Most Recent Posts

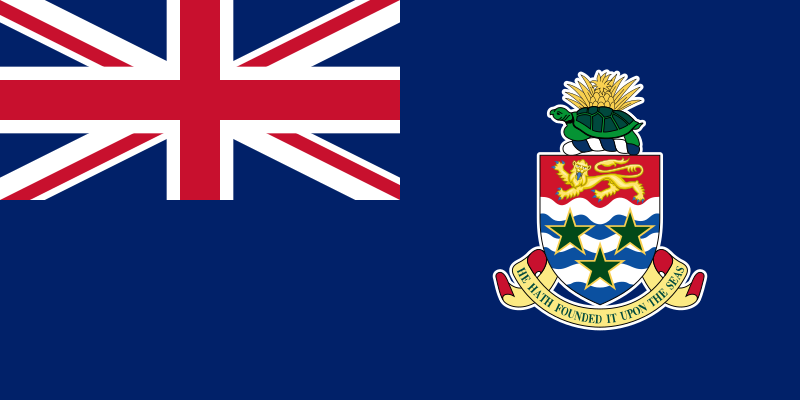

Cayman Islands Not Just A Mailbox And Not Like You Saw In ‘The Firm’

There is one thing that he noted that is a big upside to the Caymans. A tragic remnant of racism probably has its roots in white supremacist ideology, which used to be quite popular and often seems like it will make a comeback. It blights much of the English speaking world. Mr. Leung, who is of Asian descent, noticed a whiff of it in Scotland, but finds the Caymans utterly devoid of racism. Pirates, refugees, shipwrecked sailors and enslaved people might not seem to be the best material to start a country to some, but clearly there is an upsid

Treasury Capital Gain Indexing: Who Can Sue?

Remember when the income tax was first implemented the country was on the gold standard. ( How we went on and off that is a story too complicated for this post). At any rate, if during the gold standard days you bought something for twenty dollars, you might hand somebody a twenty-dollar gold piece. If you sold it for $40 a few years later, you would get two $20 gold pieces. You could go make change for the second one and use some of that to pay taxes and you are clearly ahead.

Off the gold standard, it is a different story. Suppose you bought a vacant lot for $10,000 in 1980 and sell it for $20,000 next week. Is that extra $10,000 an “undeniable accession to wealth”? Well maybe not. According to this handy calculator, $10,000 “1980 dollars”, which is what you paid are equal to $32,912.52 “2018 dollars. There is a common expression “today’s dollars”. You paid over $30,000 in today’s dollars for the lot and are only getting $20,000 in today’s dollars. So indexed gains are a reasonable interpretation of the word “income”, which was not defined because everybody knew what it meant and they were on the gold standard when it went into law.

Lafayette In Charlton On September 1 2018 – Press Release

Contact: Peter J. Reilly Phone: 774-364-2595 Email: peterreillycpa@gmail.com For Immediate Release Website: We Are The...

The Spirit Of 1824

... there never was nor will be such a meeting in this or any country ,,, Salem Towne Junior July 25, 1824 Salem Towne Junior wrote those words to encourage his wife to...

Why Gender-Critical Radical Feminists Might Want A Church And Why IRS Approved

The priest, rabbi, minister joke form was common when I was growing up, along with other types of jokes which would no longer fly at all. It was generally innocent, the best indication that being if it did not change depending on which one did what. On reflection, I realized that in writing the joke I was mentally back in my boyhood when it would be understood that the threesome would be male. So here is an alternative.

An Episcopal priest, a Reform rabbi and a Unitarian minister walk into a temple – the lesbian leader asks them if they are interested in becoming congregants.

New IRS Regulations: Maybe TCJA Really Was Bad For President Trump And Some Wealthy Friends

To make up an extreme example consider Bruno Bigbuilding. Bruno supports his family with a modest $10 million salary that he takes from his development and management company. His net worth is close to a billion and it is based on real estate interests in which he is 90% leveraged. That produces a lot of depreciation, the deduction that President, then developer, Trump said he loves so much in The Art of The Deal:

“I don’t have to please Wall Street, and so I appreciate depreciation. For me the relevant issue isn’t what I report on the bottom line, it’s what I get to keep.”

After sheltering the income from the real estate, there will be plenty left over to shelter the $10 million salary. Not anymore.

Ninth Circuit Pulls Back Big IRS Victory Issued After Judge’s Death

But, but, but, the case is not a win for the IRS as of today. It is back in limbo. Because unlike the stories you hear about Chicago, it seems that in the Ninth Circuit they don’t want the dead to vote. One of the two votes in favor of the IRS was cast by Judge Stephen Reinhardt who died on March 29, 2018, almost four months before the decision issued.

Pay Your Taxes!

So this will be a longish introduction to a really long piece. I will start with the disclaimer that the views expressed by Johnny Cirucci (below the dotted line) are...

Lesbians Want A Church Of Their Own And IRS Approves

Originally published on Forbes.com. Pussy Church of Modern Witchcraft might strike you as something you would find in the Onion, rather than here on a Forbes tax blog,...

Janet Yellen and the Economic Impact of Gender Discrimination

By all accounts, Janet Yellen was more than qualified for the position is Chair of the Federal Reserve. Her PhD in economics is from Yale University. From 1994 to 1997 she was on the Federal Reserve Board of Governors. In 1997 she served as Chair of Bill Clinton’s Council of Economic Advisors. From 2004 to 2010 she was the President and Chief Executive Officer of the Federal Reserve Bank of San Francisco (there are twelve regional reserve banks and San Francisco is the second-largest by assets held, next to New York). She worked her way up in the Federal Reserve after an impressive career and education at the top U.S. schools in economics. Yet, she was confirmed in the Senate by the narrowest margin in history.

The Federal Reserve is tasked with two goals: maximize employment and stabilize prices (inflation). The biggest argument against Janet Yellen for her confirmation was she was a “dove”. A “dove” refers to someone whose economic policy favors low unemployment above the inflation goals. The opposite of a “dove” is a “hawk” whose focus is more on inflation than unemployment. Yellen’s goal was unemployment and during her tenure, there was one of the largest drops in unemployment during any Federal Chair’s tenure. And the other mandate, of keeping inflation stable, she did.