Most Recent Posts

Tax Court Rescues Taxpayer From The Agent From Hell

AFH is firmly convinced that your client is up to no good. I have only run into AFH a couple of times. My personal approach to Revenue Agents is that we are brother or brother and sister accountants searching for the truth. That the truth is definitely “no change” or in a very rare circumstance a refund is something that I don’t emphasize.

AFH is a different story. I have a friend who would yell and scream and pound the table with AFH. My approach is more passive-aggressive, which I like to think gets under AFH’s skin even more.

IRS Grinch Ruining Christmas For Syndicated Conservation Easements

Bill Clabough, Executive Director of Foothills is unable to comment on the case, since Foothills is not really involved in the tax structuring or the valuation. He can wax poetic on the beauty of the property and the satisfaction of having it preserved. And he assured me that there is not a lot of unexploded ordnance laying around. We made some tentative arrangements for me to visit the property, but that won’t be for a few months.

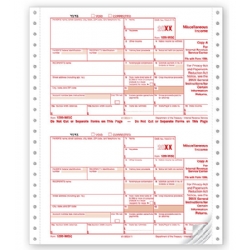

How Not To Deal With A Bad 1099

In an email exchange in one of the exhibits, it is mentioned that Jane’s attorney was charging $850 per hour. Given that Jane’s exposure might have been an unjustified tax deficiency in the $20,000 vicinity, it’s hard to see the value there particularly since having to pay any sort of deficiency would be highly improbable.

Special American Flags – Do It Like The Marines

When the American flag has a Marine Corps flag on its left (which is the correct way of doing it of course), it will never look faded, or, God forbid, torn.

More On The Mormon Ensigngate

I have expressed the view that there is probably nothing for the IRS to investigate. Still, much of what Lars Nielsen, the whistleblower’s brother, has to say in his long video is worthy of attention and I agree with some of the reforms that he proposes

$100B In Mormon Till Does Not Merit IRS Attention

If LDS has accumulated $100 billion and not been transparent about it, it is really up to the members to deal with their leadership. If it is bad policy to allow exempt organizations to accumulate so much, Congress should change the law. There is really nothing here for the IRS to do making the whistleblower complaint pure drama.

IRS Wins Most Hobby Loss Cases But Don’t Let That Intimidate You

If your client has something that they want to do and can tell you with a straight face that they are trying to make money at it, you should counsel them to take the losses, but only if they are willing to act in a businesslike manner. Separate accounts. Strong substantiation. But most importantly at least once a year talk to your client about why there were losses and what they are going to do differently in the future in order to change things. Document those discussions.

It does not matter that profitability is improbable, it just has to be sincerely pursued.

Tax Court Allows Long String Of Horse Losses

Photo credit Midge Ames. Originally published on Forbes.com. A long string of losses in a horse-related business may well attract IRS attention. Don’t despair. If you...

Tax Planning For The High Salary Pauper

Back in days of very high marginal rates – 70% federal – people who made their money by working got a break. Their was a maximum tax on income from, you know, working. And there were shelters. Many were sketchy and abusive and could get you in trouble, but some like low-income housing were blessed. You could defer your income and when the deferral turned around it was taxed at capital gains rates.

Now it seems that there are breaks for everybody, except the high salaried. Of course, if you are prudent with a very high salary you will accumulate net worth and ultimately be able to do some fancy stuff, if you are so inclined.

Santa Forever

I uncovered where Santa Claus spends his vacation time.