Most Recent Posts

The Stuff That Dreams Are Made Of – The Rise And Fall Of Malta Pension Plans

When the IRS dropped its guidance, it was like watching a chess game played in a sitcom, where one player is “beating” his opponent, only to be shocked when his opponent suddenly announces checkmate. There is no such thing as a mate-in-one in serious chess. I thought the same was true of tax planning. Apparently I was wrong.

Neil Gorsuch Wanted US Supreme Court To Overrule Virginia Courts On Local Real Estate Tax Issue

Determining who is a minister is an entangling enterprise, as the critics of Code Section 107 have pointed out. We should not be surprised when such entanglement occurs in the context of state property taxes.

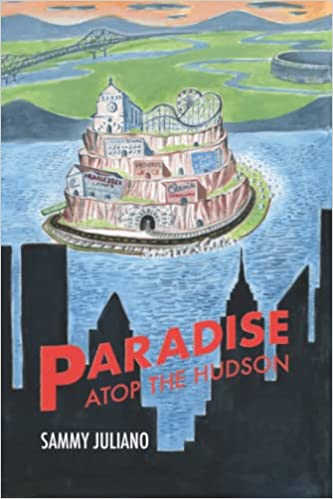

Paradise Atop The Hudson – A Sixties Working Class Middlemarch

Adam represent a complementary problem. What happens to a compassionate, caring boy in a context which was, in spite of all the ways Sammy Juliano and I might celebrate, marred by toxic masculinity? Much as I am inclined to root for the home team Paradise Atop The Hudson is not quite as good as Middlemarch, but you have to consider that it is a first novel.

Stimulus Checks Unpassed Tax Provisions And Other Fun In 2021

I declared an end to Young Earth Creationist Kent Hovind having a Forbes worthy story in 2015 after his codefendant Paul Hansen was sentenced in the 2015 trial that lit up the alt-right blogosphere. He keeps coming back, though, and readers find him interesting. In 2021,

Eleventh Circuit Deals IRS Defeat In Conservation Easement Struggle

The Hewitt court seems only to have held that the regulation was invalid because it failed the procedural regularity test. The Court never engaged with the issue of whether the interpretation (as opposed to the regulation) was a valid interpretation of the governing statute, § 170(h)(5)(A). There is thus the possibility that the IRS could or should still prevail if the interpretation is the best interpretation of the statute.

Millennial Reviews The Old Man’s Tax Blog

Karen Slaughter is actually someone I know of- unlike the madcap tax dodgers my father usually casts for his posts. Doesn’t stop Peter from asking, just because I lived in the same state as his current obsession, if I’ve heard the name of some weird millionaire trying to deduct horse semen as hobby loss.

Tax Court Christmas Donkeys – A Present For Taxpayers With Losing Side Gigs

Taking Judge Urda’s narrative Huff and his wife Cathy Markey Huff did not raise their daughter Jennifer to be a trustifarian. Mr. Huff capitalizing on her love of animals and her experience in greyhound rescue had helped her start Doggy Styles a pet grooming business. He was concerned however that it was not enough so he and his wife started Ecotone

Removing Inflation Distortions From The Tax Base – The 1984 Solution

The Tax Reform Act of 1986 was a great achievement and it really did represent a step toward a more rational tax system. But what happened ? As it turns out using the tax code as an instrument of social and economic policy is just too big of a temptation. It seems too much like a free lunch.

Tax Court Judge Emphasizes Magnitude Of Losses In Denying Horse Breeding Deductions

Mitchel and Eric clearly wanted to have a high-quality horse-breeding operation, and they spent generously to demonstrate that they were serious players in the Standardbred universe. But we find little evidence that they conducted this activity in a “businesslike manner,” i.e., in a manner intended to generate a profit. Many hobbyists desire to have a high-quality activity, but that does not necessarily mean that profit making is their goal. We regard this first factor as important in our analysis, and we find that it strongly favors respondent.

A Revolutionary Tax Court Petition

Making this film in a charity means that historical accuracy will be paramount, free of the conflict of profit goals. This creates a unique opportunity for those who care deeply about this story, and who have the wherewithal to make this film a reality. Great pains have been taken to tell this story of our shared history in a compelling,