Most Recent Posts

Hobby Loss Deduction Developments In 2021

Section 183 is one of the few areas where I think tax advisers are too cautious. The law is clear that a realistic expectation of profit is not required to sustain a loss. What is required is an honest objective.

Opportunity Zone Investment Fraud – Sometimes It’s Better To Just Pay The Taxes

My source claimed that he had put Burrell on to the notion of rehabbing, where 8% returns were quite feasible. As far as he could tell, though, what was currently going on in Coatesville was the development of a velodrome. Now you and I both know that velodrome is an indoor bicycle track, but you have to consider the other readers.

S Corporation Or LLC ? A Misleading Question That Can Lead To Expensive Mistakes

You can find quite a few articles floating around in which the question under discussion is whether you should use an S Corporation or an LLC for your business. It would be two harsh to say that it is a stupid question. Let’s rather say that it is the wrong question.

Judge Denies Stimulus Payments To Citizen Children With Undocumented Parents

He notes that it is clear that Congress has no constitutional duty to provide all non-citizens with the same benefits it provides to citizens. The Matthews precedent holds that it is “unquestionably reasonable” to make a non-citizen’s eligibility depend on the character of his or her residence in the United States.

IRS Automatic Notices Alienate Taxpayers

Here is what I think happened. Blynn’s timely response to CP 162 is still sitting in the IRS unopened mail pile. They have their programs in place to issue a collection notice two weeks after not receiving a response to the CP 162. They actually have a response, but the left hand doesn’t know that the right hand is not keeping up.

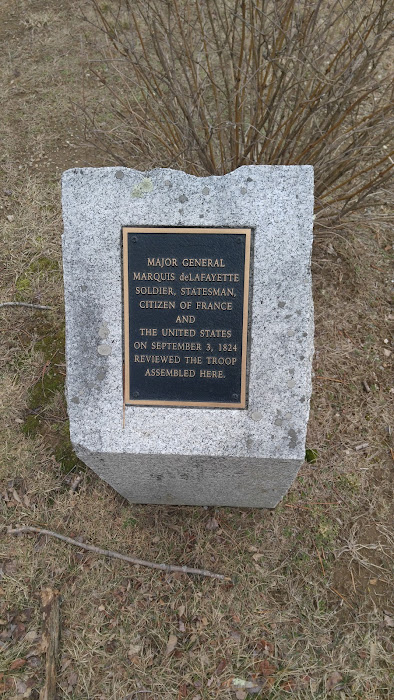

Lafayette In Worcester County – September 3, 1824 – Introduction

When it comes to local history, though Lafayette’s brief stop in 1824 and 1825 may be the most memorable thing that happened in a small town in the 19th Century. A handshake with Lafayette was something worth noting in the obituary of someone who died in the gay nineties some seventy years later.

Family Attorney Fears Tax Decision Smuggles Religion Into Family Law

The Court’s opinion in Grossman, which sets the dangerous precedent stating that a religious divorce can itself civilly dissolve a marriage, misapprehended multiple issues of New York State’s law, and violates the constitutional mandate that there be a separation between church and state. The effects of this decision are monumental.

Dark Side Of Tax Incentives: Baldwin Shooting Raises Issues Of Safety And Dispersion Of Film Production

Incorrect information was too quickly shared on the set of Rust, there was a gummy chain of command, and apprentices were elevated who were not intimate with contemporary norms

Who’s Afraid Of Bank Reporting To IRS?

There is grounds to be skeptical that the IRS will get much out of the new information source. In 2018 TIGTA reported that IRS was not taking advantage of currency reports generated under the terms of the oxymoronic Bank Secrecy Act.

Part Of Build Back Better Could Be Disaster For Trust Owned Life Insurance

Take the case of an ILIT that is meant to take care of a special needs child after the parents are gone. It is funded by a second to die life insurance policy. If the second to die parent is leaving a nice house and some left over retirement funds, they might be close to or slightly whatever is then the federal threshold. Pulling in a big piece of the special needs trust would be nasty