Most Recent Posts

Will E-cigarettes Become A Taxing Experience ?

There is a push to tax e-cigarettes like regular cigarettes. The latest threat was in Utah. The debate centers around how good or bad these things are for people, but there may be another factor at work, which is a problem created by sin taxes. The taxes may first be pitched to discourage the bad behavior, but the taxes are a revenue source. If they successfully redirect behavior, revenue declines. Consider this story from Sacramento about the fiscal havoc wreaked by people becoming more scrupulous about obeying the parking laws. There you are talking about fines rather than taxes, but the distinction is often pretty thin.

International Flight Attendant Does Not Score As Well As Sergio Garcia In Tax Court

The term “foreign country” when used in a geographical sense includes any territory under the sovereignty of a government other than that of the United States. It includes the territorial waters of the foreign country (determined in accordance with the laws of the United States), the air space over the foreign country, and the seabed and subsoil of those submarine areas which are adjacent to the territorial waters of the foreign country and over which the foreign country has exclusive rights, in accordance with international law, with respect to the exploration and exploitation of natural resources.

Only Modest Valuation Discounts Allowed On Estate Artwork

The Court hypothesized that hypothetical buyers might have considered that the Elkins would get sick of the amount of schlepping that was involved in the co-tenancy arrangement and that the Elkins would be motivated to buy them out and could afford to do so. With that theory, the Tax Court allowed a 10% discount.

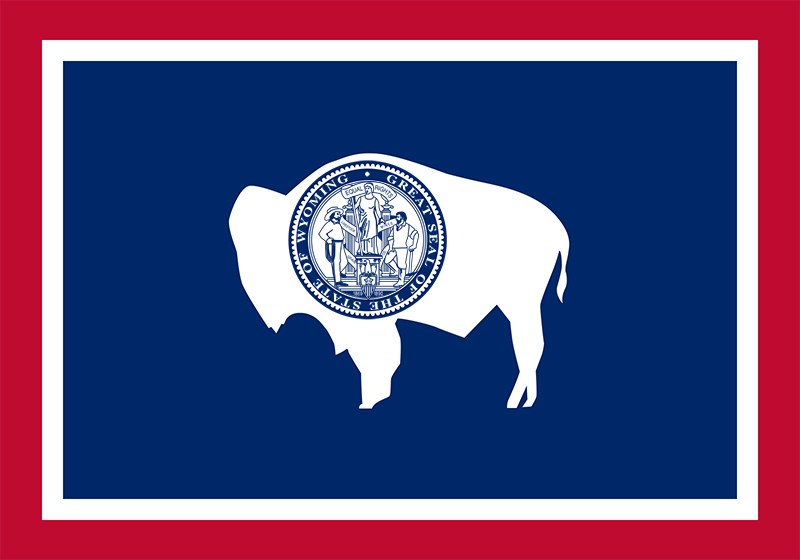

Wyoming Beats The On-line Companies On Room Tax

The decision is pretty lengthy. It is a good read, if you are interested in keeping score on this issue. The decision notes how the on-line companies have fared against Birmingham and Bowling Green and numerous other places large and small. Apparently there is not a broad overreaching federal principle at stake here or at least none that the companies have been able to make stick.

Written Business Plan Is Crucial In Horse Tax Court Case

Petitioner failed to provide a business plan that included more than just generalized goals. …. Petitioner likewise failed to maintain a budget or to make any financial projections, economic forecast, or other analyses demonstrating financial management or planning.

New Yorkers Work For A Sober Saint Patrick’s Day While Maine Enables

In one year, Sober St. Patrick’s Day® has established itself as a family friendly option for celebrating St. Patrick’s Day. Over the years, the holiday has become associated with binge drinking and public intoxication, which reinforces the stereotype of the “Drunken Irish.” This negative image alienates large segments of the community: families with young children, teens, senior citizens, members of the recovery community and many others who have stopped celebrating the day due to concerns about out-of-control behavior.

No Fans Of Sister Wives At The IRS ?

These beliefs and practices include polygamy or plurality of wives. You stated that you “…have a religious belief known as ‘Celestial Marriage’ which includes a plurality of wives.” You describe “Celestial Marriage” as a private religious relationship between consenting parties of legal age which is not recognized as a marriage by state authorities.

Carried Interest Debate Heats Up Without Much Light

If, however, the Administration really thinks venture capitalists and the like should not be getting capital gains treatment, there may be a fix that does not require another three thousand words in the Code and the cooperation of Congress. Just have the IRS rule that operating investment pools as partnerships so that managers can receive their compensation in the form of a share of the partnership’s capital gain is not consistent with the intent of Subchapter K. Those arrangements could be operated as co-ownerships that pay a management company incentive compensation.

Render Unto Caesar – Mormon Tithe Not A Necessary Expense In IRS Collection Case

Laws of general applicability that require persons to meet certain general requirements of citizenship, such as paying taxes, cannot be avoided by the fact that they indirectly make it more difficult to fulfill a purely religious duty, such as a member tithing a certain amount to his church or making a pilgrimage to a shrine in a foreign country.

Ellen DeGeneres Speaks Out For Spanish-American War Widowers

You would think with all the talk about the 1,138 rights there would be a list somewhere. Well, if I was more of a geek, I would make one for you. What you have to do is take this report from 1997 and update it with this report from 2004, which lists things that were either repealed or added.