Most Recent Posts

Maryland Exempts Residence For Mormon Temple Workers As "Convent"

The ordinance workers qualify as a “community of people who live together.” Although the workers inhabit separate units within the apartment complex, they live together at one location, socialize, and worship together as a group every Sunday. In addition, the ordinance workers “follow strict religious vows” and are removed from their positions working in the Temple if they forsake them.

Is Art Advisory Panel Giving Taxpayers A Fair Shake ?

On the surface, it strikes me that the panel might be doing OK, but, of course I’m probably as cynical as the average revenue agent – and know as much about art. That’s why I ask Matt about things like this.

Future Baseball Commissioner Tackles Tax Laws As Complex As Infield Fly Rule

As previously discussed, subchapter K’s provisions are largely technical, involving specialized language, multi-factored tests, and computational analyses that challenge all but the most experienced partnership tax specialist.

Not Income Tax Evasion – Structuring – That’s How They Got Kent Hovind

Despite his claim to the Creations Science Hall of Fame that he is not a tax protester, Mr. Hovind at different points in time has made the type of statements associated with protesters and based on the outcome of civil litigation had not been filing returns. He was pretty well trounced in Tax Court and it is possible that going after him criminally was superfluous, but I have never been able to discern why it is that some cases rather than others go criminal.

Real Estate Professional Status – Becoming More Important – Very Hard To Prove

750 hours is not the sole requirement. You also have to spend more time on the real estate activities than you do on anything else. This generally proves to be an insurmountable obstacle for amateur landlords with day jobs, particularly since there is a much harder unstated requirement.

Is Super Bowl Monday Holiday More Important Than Tax Reform ?

My plan to flood the White House "We The People" petition site with tightly targeted tax simplification proposals has not taken off. That does not mean I am giving up,...

IRS Plays Sore Winner In House Burning Charity Case

What the IRS seems to be saying in the AOD is that the Patels were just lucky that the law was uncertain. They were taking a very large deduction that, on its face, had a bit of the “too good to be true” about it. The law was uncertain, but they didn’t prove that they did the research to determine that it was uncertain. The moral of the story seems to be that if you are taking a position that seems like it might be sketchy, you should do the research or have somebody do it for you and document it. Nothing new there really.

Why Phil Mickelson’s Remark Was Really Dumb

The state of residence of someone who works all over the world and is able to own several residences is far from a straightforward question. It turns on a concept called domicile, which can border border on the mystical.

Why Phil Mickelson’s Remark Was Really Dumb

If you have very high income and leave a very high tax state, you can almost count on the taxing authorities challenging you on domicile, because once you have established domicile you are stuck with it until you establish a new domicile. To make up a fairly silly example, if Phil moved his family into a luxurious RV that followed the tour, California would have a very good case for holding onto him. That’s why he needs to buy the place at Lake Nona.

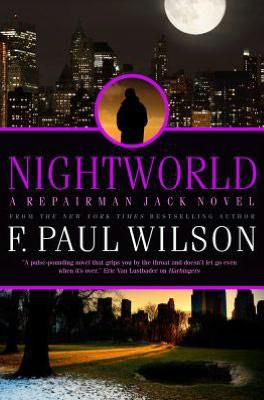

Tax Planning – Repairman Jack Style

She shook her head. “How can that be? You’ve got to have a social security number. You’ve got to have a bank account, a credit card, a driver license. You can’t function without them.”