Most Recent Posts

Estimated Tax Payments – Don’t Sweat The Small Stuff

There’s a large contingent of wealthy individuals in this country who do not make their estimated payments,” Rettig told Rep. Brad Schneider, D-Ill.

These wealthy individuals take the money that should be “paid in estimated payment on a quarterly basis to the government and take the arbitrage and they invest it,” Rettig said. “We’re not going to give them a break of interest and penalties to do so.”

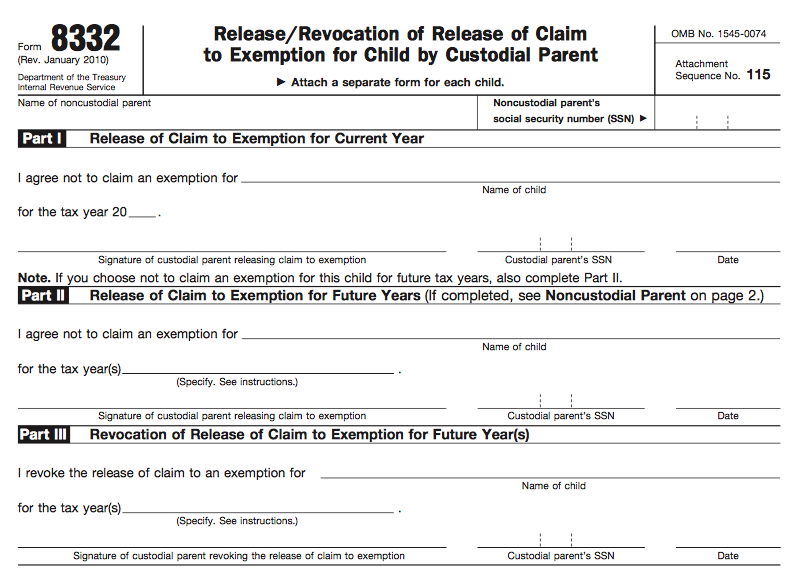

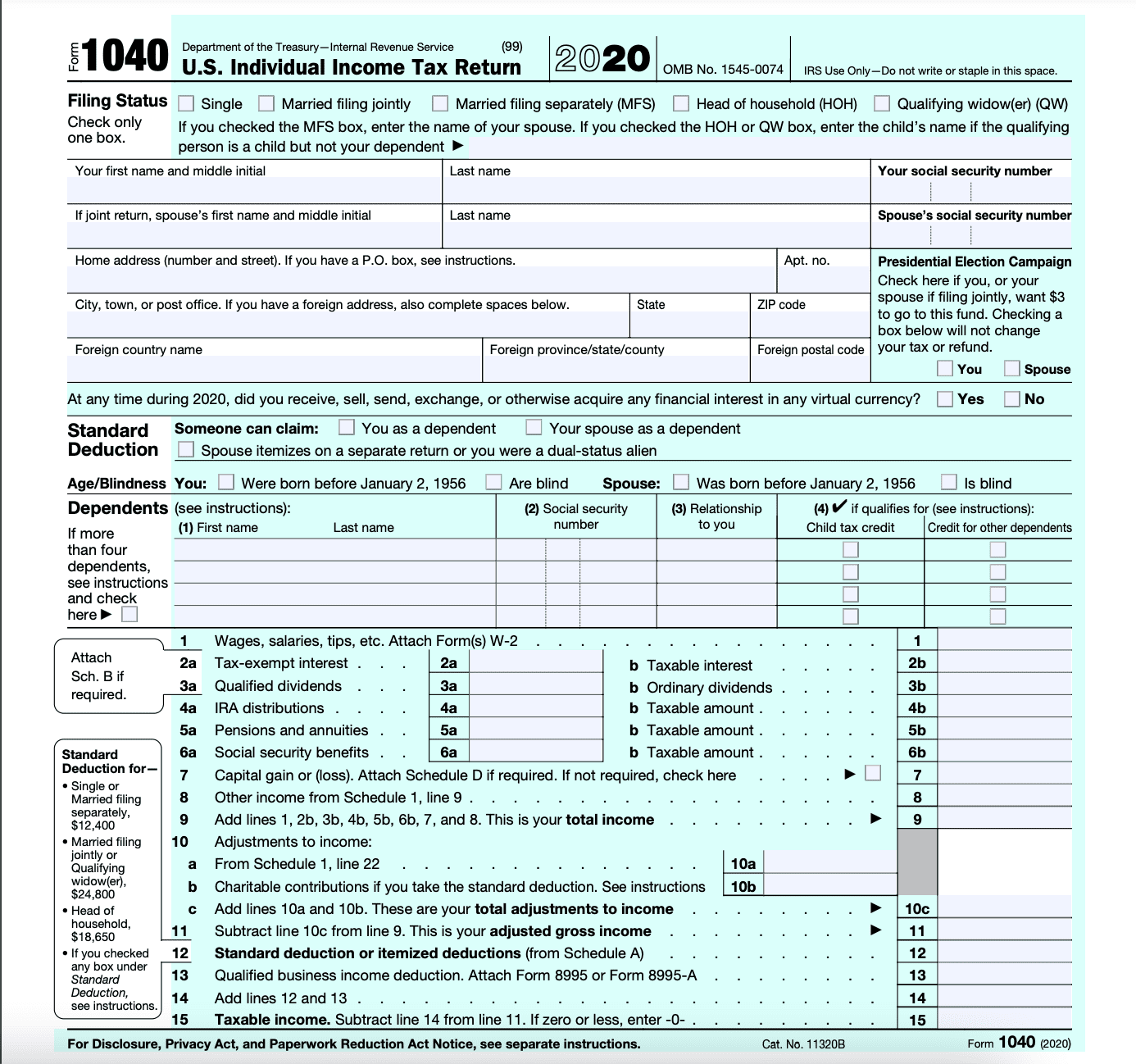

Form That Will Make Or Break Rebate Credits For Noncustodial Parents

Careful timing of return filing and mixing and matching dependency exemptions will present many divorced or never married co-parents with opportunity to pick up thousands of dollars.

TurboTax – H&R Block Software Smackdown

I bought both TurboTax and H&R Block and did my taxes on each. Both had software bugs that caused the taxes owed to be too high. Turbotax phone support had very short hold times and intelligent people on the other end, who acknowledged the bugs were real

Third Win For Investors Versus Not For Profit Sponsors Of Low Income Housing Tax Credit Projects

Congress contemplated that tax benefits such as the credit and depreciation would be available to taxpayers investing in low-income housing, even though such an investment would not otherwise provide a potential for economic return.

Cooling Breeze For The Tax Season From Hell – IRS Does Not Want Amended Returns Right Away

And then there is the really nice thing that favorably affected a lot of people, the Rescue Plan indicated that up to $10,200 of unemployment insurance could be tax-free in 2020. There is this unusual cliff effect.

With Large Charitable Contributions Aim For More Than Substantial Compliance

We can use this opinion to illustrate three of Reilly’s Laws of Tax Planning – The Fourth – Execution isn’t everything but it’s a lot – ,The Seventh – Read the instructions -, and The Sixteenth – Being right without substantiation can be as bad as being wrong. You can quibble about the 16th, since there was a good bit of substantiation. It was just not quite what was required.

Wealth Tax Bill Act Would Double IRS Enforcement Budget

They are arguing that the 1895 decision that struck down the income tax can be ignored even though contemporaries concluded that it required a constitutional amendment to allow an income tax on income from all sources. Basically the scholars who are blithe about the constitutionality of the wealth tax say “Well Pollock was just wrong. Let’s not worry about it even though it provoked a constitutional amendment.”

The $1,100 Per Child Tax Rebate Bonus For Unmarried Parents

Is it going to be “administratively practicable” for IRS to unscramble this egg? I have to let you make your own judgement on that. I would say that if you do score the extra $1,400, put it aside just in case.

Stimulus Checks And Your 2020 Return – Hurry Up Or Wait ?

What makes it confusing is that the actual credit is determined on the 2021 return. There is a true-up then with the advance payment, but the true-up only goes one way i.e. in favor of the taxpayer. You can come out ahead if you get an advance payment that is more than the 2021 credit.

Taking Another Look At The Hazards Of Filing Form 1099

“Acrimony in litigation is not at all unusual, and advisers may find clients who want to “turn in” the opposition in a case to the IRS. This case serves as a cautionary tale about the risks of doing so”. Both sides complained to the IRS about the other and nothing good is likely to come of that. Still, much as I think some of Mr. Waldman’s behavior might have been unwise, I don’t see the reporting as fraudulent.