. Also, it is more or less likely that you will do more harm to your cause than good by attacking the other side with tax provisions. It seems though that fighting the culture war with tax provisions is an irresistible impulse. Kansas has just succumbed.

How 38 Studios LLC Turned A CPA Into A Warrior

The 38 Studio MMO was going to be so much better than WOW because it would have all these features a passionate gamer, who was excellent at his own profession, would want. Sadly, it would never float.

How To Shatter The Public Accounting Glass Ceiling ?

Why haven’t 100 or 200 women senior managers, directors, principals and income partners with 10 to 20 years experience not just walked out and started a firm ? It would be a power house and the culture it created would transform the industry.

Do Land Patents Trump Property Taxes ?

The real point is NOT that courts are deciding en masse in favor of people seeking to have their property taken off the tax rolls, but that our courts are deeply corrupt and are ignoring the lawful principle of stare decisis by IGNORING U.S. Supreme Court decisions consistently upholding the power of the land patent in decisions that ruled in favor of those claiming the “forever” benefit of the land patent.

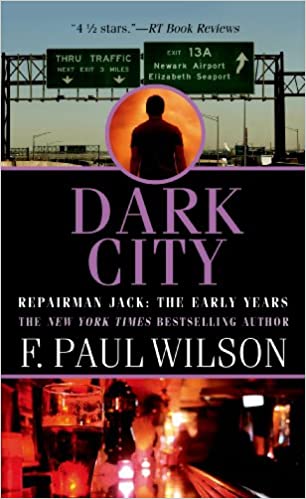

Could Repairman Jack Come In From The Cold ?

Jack would go to a country in which there had been extreme strife and much destruction of records. He would come to the United States as a refugee. Citizenship would be a piece of cake, since he would marry Gia, which was the point of the exercise. It would be too much of a spoiler to get into what happened, but I thought the plan had quite a bit of merit and might well have worked. Something to think about if you have been living off the grid and have a lover who would like you to legalize things. Maybe if you don’t have as much baggage as Jack, you might want to try the hard-core hippy parent story first.

IRS Not Screening Informant Reports Well

You may think that the IRS will never see through your brilliant deception, but that will be of no help if your disgruntled ex-employee, ex-spouse or ex-covivant knows all the details and is motivated by public spiritedness or spiteful malevolence to rat you out.

Tax Court Tells Man He Is A Mensch But Alimony Deduction Denied

Letters which do not show a meeting of the minds between the parties cannot collectively constitute a written separation agreement.

Any amounts paid in excess of that required by a written instrument are not considered deductible alimony payments.