Most Recent Posts

Kent Hovind’s Half-Billion Dollar Lawsuit – Legal Analysis

What is extraordinary to me is not so much the confidence that they have that they are right. It is the seeming total assurance that they will prevail. Kent explains the “verified complaint” argument with one of his sports analogies. Under Paul John Hansen Law there must be a “verified complaint” in order for a grand jury to consider an indictment.

They have asked the clerk of the court for a copy of the verified complaint. There is not one. So under Hansen law that means that even though federal prosecutors hit a home run with Kent’s 2006 conviction, long sentence and property forfeiture which was upheld on appeal, it was all for naught, because they failed to touch first base as they rounded it.

Who Is IRS Aiming At In Recent Partnership Notice?

The information you have is not the information you want. The information you want is not the information you need. The information you need is not the information you can obtain. The information you can obtain costs more than you want to pay

Paycheck Protection, Churches And The Constitution – It’s Complicated

There are cases where I assume the professors would agree that churches may receive public services. I suspect that they do not object when local police or fire departments respond to problems at church buildings. By the same token, one could envision public policies so targeted at religious institutions that no plausible First Amendment justification can be proferred for them. There would, for example, be no tenable constitutional defense if Congress adopted a program exclusively subsidizing clerical salaries.

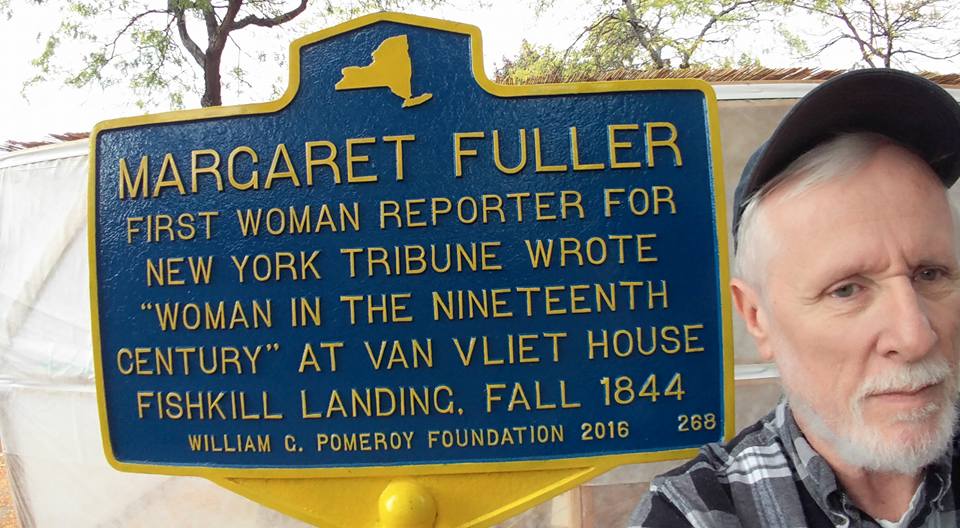

How I Fell For Margaret Fuller

When Margaret Fuller (1810-1850) died in the tragic shipwreck of the Elizabeth off Fire Island, she was the most famous woman in the United States and an international...

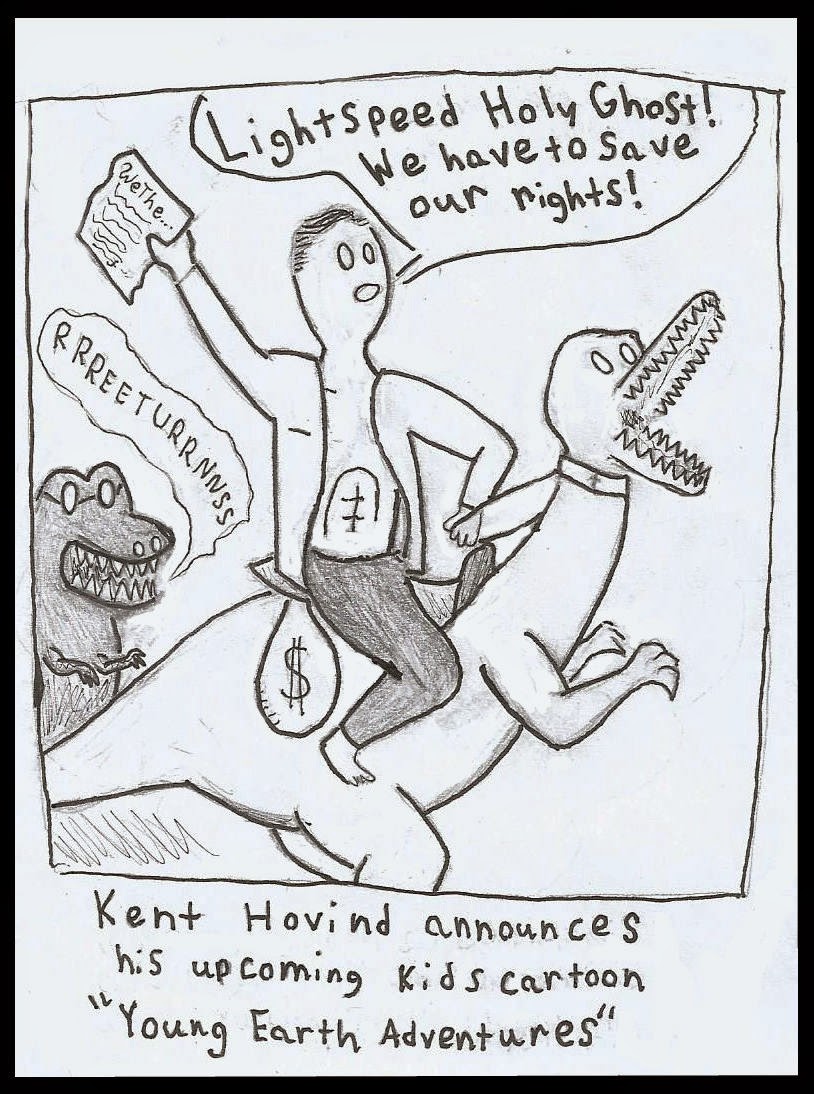

Kent Hovind Sues US Government For Over Half A Billion Dollars

Kent Hovind has finally followed through on the lawsuit that he promised to bring to seek compensation for what he sees as unjust imprisonment and theft of his property. He had always indicated it was going to be a lot, but frankly I hadn’t expected anything nearly $536,041,100. I would have thought forty or fifty million would have been enough.

Paycheck Protection Loan Forgiveness Just Got Easier

#TaxTwitter where tax professionals of various sorts kind of swap professional recipes and engage in remote group therapy practically turned into all Paycheck Protection all the time as CPAs and others who often are a business’s most trusted advisers threw themselves into helping their clients.

For Some Churches, SBA’s Paycheck Protection Program Is Better Than Bingo

If churches want to be treated like the other 501(c)(3) when it comes to receiving government bailouts, they should probably be treated the same when it comes to disclosure and file 990s. And if ministers want their paychecks protected like everybody else’s, maybe they should not be able to exclude cash housing allowances. Just saying.

11th Circuit Blesses Conservation Merit Of Golf Course

The Eleventh Circuit has given one of President Trump’s favorite tax deductions a boost with its decision in Champion Retreat Golf Founders LLC. When a list of Trump Charitable contributions was released, “Various Conservation Easements” topped the list at $63,825,000 and according to this story in the Wall Street Journal, golf courses number among his many easements.

Why Do We Need Public Companies To Hand Out Free Money?

Now if you are somebody who just got an EIP card you might wonder why you have to pay more for the second card replacement than a Direct Express cardholder. I can’t figure it out, but the DE cardholder is likely a veteran or a senior citizen (or maybe both), so you should not feel bad about it. Thank them for their service or congratulate them for having lived so long and carry on.

Debit Card Impact Payments Are Real

My source called the number as directed. She had to enter the card number and six of digits from her social security number. Then she was told the balance. There is a website you are directed to (eipcard.com) where the Money Network tells you how to use your card.