Most Recent Posts

Hard Rock Case Still Up in the Air Though Some Elements Well Grounded

It is not surprising that Mr. Morton owned several entities for several different purposes- ownership of different property, management, etc. He picked one of them RWB, an S corporation, to own the jet. He provided the corporation with the funds to pay related expenses. A different corporation 510 Development Corporation hired the flight team of pilot, co-pilot and flight attendant. We don’t need to get into the details of the purposes of the various entities to frame the issue. RWB, all by itself, was not about to make a profit from owning the plane. So the IRS wants to disallow any expenses over and above some charter income. Mr. Morton maintains that the plane was being used for his overall enterprise – himself and all his various entities. The Court approves of the latter approach:

Creative College Funding Plan Fails

Originally published on Passive Activities and Other Oxymorons on May 4th, 2011. ____________________________________________________________________________ SETTY...

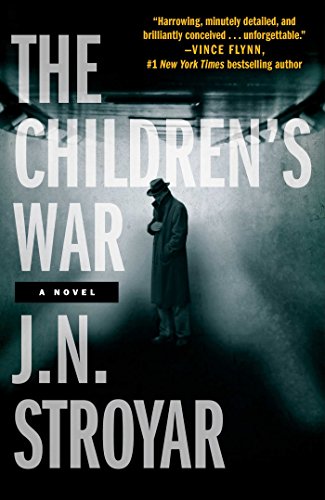

Learning to Be a Bad Guy

Originally published on Passive Activities and Other Oxymorons on May 2nd, 2011. ____________________________________________________________________________ IRSIG...

Saga of A Male Rape Victim in an Alternate History

If we can stand up to him, all Europe may be free and life of the world may move forward into broad, sunlit uplands. But if we fall, then the whole world, including the...

Some Stubborn People

Originally published on Passive Activities and Other Oxymorons on April 29th, 2011. ____________________________________________________________________________ Patrick...

Tax Court Sticking with Three Year Statute on Basis Overstatements

Originally published on Passive Activities and Other Oxymorons on April 27th, 2011. ____________________________________________________________________________...

Should IRS Gets Extra Time to Nuke Abusive Shelters ?

Originally published on Passive Activities and Other Oxymorons on April 27th, 2011. ____________________________________________________________________________ HOME...

What is Nothing ?

Originally published on Passive Activities and Other Oxymorons on April 25h, 2011. ____________________________________________________________________________ What...

The Four Per Cent Solution

Provided, nevertheless, that capital shall never receive profits exceeding an annual amount equal to six percent per annum simple interest for the whole time of...

Is IRS Ready to Attack Advance Bonus Arrangements ?

Originally published on Passive Activities and Other Oxymorons on April 22nd, 2011. ____________________________________________________________________________ CCA...