Most Recent Posts

Grassley Wyden Take On Sketchy Conservation Tax Shelters

The highest and best use is going to be something hypothetical. This is where things can get out of hand. The development to bring the property to its highest and best use is not something that actually has to be executed. So there can be a tendency to think big and assume away minor obstacles like zoning. There was one case where the proposed development didn’t even fit on the parcel. I mean – So what? It’s not like you were going to actually build it.

On top of the valuation issue, there are times when the donee organizations are a little sketchy and won’t really be able to enforce the easements. And sometimes the conservation or public benefit of the easement is altogether dubious. Sometimes easements are given on properties that are already so restricted that there is no real value to them. I compare those to me renouncing my superpowers.

Hobby Loss Claim Goes Down In Flames

The captain’s initial plan was to sell rides on the plane. (The Firefly had a crew of two, so I guess the passenger would get the navigator/weapons officer spot) Of course, that required making the 60% restored Firefly 100% flyable. That took eight years and 45,000 man-hours. Some of the tsoris involved is outlined in this story by John Sotham in Air&Space.

When the plane was ready for its intended use, basis had grown to $1.6 million which translated into annual depreciation deductions over $80,000. It turned out that taking up passengers who could fantasize about dropping bombs on the Tirpitz or Japanese submarines was not feasible. So Captain Eddie took to the air shows, where the plane did quite well, but to live in fame did not bring in enough revenue to cover expenses. Losses mounted up.

A Day At Dinosaur Adventure Land

When my son William and I were driving across the country in 2010, our Garmin sent us on a dirt road, where we ended up stranded for a couple of hours. So there was a...

On The Basis Of Sex: Treats RBG’s Opponents Like Cartoon Villains

Originally published on Forbes.com. On The Basis Of Sex will be on Amazon on March 26. If you didn't see it in the theater, watch it. And if you did see it in the...

Parsonage: Religious Liberty Smuggles Sex Discrimination Into Tax Law

The stipend is a nice gesture and I applaud, but ironically it makes the case for 107(2) at least in this context being a straight up subsidy. The college doesn’t have to pay the men as much, because of their religious status which has nothing to do with the work that they do.

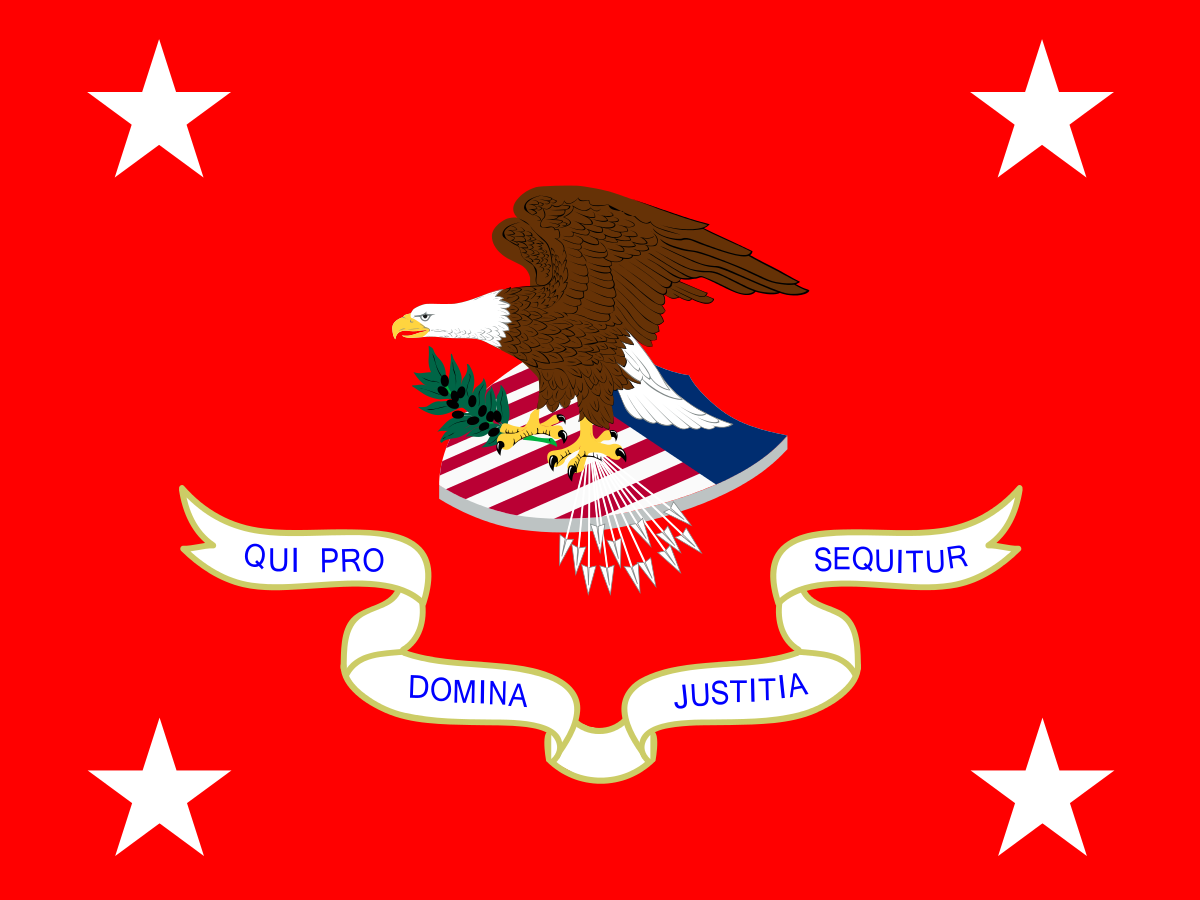

I’m not that much of a constitutional purist, but 107(2) is really in need of an overhaul due to the abuse that is going on. First off it needs a dollar ceiling like just about every other housing provision. I’d go with $50,000 because I like round numbers and that is about what a two-star general gets in an expensive part of the country.

And if the rationale is the special requirements of parish ministry substitute “community spiritual leader” or something like that for “minister of the gospel”. Define “community spiritual leader” in terms of actual face to face activity in a defined geographic area. That will cut out the televangelists, denominational leaders, professors, and basketball ministers and create parity among churches that have tighter or looser standards for who is a minister.

Discrepancy or Discrimination? Doesn’t matter

I inquired why some of the men I worked with were considered ministers and thus, eligible for the ministerial housing allowance tax benefit while the women I worked with were not considered eligible

Lunch At The Drowsy Poet With Eric Hovind

I hadn't planned on writing about my get together with Eric Hovind or even telling anybody about it other than my partner. At the end of our time together, though, he...

Seventh Circuit Blesses Tax Free Housing Payments To Clergy

Although I will be studying the decision more, I think it is fair to say that the reasoning of Professor Edward Zelinsky author of Taxing The Church carried the day. The Court viewed 107(2) as just one of a myriad of provisions exempting housing. To treat ministers like secular employees receiving the 119(a) convenience of the employer exemption might lead to intrusive inquiries. This is weighed against the IRS having to patrol the boundary of who is a minister.

These parallel provisions show an overarching arrangement in the tax code to exempt employer-provided housing for employees with certain job-related housing requirements. Congress has exempted certain categories of employees from complying with the specific requirements of § 119(a)(2) to simplify the application of the convenience-of-the-employer doctrine to those occupations. Section 107, including subsection (2), recognizes ministers often use their homes as part of their ministry. This provision thus eases the administration of the convenience-of-the-employer doctrine by providing a bright-line rule, instead of requiring that ministers and the IRS repeatedly engage with a fact-intensive standard.

Tax Court Petition: Just Go To The Post Office

Now the Endicia.com date stamp might have been good except for two things. If there is a USPS date stamp on the envelope, that trumps anything else. This envelope had the Endicia.com date of March 6, which was the absolute drop dead for mailing the petition. There were two USPS date stamps. One was March 7 and the other was March 20. So Teri loses there.

The other requirement is that the petition actually arrive at the Tax Court in a normal amount of time, three days in this case. This one arrived on March 26, twenty days, which probably would not have been good time even in pre-railroad days.

Don’t Wrestle With The IRS Robots

I think the IRS should adopt a new policy on frivolous refund claims. If a taxpayer is looking for a refund of withholdings that are out of proportion to positive income, do nothing. After six months the really determined ones can sue in federal district court or the court of claims, which is a lot harder than the Tax Court. That would make it not an IRS problem so much as a problem for the DOJ Tax Division. The Tax Court would probably appreciate the lessened pressure on its docket.

I’m sure there is a reason why my plan doesn’t work, but it is a nice thought experiment. Any readers who know why this is a bad idea can send me their thoughts which I might include in an update.